I worked in the technology analyst business for a long time. I worked with, and got to meet, a lot of great analysts. There are none that I have more respect for than Bob Meara from Celent.

But a recent post on LinkedIn from Bob isn’t going to escape a little scrutiny here. In the article, Bob argued that:

In-person (physical) engagement will be of lasting importance in financial services for at least three reasons: 1) Most consumers rely on brick & mortar for commerce and will continue to do so; 2) Most retail deposits still take place at the branch; and 3) Most banks don’t offer a decent digital customer acquisition mechanism.

My take: You can’t see where you’re going by looking down at your shoes. Let’s examine each of the reasons Bob lists.

Most Consumers Rely on Brick & Mortar for Commerce and Will Continue to Do So

Really? Seems to me that brick and mortar for commerce is dying. Department stores like Macy’s are closing shops. Yes, Amazon is actually opening physical locations — to supplement and support their digital channels.

In addition, I’m a bit caught up with the phrase “and will continue to do so” in the sentence. Why will they continue to do so?

I hate to hearken back to 1979 (because I know so many of you weren’t even born then), but back then one might have been inclined to say “People rely on gas station attendants to pump gas for them, and will continue to do so.”

But that didn’t happen — gas stations went self-service, and guess what? People adjusted! And thanks to technological development, the process was faster. Granted, there are times when it’s pretty damn cold up here in Boston, and I would love for somebody to pump the gas for me. But I don’t rely on that.

Bob is making a mistake that I hear over and over again from people in banking: He’s confusing physical presence with the need to talk to someone. Just because a consumer might need to — or prefer to — talk to a person, it doesn’t mean they have to be in the same physical space to do so.

The problem has been that banks have done everything they can to prevent customers from talking to real human beings over the phone. The IVR is an evil evil technology (damn, that’s going to get me in trouble with IVR vendors).

In the 25 years that I’ve been living in the Boston area, I’ve been involved in a few automobile-related incidents requiring the involvement of my insurance company. I’ve never met my insurance agent in person. She could be sitting next to me at the moment, and I wouldn’t know who she was. But when I pick up the phone and call her and tell her my problem, the problem gets resolved.

I don’t need to see her in person to get the problem fixed. I don’t rely on brick and mortar for insurance-related services. And there’s no need for me — or most people — to continue to rely on brick and mortar for banking service.

Read More: Do Banks Need Branches in the Digital Age?

Fractional Marketing for Financial Brands

Services that scale with you.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Most Retail Deposits Still Take Place at the Branch

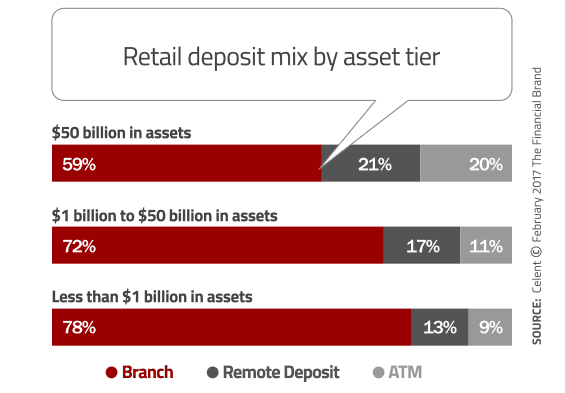

I’m not so sure about this statement. Bob has a chart in his post (which I hope he doesn’t mind me republishing here) that shows that an overwhelming percentage deposits comes in through branches.

I have a little trouble believing this, because I would have guessed that the overwhelming majority of retail deposits comes in through direct deposit from consumers’ employers. That’s not really the branch.

In addition, I have two words to argue against the importance of the branch as it relates to deposits: ING Direct.

Before it was acquired by Capital One, ING Direct amassed $80 billion in deposits… and did so without a single branch.

Read More: Will Branches Ever Die?

Most Banks Don’t Offer a Decent Digital Customer Acquisition Mechanism

True dat.

But it’s not likely to be a true statement forever.

In Cornerstone Advisors annual survey of technology investment plans, digital account opening is one of the top three technologies (out of 38 technologies asked about) in terms of investment in new/replacement apps, or in terms of enhancement.

There is something else to consider here, though. While many banks might not have a good digital acquisition mechanism, don’t lull yourself into the belief that the branch experience is that great.

Eric Gagliano of MarketMatch told his story of a recent branch visit on the firm’s blog. According to Eric:

I’m in North Carolina, walking into about 30-40 branches for a new client and their competition to gauge the customer experience for each. On the very first shop of the day, I walked into a picturesque credit union branch. A nice woman greeted me as soon as I walked in, with the Southern hospitality you would expect from North Carolina. [I said], “I’d like to see what kind of checking accounts y’all have.”

At this point, Mrs. Southern Hospitality could have: 1) Shook my hand, introduced herself, asked my name, or 2) Asked me where I bank today and what kind of account I have; or 3) Asked me how I use my checking account … how many checks I write, what kind of balance I keep?

With this info she could have taken all of their accounts and narrowed them down to ONE recommendation.

She did none of this. The very next words out of her mouth were about their checking account for folks age 55+!!! Trying not to sound too irate, I said, “Do I look 55?”

At this point, Mrs. Southern Hospitality could have gone in a million directions. But she didn’t take the hint. “But it comes with free checks,” she persists.

“But I’m NOT 55,” I lament.

For me, the shop was over right then.

We really have to stop assuming that just because the majority of account openings happen in branch it means the branch experience is better.

You Can’t See The Future If You’re Staring At Your Shoes

The statistics that Bob uses in his post may very well be true, and may reflect today’s reality. But to assert that today’s reality will be tomorrow’s reality isn’t a supportable assertion.

For the record, I’m not arguing that branches will die out. It’s a call each individual financial institution must make regarding the importance of physical presence in the context of their own business and delivery strategy.

But thanks to the ongoing development of technological capabilities, you’re going to have to do a lot better than rely on today’s behavior to assert that the importance of physical presence is enduring.

P.S. – Are we still friends, Bob? 🙂