For the second year in a row, the 2016 Performance Against Customer Expectations (PACE) Index, published by FIS, polled consumers globally about their financial institution expectations, the importance of 18 key attributes, and how well their primary financial institution meets those expectations. The results were then compiled into a score, allowing for an evaluation of how financial institutions perform.

Globally, up to 50% of consumers would turn to their primary financial institution first for deposits, advice and borrowing needs. This percentage was as high as 60% for consumers in the U.S. Alternatively, between 20% and 25% were either undecided, or would turn to an alternative source for financial assistance according to the survey.

As was found in the inaugural year of the study in 2015, there are significant opportunities to build a stronger foundation for banking consumer relationships. This can be achieved by more fully leveraging digital and social platforms to integrate with consumers’ lives through insight-driven alerts, advisory services, planning tools and more. This provides opportunities for impacting the decision process when a consumer is searching for a financial partner.

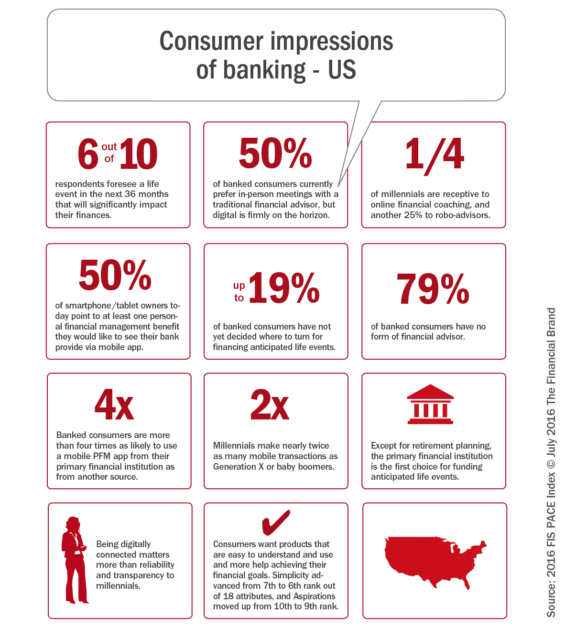

The infographic below provides an overview of some of the key findings of the 2016 FIS PACE Index for U.S. banking institutions.

( Read More: Banking Industry Not Meeting Basic Consumer Expectations )

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Banking Performance Against Expectations

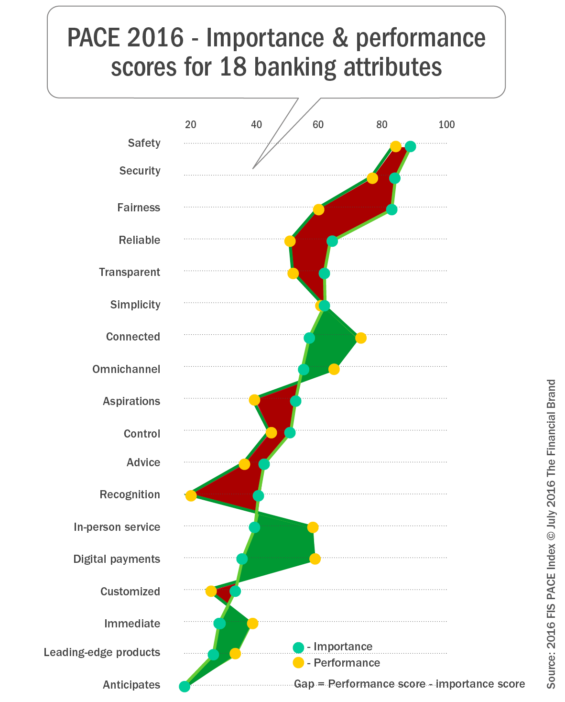

In 2016, the U.S. held a 7-point lead over the global average PACE Index score (79 out of 100), ranking second out of the 10 countries surveyed. As could be expected, the basic foundational aspects of banking are still the most important attributes for consumers globally. The top 2 attributes in terms of importance from the PACE index were Safety and Security, with most banks performing close to par in these “table stakes” attribution categories.

There were deficiencies, however, in performance for the next three attributes – Fairness, Reliability and Transparency. Fairness provided the biggest challenge, with a 20 percentage point gap in performance against importance of this attribute in the U.S. Customers equate Fairness to when there are no hidden charges and fees.

While financial organizations narrowed the negative gaps for the five most important attributes by an average of nearly two points, the majority of these improvements were the result of lower consumer expectations of their banks’ performance as opposed to improvement by their primary financial institution.

The next highest rated attribute was Simplicity (ease of product use and understanding) which rose to #6 in importance. On average, financial institutions are meeting expectations for this attribute. Other attributes where financial institutions met or exceeded expectations – in order of importance – were, Connectivity (online/mobile accessibility), Omnichannel (consistency across channels), In-Person Service, Digital Payments, Immediacy (fast systems), Innovative Products and Needs Anticipation.

Beyond falling short on the five most important financial institution attributes, organizations also fell short on many of the attributes associated with personalization. These included – in order of importance – Aspirations (helping achieve financial goals), Control Over Finances, Trusted Advice, Recognition (rewards) and Customized Products.

When reviewing the gaps (in red) below, these represent opportunities to position an institution as a leader in a market where other organizations are falling short.

It should be noted that, in the U.S., community bank customers continue to rank in-person service far more important than the overall U.S. ranking. Community bank delivery of in-person service also outperforms their consumers’ expectations by a wide margin. While that may sound encouraging, these rankings need to be viewed against a backdrop where physical branch transaction volume continues to plummet and digital channels are having a greater impact on overall satisfaction.

Banking Industry Opportunities

56% of respondents anticipated at least one life event with financial implications in the next 36 months. Nearly 75% of Millennials expected such an event during the same period, including tuition payments, a house purchase or the purchase of a car. Interestingly, only one-in-three U.S. bank customers ranked their primary financial institution as the first place they would turn for major life events that required a financial investment. That leaves at least twice as many customers who may consider an alternative resource, particularly when it comes to investing or retirement planning.

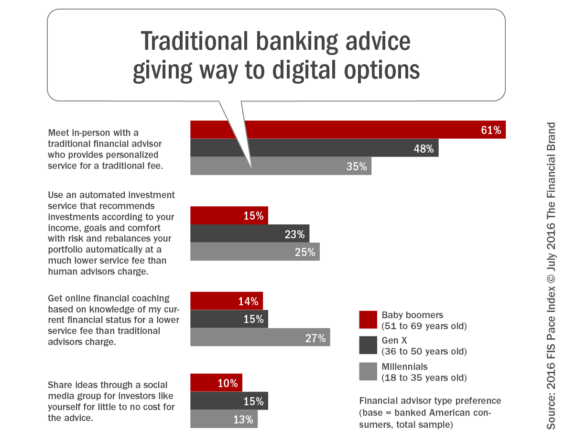

Almost 80% of respondents in the U.S. said they have no financial advisor – underscoring a prime opportunity for financial institutions to provide value to their customers. One-half of the respondents want to meet in-person with an advisor, with Millennials and Generation X much more accepting of a robo-advisor option, and Millennials being receptive to online financial coaching.

According to the FIS PACE Index report, “The opportunity – and the challenge – to banks is dual: Attract younger consumers with online-based financial advisory services, and then keep them as their net worth grows and they transform into increasingly profitable customers who may opt for face-to-face advice.”

Other findings around the Millennial segment included:

-

- Being digitally connected to their financial institution matters more than reliability and transparency.

- Banked millennials are four times more likely to use a mobile personal financial management (PFM) app from their primary financial institution as from another source.

- Slow loan processing is the single biggest pain point for this consumer group.

- 80 percent of banked millennials with smartphones or tablets respond positively to at least one personal financial control tool, such as a warning when funds run low, savings maximization, budget planning, timely bill payment, and the most popular – a spending tracker.

Remaining First in the Mind of Consumers

While the majority of banked consumers continue, for now, to place their primary financial provider as their first choice when a significant life event occurs, the move to digital transactions (and digital interaction) can quickly change this advantageous competitive position. Consumers are increasingly expecting quick responses, instant access to insight, more control of their financial lives and increased personalization.

The importance of making banking more simple and moving at ‘digital speed’ is especially important to the increasingly valuable Millennial segment. “This year’s PACE Index shows that consumers worldwide generally turn to their primary financial institutions first, but those institutions must be prepared to serve their needs immediately,” said Anthony Jabbour, chief operating officer, Banking & Payments, FIS.

“That’s particularly true of millennials, who stood out in this survey for how deeply they expect their banking services to mesh with their daily lives,” continued Jabbour. “The survey shows that, if a financial institution wants to be a customer’s bank for life, it must first become that customer’s bank for living – meeting all the needs a customer may have in his or her daily life, so that customer thinks of the bank first, always.”