According to various sources, 68% of US adults, 66% of UK adults, and 81% of Australians own a smartphone. The ownership and use of smartphones is highest among young adults, higher income households and households with higher education. In other words, consumers are becoming more and more dependent on their mobile devices.

For some, a smartphone is the primary connection to the digital world. According to Pew Research, 19% of Americans rely to some degree on a smartphone for accessing online services and for staying connected to the world around them. This may be because they lack broadband at home, or because they have few options for online access other than their cell phone. In fact, 7% of Americans are “smartphone-dependent,” owning a smartphone but having neither traditional broadband service at home, nor easily available alternatives for going online other than their cell phone.

The groups of Americans that rely on smartphones for online access more than the norm, according to Pew Research, include:

- Younger adults — 15% of Americans ages 18-29 are heavily dependent on a smartphone for online access

- Lower incomes and lower educated households — 13% of Americans with an annual household income of less than $30,000 per year are smartphone-dependent

- Minorities — 12% of African Americans and 13% of Latinos are smartphone-dependent, compared with 4% of whites

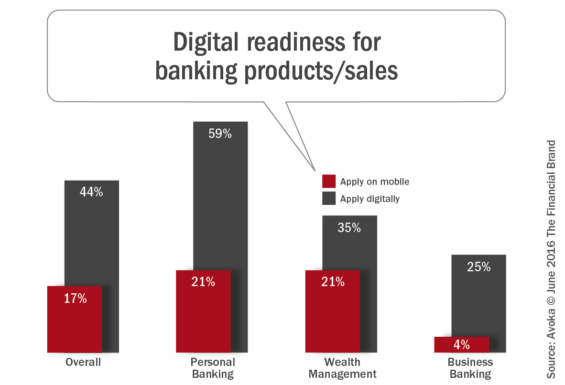

Unfortunately, despite these overwhelming ownership and usage trends, the banking industry has not responded in kind. In an analysis of US, UK, and Australian banks’ digital sales capabilities by Avoka entitled, “2016 State of Digital Sales in Banking”, only 17% of the accounts at the top 10 in these countries could be opened with a mobile device.

“Banks are doing well with digital marketing such as promoting their products via social media, internet search, online ads, their websites, and more. However, there’s often a disconnect between digital marketing and digital sales,” says the report. Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th Services that scale with you.

The Financial Brand Forum Kicks Off May 20th

Fractional Marketing for Financial Brands

Mobile Selling Disconnect

In a normal purchase journey, the consumer may see an ad from a financial institution or be in the market for a new financial product. They use their smartphone to visit several banking websites to compare features and benefits. In many instances, the consumer would want to take the next logical step to apply for the new product using their mobile device.

In most instances, even at major banks, the consumer can’t complete their purchase process on their phone. In many cases, the application and subsequent onboarding process was designed for a PC rather than mobile device, with too much typing required, or the application isn’t touch-friendly. If this is the case, the prospective customer is likely to abandon. In fact, abandonment rates of 90% for new product applications are not unusual.

With the influx of fintech start-ups and large technology firms like Google, Apple, Facebook and Amazon setting the digital experience bar for mobile engagement, the vast majority of financial institutions are playing catch-up when looking at digital selling. It is abundantly clear that the increasingly digital consumer wants simplicity and ease of use when it comes to all processes with their financial institution.

According to Avoka, there is a vast opportunity for improvement in the digital sales process. While nearly half (44%) of the banking products evaluated in the US, UK and Australia could be opened online, only 17% of the product applications were mobile responsive. The Personal Banking and Wealth Management categories had the highest level of mobile readiness (21%), while Business Banking services were least likely to be able to be opened with a mobile device (4%).

Australia Strongest in Mobile Sales of Personal Accounts

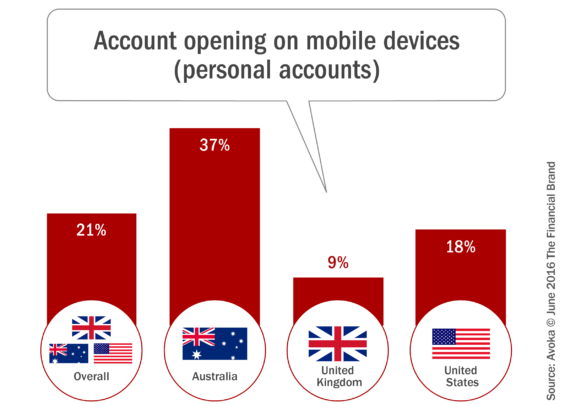

Personal Banking products, such as consumer deposit, loan or credit card applications, are the most likely to be supported on mobile devices compared to other categories of accounts, especially in Australia, according to Avoka. “Perhaps the reason is that a high percentage of consumers already use their smartphones to perform transactions for these services, so banks have invested in supporting mobile account opening for these types of products,” says the report. This is also the category of accounts where the top 10 US banking organizations perform the ‘best’ (albeit poorly).

Considering that less than one in five personal accounts can be opened on a mobile device when analyzing the top 10 banking organizations in the US, we can assume that the ability to open new personal accounts on a smartphone is most likely much lower for smaller banks and credit unions in the US. This tremendous gap between consumer desire and market delivery presents a tremendous differentiation opportunity for banking organizations of all sizes. Those organizations that can deliver a fully mobile account opening solution will be in a position to quickly acquire market share from digital consumers.

Read More: Digital Account Opening Required in Battle for New Customers

US Lags Other Countries in Mobile Support of Wealth Management

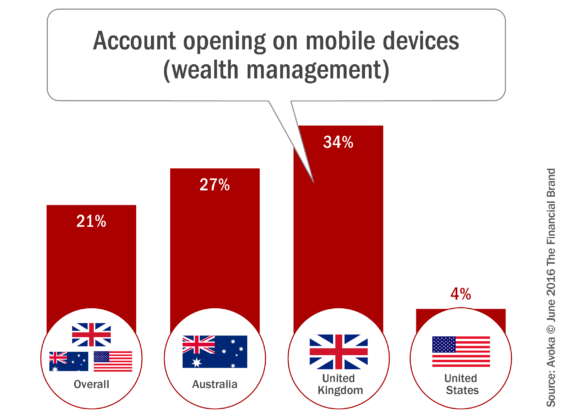

The UK and Australia far outpace the US in offering mobile support for Wealth Management account openings, according to the Avoka study. It was believed that much of this performance gap could be due to a new services offered in these countries that is classified as a Wealth Management account. The offering of ISA’s (Individual Savings Accounts) in the UK and Superannuation in Australia have been the foundation of consumers having access to Wealth Management products through the digital channel.

In both of these instances, these new service categories have been built primarily as digital relationships from the ground up. With an institutional focus on keeping administration costs for these products lower (digital is cheaper than paper or branch), the sales and acceptance of these digital services have been positive.

With many of the online investment firms in the US introducing mobile account opening capabilities, it is imperative that US banking organizations attempt to keep pace, focusing on development of similar digital capabilities. Obviously the revenue opportunities for reaching the more affluent digital consumer accentuates the importance of better serving this segment’s needs.

Mobile Sales of Small Business Services is Huge Opportunity

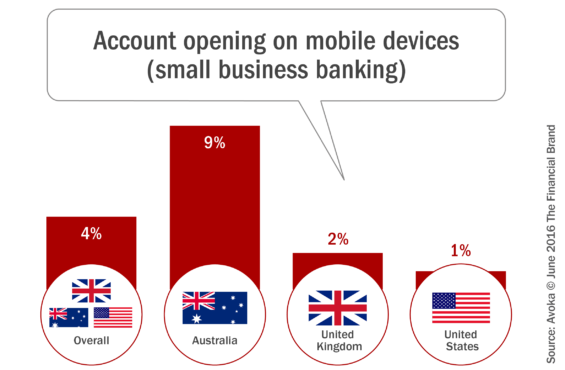

Of all of the services analyzed by Avoka, the Small Business category provided by far the biggest opportunity in each country for mobile sales and engagement. Australian businesses can apply for only 9% of Small Business Banking products using

their smartphone, while these capabilities are far less available in the US (1%) and the UK (2%).

“Consider that US small business owners work 52 hours per week and the best retail bank branches are open 51 hours per week – typically the same hours as the small business owner is working. Since the majority of Small Business Banking products can’t be applied for via the digital channel (PC or Mobile), business owners must visit a branch during office hours when they should be running their business,” stated the report.

While there seems to be a great deal more activity (at least by the larger banks) in meeting the mobile banking needs of the small business customer recently, it is obvious there is still a great opportunity to differentiate a small business offering by providing better mobile account opening capabilities.

Read More: Mobile Account Opening: The Cornerstone of Your Digital Store

Optichannel™ Selling Continues to Miss the Mark

To fully satisfy the digital consumer, banking must provide advanced digital capabilities such as “Save-and-Resume’ functionality. In an ‘optichannel™’ environment (where an organization provides the optimum delivery based on the customer’s channel preferences), banking must allow the consumer to use the best channel for each step of the account opening process … without needing to start over.

This capability is especially important for organizations that currently won’t allow a consumer to complete the entire account opening process on a mobile device (usually requiring a consumer to use a branch for identification and/or funding purposes). For those organizations that can’t support applications completed in a single session (on a mobile device), Save-and-Resume is an absolute necessity. This is also important to offer consumers who may not desire to complete the entire process at once.

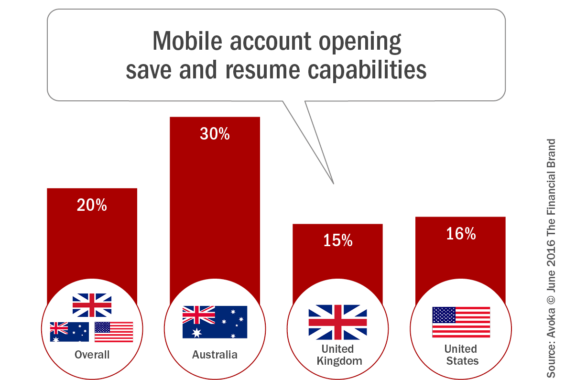

Avoka found that 20% of all banking product applications feature Save-and-Resume, led by 30% in Australia, 16% in the US and 15% in the UK. Obviously, there is still quite a ways to go in offering consumers an optichannel™ experience.

Ways to Reduce Account Opening Abandonment

Account opening abandonment on mobile devices provides a significant growth opportunity for banking. The challenge is that we often unwittingly require a lot of effort on their part to complete a digital transaction. In fact, CEB research found that “making it easy,” or reducing effort, goes further towards building satisfaction and loyalty than the conventional wisdom of delighting customers.

One of the challenges with reducing friction, or effort, in digital transactions is it’s tough to know where to begin and exactly what needs fixing. Optimally, a financial marketer or product manager would like to evaluate account opening and application processes, eliminating all steps that stand in the way of a quick and easy interaction.

To assist with measuring friction in digital account opening and the applications process and reduce abandonment, Avoka has developed a tool called the Transaction Effort Score™ (TES). With this tool, a bank or credit union can quantify exactly where friction is occurring and provide guidance as to how to eliminate the most damaging steps. The Transaction Effort Score evaluation tool analyzes all the steps required to complete a loan application or account opening, and generates a “score.” This score can then be used to identify specific areas of improvement in a bank or credit union’s online sales transaction processes, such as eliminating unnecessary fields or implementing a 100% digital experience.

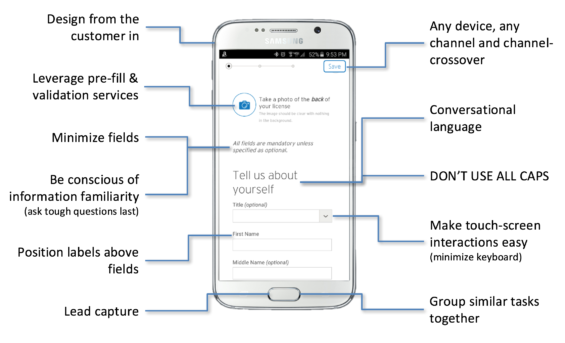

As is discussed in the best-selling Digital Banking Report, there are many ways banks and credit unions can improve the account opening and application process, leveraging digital technologies and common sense. Each improvement will reduce friction, simplify the process and enhance the consumer experience … leading to reduced abandonment and improved revenues. Below is an illustration showing many of the ways Avoka has found to improve the mobile account opening process.

To appeal to the digital consumer, banks and credit unions must offer the ability to open all accounts on a mobile device. In addition, financial institutions must make the entire process easy. With any mobile process, every keystroke and every time a consumer must exert extra effort that takes them away from the smartphone contributes to abandonment. Banks and credit unions need to minimize these hurdles in order to create a mobile new account process that is optimized and frictionless.

Read More: Measuring and Reducing Friction in Account Opening