Every marketer understands it’s important to “know the customer.” Having a fundamental understanding of the customer — flowing directly from data — should power all interactions with the brand, everything from advertising and marketing to retail channels and the customer experience.

But in the Digital Age, these data-driven insights must go beyond the standard demographics like gender, age or income to include their individual needs, wants and attitudes. How do people spend their time? How do they engage with your brand, and with other brands? How do they behave as individuals — not just members of a specific demographic?

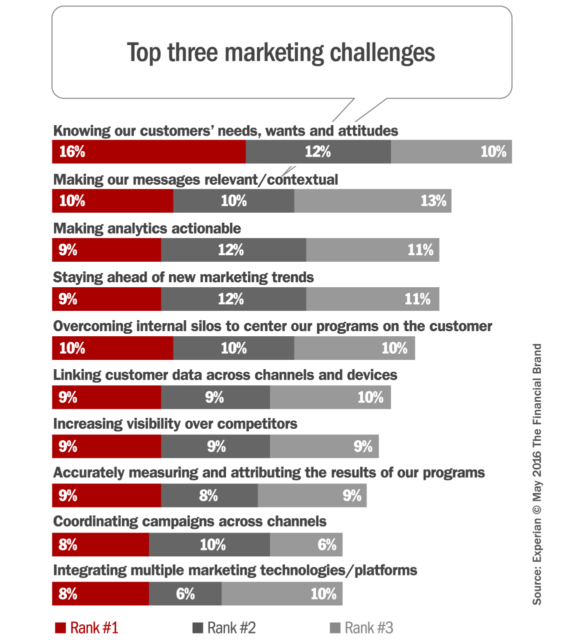

Unfortunately, this is a major challenge for financial institutions around the globe. 38% of respondents in a study from Experian say their biggest obstacle in marketing is simply knowing customers’ needs, wants and attitudes.

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape. Read More about Move the Needle from Attrition to Acquisition Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th

Move the Needle from Attrition to Acquisition

The Financial Brand Forum Kicks Off May 20th

Consumers today want the kind of personalized, relevant experiences that simply aren’t possible when using crude demographic. For instance, you could look at two women both ages 30-35, married, with a college degree, and living in White Plains, NY. Demographically speaking, these women are essentially identical. It wouldn’t matter if these two women were sisters — even twins — they are going to have different expectations and criteria for the experiences they have with brands. A message that resonates with one of the women may be completely lost on the other. Without full knowledge of their differences, marketers will speak to them in the same way, which risks making each interaction their last.

This is a problem, Experian says, because customers today won’t stand for mediocre ho-hum experiences. “When they have a brand experience that leaves them less than satisfied, they don’t just ignore it and hope the brand understands them better next time,” Experian wrote in their 2016 Digital Marketer report. “They share that experience with social networks and challenge the brand to make things right.”

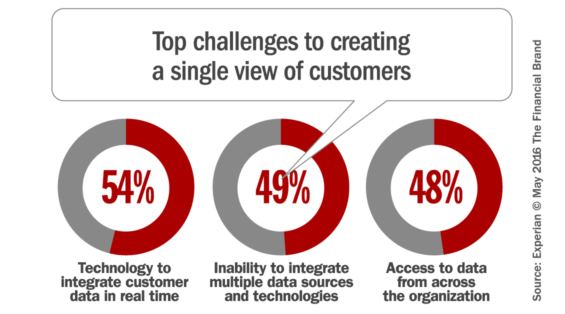

In the Experian study, 81% of marketers say they face a range of issues when trying to achieve a single view of the customer.

Nearly a third of organizations saying that “overcoming internal silos” is one of the biggest hurdles they face when trying to center their programs on the customer. So it should come as no surprise that knowing customers’ wants, needs, attitudes and behaviors is a top challenge. At many financial institutions, different teams control the customer experience for each channel; one marketer covers email, one covers mobile, another covers social and so on. What results is a disjointed customer experience — the opposite of the seamless experience today’s customers require.

Breaking down these silos is a challenge that must be overcome from the top-down. This must be a priority of C-level executives in order for change to happen, but CMOs may not be able to convince their peers of the rewards resulting from this endeavor. Fortunately, 42% of C-level executives say they already appreciate the problems silos create and plan to attack it in the year ahead.

Experian says that even if your organization can’t undertake a massive restructuring to break down interdepartmental barriers, you still have the ability to affect change and deliver better customer experiences by realigning your marketing department from one that is channel-focused to one that revolves around your customer. At the very least, you should be investing in technologies that makes data accessible and actionable across groups.

Marketing Attribution: What’s the ROI?

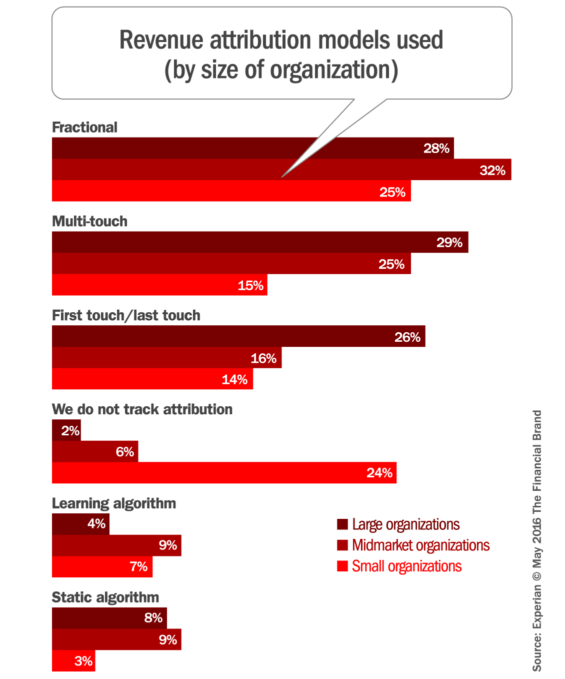

Many marketers have little- to no understanding of what their investments are actually netting them. The majority of marketers in the Experian survey (51%) use simplistic or inaccurate forms of marketing attribution… or use none at all.

More than one in ten marketers say they do not track revenue attribution. This means they have no insight into how their marketing programs contribute to the bottom line. They must rely on “favorite channel” biases and gut-based assumptions rather than a data-driven understanding of how specific channels and tactics perform.

Two out of every five marketers in the Experian survey say they use basic forms of attribution like first touch/last touch in which the entire sale is attributed to either the first or last interaction, or multi-touch in which equal revenue is attributed to each interaction in the customer’s journey. This limited view is better than none, but it does nothing to help break down operational silos or deliver truly improved customer experience.

According to Experian’s research, 45% of marketers employ more advanced attribution methods. 30% use fractional allocation, a method that accounts for multiple channels and touch points by dividing purchases into weighted values that are measured incrementally and allocated to each channel. There are varying degrees of sophistication within the fractional attribution method. The key is to consistently test and refine the weights to establish the most accurate equation for your program.

The most sophisticated marketers in Experian’s survey are using algorithmic attribution models — either static or learning. Algorithmic attribution models use robust statistical techniques to credit weighted influence across all interactions, typically by comparing the path of customers who convert against those who do not. Provided the models are robust and transparent, Experian says this is the most objective and reliable methodology available to attribute credit.

Reality Check: You will never answer questions surrounding marketing ROI without a mature, robust data analytics program. With as many different channels and streams of data pouring into your financial institution, it’s imperative that you establish the metrics and implement the tools necessary to capture the data necessary to develop marketing attribution models.

Personalization: The Quintessential Element to Marketing Relevance

There are two over-arching themes that are central to the discussion of data in financial marketing: personalization and automation. This is the goal — creating systems that will automatically generate marketing messages with maximum relevance — but it takes the right data to make it happen.

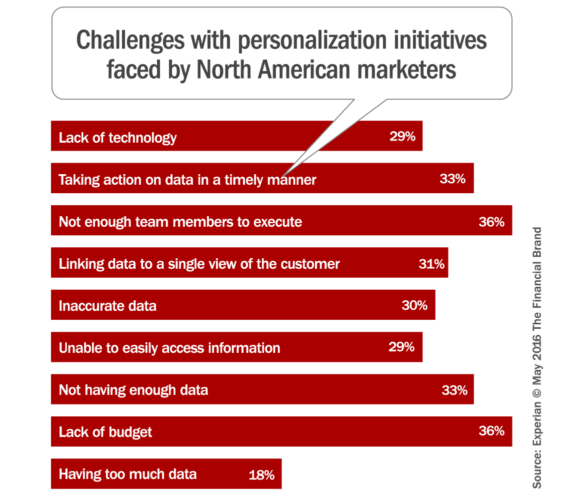

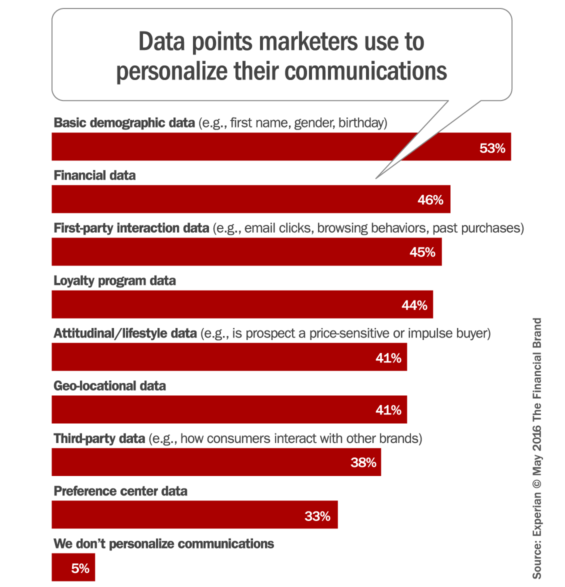

In Experian’s study, 93% percent of marketers say they are personalizing communications to some degree. But most are only using basic demographic data like first name, gender or birthday as the basis on which their messages are “personalized” (this would probably more accurately be described as “segmentation” than true “personalization”).

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

Instant Messaging. Instant Impact.

Surprisingly, fewer than half of respondents in Experian’s research say they use first-party interaction data such as email clicks, web browsing behaviors or past purchases to tailor their communications. This is data you already have right at your fingertips. Retail and ecommerce marketers have recognized the value in this kind of data for some time now, and are 38% more likely than all other industries to personalize using first-party interaction data. They also leverage loyalty program data and preference center data to greater degrees than other industries.

Experian warns that if you botch attempts at personalization, it can have disastrous results not only for an individual campaign but also on people’s perception of your brand. Brands that employ first, second and third-party data together (and do so responsibly) will reap the rewards.

Reality Check: You can’t develop a personal relationship with someone if you don’t know them. It’s impossible to personalize marketing messages without having rich insights into their needs, wants, desires, interests and preferences. Without data, you’re shooting in the dark.