Until the relatively recent past, banks and credit unions needed to invest significant resources in a branch network to achieve scale for acquisition and servicing of customers and members. Today, technology advances allow a digital bank to serve consumers in a single country or globally without a single branch. For many organizations, digital delivery has provided an alternative channel for the vast majority of activities previously performed at a physical branch.

Beyond technological advances, the behaviors of the consumer base have also shifted. For instance, the way in which Millennials use bank branches is a good leading indicator of the vulnerability of vast branching networks. According to a report from Business Intelligence:

- A large percentage of banked Millennials don’t use branches: 38% of banked Millennials say they don’t use a bank branch to perform banking activities, and 26% say they visit a bank branch less than once a month. This means that other banking channels are meeting the banking needs of Millennials.

- Branch visits are infrequent: Nearly 75% of Millennials visit bank branches either once a month or less, or not at all. Only 6% indicate visiting a branch weekly or more often.

- Branches not required: Only 16% of banked Millennials who visit branches say they do so to perform activities that can only be carried out at a physical branch. With almost every type of transaction currently possible on a digital device, the perception of the need to visit branches will only decrease.

The Importance of Physical Branches Fades

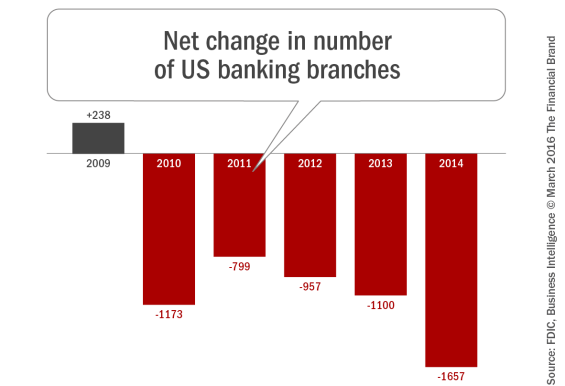

Overall, we have seen many financial services organizations respond to these changes, albeit very tentatively. Some banks have closed branch offices, while others have reduced branch footprints. The result has been that the net change in US branches has remained negative for five years, and the rate of decline appears to be accelerating, according to FDIC and Business Intelligence statistics. In 2014, 1,657 branches closed, marking the largest net decline in history, according to the FDIC.

Closing branches is still difficult for many banks and credit unions. The Business Intelligence study found that 62% of Millennials still use and value branches. Older segments are even more likely to use and value branches, with the risk of losing customers and members associated with closing offices.

The shift in branch use also impacts employment numbers, which can have a negative impact on an organization’s community and customer relations. According to the Bureau of Labor Statistics (BLS), the number of tellers working at American banks will decline by as many as 40,000 (7.7%) through 2024 (from 520,000 today). While providing cost savings for banking organizations, these reductions are difficult for many banks and credit unions to make.

Finally, there are regulatory implications associated with closing some of the worst performing branches that are located in urban areas. While not stopping any closing, a downgrading of an organization’s Community Reinvestment Act (CRA) rating can impact the ability to grow in the future.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

What’s the Future for ATMs?

ATMs continue to be an important alternative to branch visits for most bank and credit unions, especially by younger generations. ATMs also provide substantial cost savings to banks compared to in-branch teller transactions.

According to the Business Intelligence study, Millennials are heavy ATM users overall, overwhelmingly preferring in-network ATMs, since using in-network ATMs usually eliminates any fees. Other findings include:

- There’s an in-network/out-of-network divide: 95% of Millennials who use ATMs to perform banking activities say they use their banks’ in-network ATMs; 33% say they use out-of-network ATMs.

- Millennials visit ATMs frequently: 48% of Millennials who use ATMs report they make three or more visits per month.

- Out-of-network ATMs are avoided: 72% of Millennial ATM users say they use out-of-network ATMs less than 10% of the time.

- Willingness to give up cash: About 40%, 0r 31 million Millennials, say they would give up cash completely if their credit or debit card could replace all forms of cash transactions. Without the need for cash, the value of ATMs diminishes.

As mobile payment options increase (Apple Pay, Samsung Pay, Google Pay, etc.) and P2P payment apps become more ubiquitous, the need for cash (and ATMs) is reduced. In addition, as usage decreases, the cost per transaction to financial institutions increases and the viability of maintaining vast networks of ATMs is negatively impacted. So ATM networks, like branch networks, shrink.

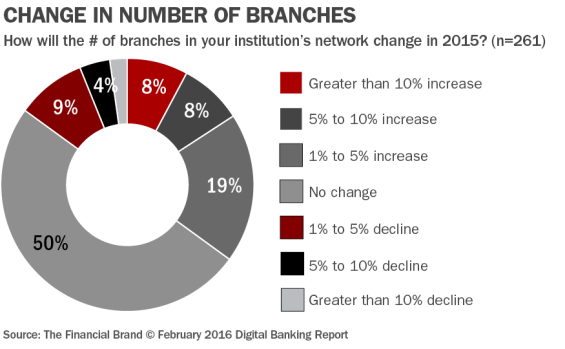

Based on all of the statistics and trends presented, some would believe that all organizations are closing branches and that the strategy of expanding branch networks is no longer occurring. Surprisingly, that is not the case.

Branches Continue to Be Built

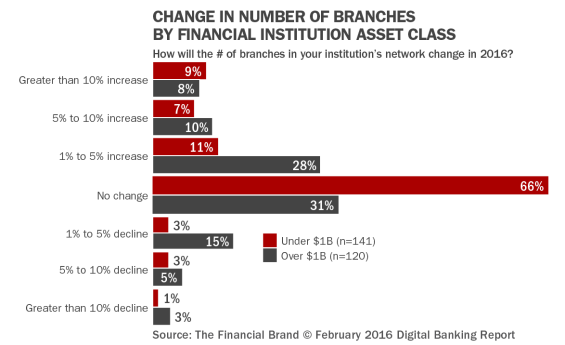

Despite trends that would indicate the contrary, the “2016 State of Financial Marketing” survey, fielded by The Financial Brand, sponsored by Deluxe, and published by the Digital Banking Report, found that 35% of executives responding indicated that they will be increasing their branch network in 2016. Of the organizations that will be increasing their branch network in 2016, roughly a third will be increasing their networks by more than 10%, with just over half indicating a 1% to 5% growth. Only 15% of survey respondents indicated that they would be reducing their branch network in 2016.

When we looked at the changes in branch distribution by asset size, we saw a bell curve with the top of the bell curve in the “no change” category (especially with the smaller institutions). Similar to 2015, the smaller institutions are more likely to increase their branch networks this year. As can be expected, this same growth strategy is evident by institution type, with 37% of credit unions increasing their branch networks and 35% of community banks deploying more physical branches in 2016. Only 6% of credit unions and 14% of community banks are planning to decrease their networks this year.

Interestingly, the study found that 33% of regional or national banks were going to increase their branch presence, while 42% will be decreasing their networks. Which begs the question … what is behind the strategy to expand branch networks when the demand for branch-based services is contracting? In addition, with many organizations moving into areas with a higher penetration of Millennials and Gen X consumers, would the objective of expansion be better achieved through digital channel enhancement?

How Should You Allocate $2 Million?

Building a branch has never been inexpensive. According to Bancography, freestanding branch costs range from $700,000 to $2 million, and averaged $1.3 million, in 2013. For inline branches, reported costs ranged from $250,000 to nearly $1 million, averaging $530,000.

Reflecting the wide regional disparities, the cost of land for a typical branch ranged widely from $250,000 to $1.4 million according to Bankography. As expected, costs tend to be much higher in the larger metros, especially in the Northeast corridor and the Great Lakes region. Cost of land has actually decreased in the past several years with the depression of the commercial real estate market.

With the cost of building a new branch being so high, banking and credit union executives need to ask themselves, “Is expanding my physical presence the best use of my limited funds?” More specifically, they should determine if the $2+ million investment would generate a better return on investment if invested in an improved mobile and online banking experience for their customers (or members).

Building for the Future

Assuming that the traditional rationale for building a new branch was to either acquire new customers in a new market, or to improve the accessibility of branch services to a consumer base already established, aren’t both of these objectives better met through digital offerings given the shift in the marketplace? Given that the majority of shopping for banking services is done through online and mobile channels (before ever stepping into a branch), providing an enhanced digital account opening process and advanced onboarding would achieve both of the desired objectives (acquisition and growth) at a much lower cost.

More importantly, as referenced in a previous article published on The Financial Brand, Digital Divide: Can Small Banks Keep Pace, consumers are now basing their satisfaction on how well financial institutions can serve them from a digital perspective. For the first time ever, larger financial organizations are outpacing their smaller counterparts based on the delivery of mobile and online services. And the segment that most institutions are fighting over (Millennials and Gen X) are the most likely to demand digital solutions today.

Maybe, instead of building that next branch, the funds allocated for a new building could be used for an enhanced mobile offering, including the ability to open a new account and build engagement through the use of a mobile device or your online banking platform.