For nearly a decade, the Federal Reserve has held short-term interest rates at record low levels. With lift-off now behind us, and interest rate increases likely to continue over the coming few years, the banking industry is faced with some marked shifts from the last rising rate environment in 2006.

The banking industry of 2016 has already been dramatically transformed by technology, regulation, new players and consumer access to information. It is also operating in the age of the empowered customer. The days of the passive bank customer are quickly fading, and a new segment of consumers we’ve dubbed the “Overbanked” is emerging.

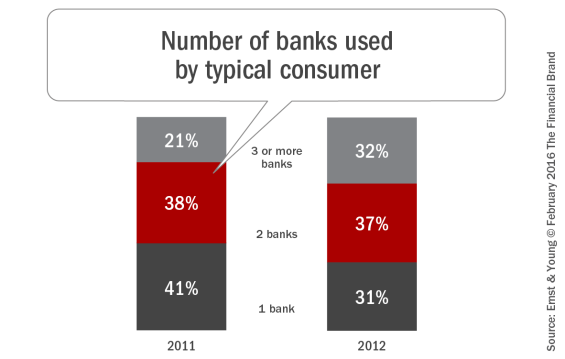

An Overbanked consumer is defined as someone holding open deposit accounts with three or more institutions at any given time, some of which are wired together. A 2012 EY Global Consumer Banking Survey found that 32% of retail banking customers had three or more banking relationships. The survey found that customers are more likely than ever to switch their main banking relationship.

Similarly, a 2015 Consumer Reports Bank & Credit Union Buying Guide noted that in a survey of its subscribers, half reported that they had a second bank or credit union relationship; and almost 38% surveyed indicated that they were able to get better rates for some services and products from institutions that were not their primary bank or credit union.

Motivated by economic benefit and fueled by new technology, the Overbanked are neither swayed by the attentive service of their branch teller nor intimidated by the complexities of managing their personal finances across multiple accounts and online banking platforms. The Overbanked tend to dismiss the notion of a ‘relationship’ with a given institution – making financial product decisions simply based on how much they stand to gain.

The Overbanked are quite likely to spell big trouble for bank deposit portfolios in the emerging environment. Executives at top banks recently shared their estimates for deposit run-off, which ranged from 5% to 11% of their portfolio balances, according to the article in the American Banker, “Bankers Brace for Deposit Losses as Higher Rates Loom.”

The Overbanked are likely to be at the forefront of these changes, and its unlikely banks have fully accounted for the degree to which balance run-off could be possible in varying scenarios. With bankers facing the allure of widening margins in the rising rate cycle, it’s becoming increasingly obvious that customary ‘lag and pray’ practices will simply be outperformed.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Financially Literate, Tech Savvy and Wealthy

Many banks employ minimum balance requirements in order for customers to enjoy perks like higher interest rates, monthly fee waivers or rewards programs. This is generally not an obstacle for the Overbanked, who have the funds to meet minimums across several bank accounts allowing them to benefit from competitive rates, broader product options and premium features.

The Overbanked have the financial literacy and skills to manage money effectively in different accounts while keeping track of varying financial goals, and aren’t afraid to spread their funds across institutions if they see the opportunity to benefit. The Overbanked are not all ruthless optimizers, but they have the near frictionless ability to rebalance quickly across all of the banks they work with.

Aided by Technology

The emergence of websites like bankrate.com and nerdwallet.com have made ‘shopping around’ for the right combination of product features, fees and rates a snap for the Overbanked. Bankrate.com aggregates – and make available for free – the best rates on more than 300 financial products including CDs, deposits, mortgages and checking accounts from some 4,800 financial institutions.

Once an account is opened, the Overbanked can turn to sites such as Mint.com, LearnVest and Personal Capital to keep tabs on multiple bank accounts and to get a complete view of their financial life. These sites have the capacity to connect to almost every US financial institution, showing consumers a view of their transactions and balances from all accounts in one place. Despite some lingering security concerns, the popularity of these websites is undeniable, with Mint.com claiming to have as many as 10 million users in 2012.

Completing the picture, the ease of transferring funds between accounts using mobile banking technology has made the Overbanked’s approach to financial management far more feasible then ever before.

Banks are Unprepared for the Overbanked

A 2014 Bain & Company report on customer loyalty in retail banking stated that hidden defection of customers from their primary bank is rampant, with more than one-third of respondents saying they bought a banking product from a bank other than their primary financial institution in the past year. Even though it is not as alarming as losing a customer relationship, this hidden defection is still a missed opportunity that promotes a fraying of the customer relationship. With unprecedented access to information and broad declines in bank customer loyalty following the Financial Crises already in place, the increased economic incentives associated with rising rates is likely all that is needed to spur the Overbanked segment into more pronounced action.

While strategies to proactively market and sell additional products to existing customers are commonplace, the majority of American retail banks have not invested in gaining a granular understanding of the factors actually driving their customers’ choices. This lack of insight, paired with inadequate technology infrastructure to quickly adapt products and pricing, represents a material portfolio risk to many institutions as the rising rate environment unfolds.

Developing a holistic understanding of emerging banking segments like the Overbanked will become a critical differentiator in the ongoing fight for customers. Knowing what a customer values in their banking relationship, and effectively tailoring products, pricing and service around that understanding, allows for the most efficient deployment of bank resources to retain and deepen customer relationships. While banks may decide that chasing certain customers is not worth the expense, these decisions need the benefit of clear trade-offs and a dedicated strategy that aligns with realistic portfolio expectations.

As shown in many other industries recently revolutionized by the era of customer-centricity, the expectation of a personalized experience has truly become ‘table stakes’. It is time for banks to put their expansive data resources to use in pushing forward a prioritization of the customer experience.