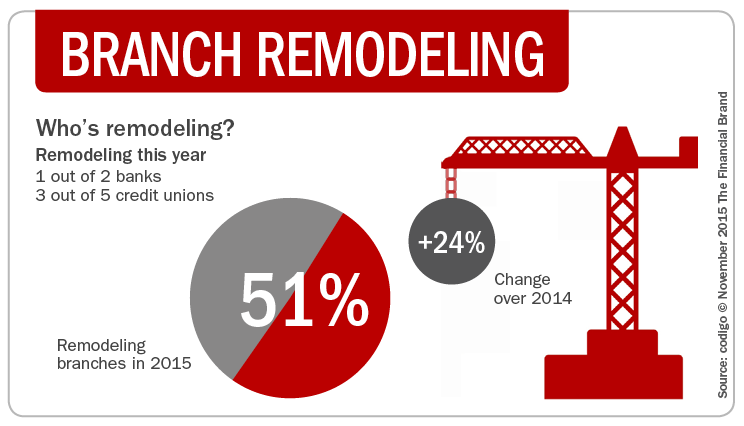

According to Codigo, more institutions are remodeling branch locations than in previous years. According to Codigo’s 2015 Branch Transformation Report, 51% of banks and credit unions are remodeling a banking center now through 2016. This compares to only 26% who indicated remodeling plans in 2014,

This data indicates that more institutions are rejuvenating old branch locations to better respond to the changing needs of today’s consumer, including the highly digital-first Millennial segment. This report is the second annual research study that provides a snapshot of branch strategies for over 250 financial institutions in the United States.

Compared year-over-year, the report provides great insights into the banking industry’s branch transformation trends. Here is a brief summary of five takeaways from this year’s report.

The Remodel Revolution

In 2014, 26% of respondents claimed to be remodeling an existing branch location. This year, that number nearly doubled (51%), and the data shows one in every two financial institutions are remodeling at least one branch in 2016. This statistic is a clear indication that major changes continue to happen in the branch.

The newly remodeled branches have an average of 6 employees, with one out of 4 credit unions having 10 or more employees in the remodeled office. It is clear from the research done by Codigo that the ‘Remodel Revolution’ will continue, with space decisions continuing to evolve with modern technology positioned for improved customer experiences.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

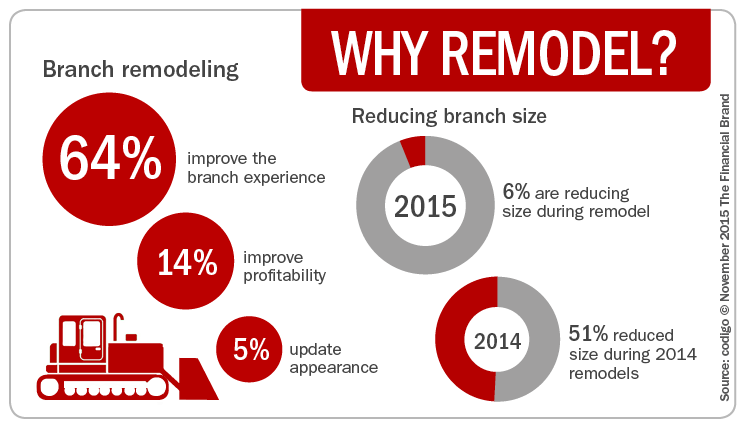

Focus on the Customer Experience

There are several reasons why financial institutions are remodeling their branches, but the primary reason (64%) is to ‘improve the customer experience’. Fewer than one in five respondents said ‘increasing branch profitability’ was their main goal. This finding reinforces the research done for the Digital Banking Report. In that report, it was emphasized that today’s digital consumer may visit the branch less often, but they expect an experience that reinforces digital interactions. Instead of just cashing a check or making a deposit, today’s digital savvy consumer expects more informed interactions and enhanced advisory services.

Interestingly, 94% are NOT reducing the size of the branch as part of the remodel. In 2014, 51% reduced the size of the branch during remodeling.

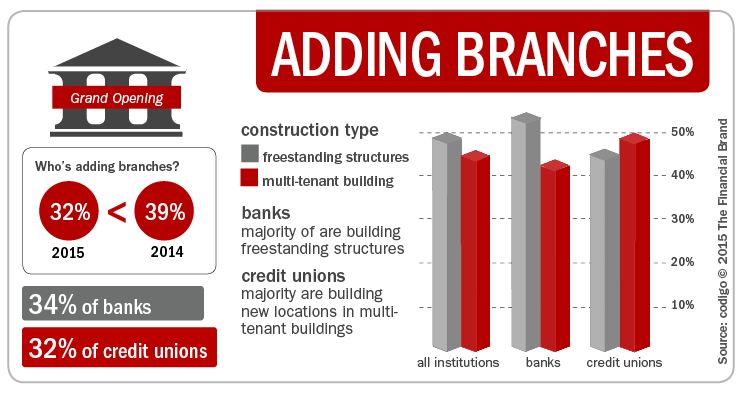

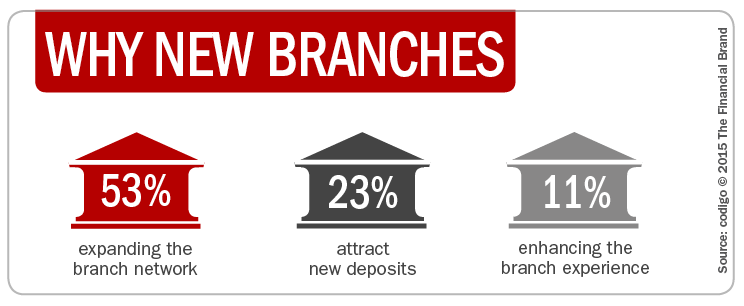

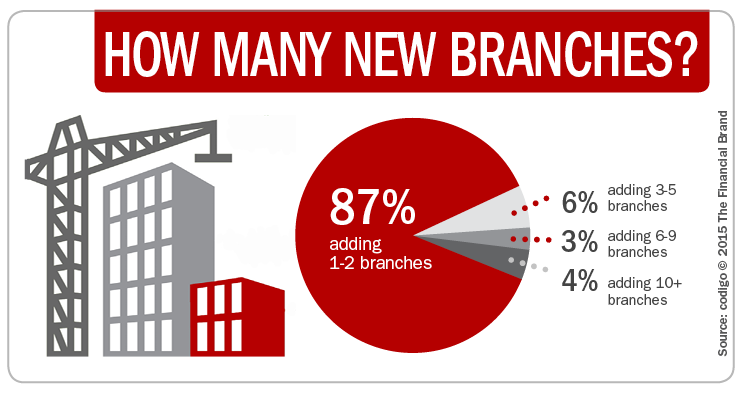

Fewer New Locations

The Codigo study shows that institutions are hesitant about adding branches. As has been widely covered by industry reports, the majority of institutions adding locations are larger organizations with $1B or more in total assets – 65%. According to Codigo, “This trend could be an indication that smaller community institutions are focusing resources on adapting current locations to comply with the banking demands of today’s consumer and expanding reach with new methods of distribution such as mobile and online channels.”

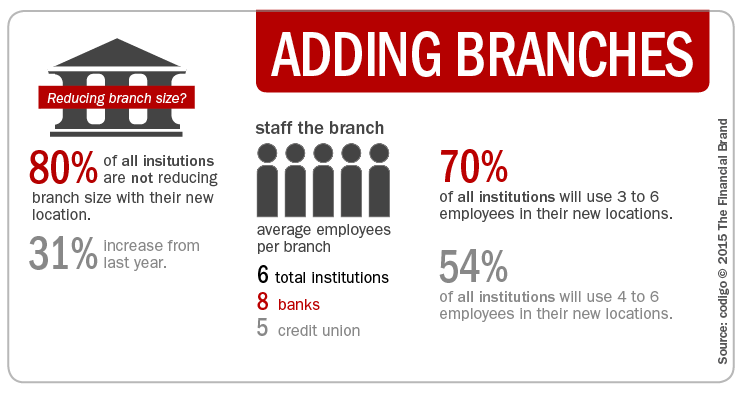

Not Reducing Branch Size or Headcount

Contrary to 2014, most institutions said they would NOT be reducing the physical size of newly added branches – 80% of respondents compared to 49% in 2014. According to Codigo, the current average branch size was 2,116 SQFT. Interestingly, of those organizations that did say they were reducing branch size, 83% claimed their new location would be 2,000 SQFT or less. Based on this research, it appears the ‘magic size’ of branch is around 2,000 SQFT.

For new branches added, the average employee headcount is 6.5 total employees per branch. Credit unions reported they would use seven total employees in the new or remodeled locations while banks reduced to 6. In 2014, respondents projected new or remodeled locations to be staffed by only four employees. In other words, the number of employees at new locations is actually increasing despite drops in transactions industry-wide.

Bricks + Clicks

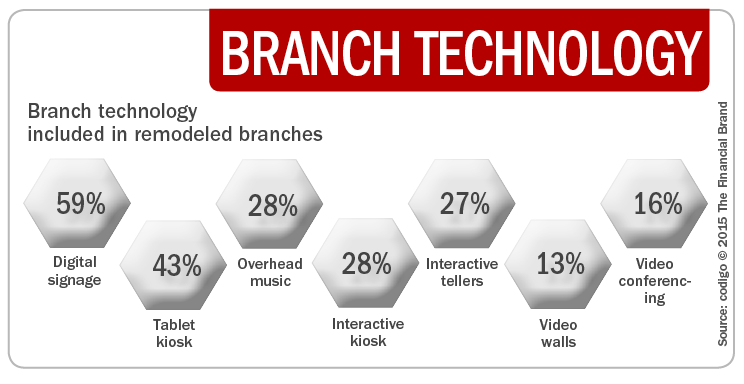

As new technologies enter all aspects of our daily lives, the bank branch is no exception. As was found in research highlighted in the Digital Banking Report, financial institutions are trying to build an omnichannel experience that integrates online and mobile experiences with the experiences in bricks and mortar facilities.

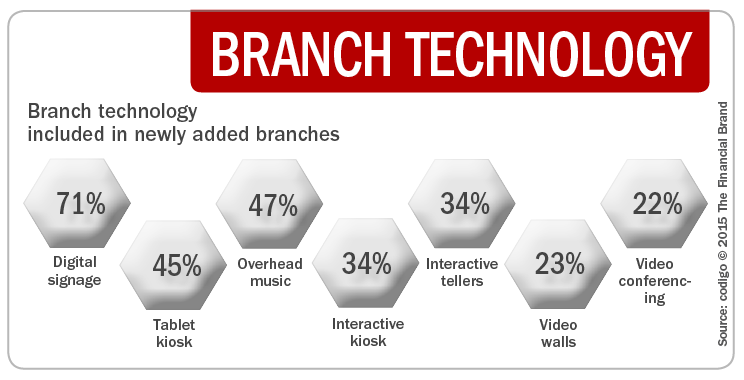

As Codigo found in 2014, digital signage leads the way as the most chosen technology in new or remodeled branches, with 59% of respondents remodeling branches and 71% of respondents adding branches reporting plans for new digital signage. With some organizations beginning to test beacons for customer identification, the personalization of in-brach communication could become a reality.

Tablet kiosks were also a hot technology in the Codigo research, as the branch becomes more self-serving and interactive. Forty-three percent of survey respondents said they would be adding interactive tablets to a remodeled brach and 45% to a new branch build next year.

As shown below, all digital categories were thought to be more important for new branches (the bottom chart) than for remodeled branches.

The Future of Branches

Despite numerous branch banking obituaries written industry-wide, the banking center is still alive at least for the foreseeable future. The millennial segment and digital natives in all demographic groups are forcing the financial sector to adapt retail banking to fit its needs or risk attrition. Branch transformation projects are at the core of the revolution.

According to Matt Deaton, Marketing Manager at Codigo, “With 49% of millennials saying they would consider using financial services from companies like Google or Apple, it is clear banks need to make a shift. The old branch of transaction and volume is rapidly being replaced by one focused on personal service.”

“The revolution has begun. Many institutions will succeed; others will fail. However, there is one clear-cut winner that will arise from this revolution – the consumer.”