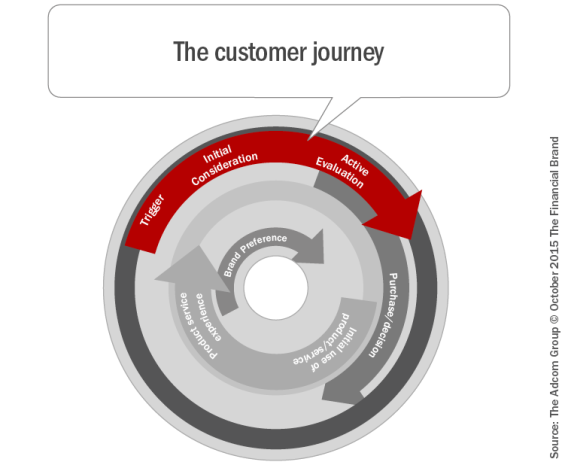

How do consumers make decisions? We used to think we had it all figured out with the marketing funnel. It was simple. Consumers moved logically through the stages of the funnel from awareness to familiarity then consideration, purchase, and finally loyalty. Marketers spent their time on figuring out how to move consumers through the funnel. They knew what to do in each phase to push them along. Life was simpler then.

The fact is that brands and consumers are engaged (or should be) in a continuous exchange of information and experiences. How well a bank or credit union maintains it’s authenticity – or put in simpler language – how well organizations do what they say, and truly listen to the feedback of their customers and members, is dictating the future success of growing and retaining a client base.

Consumers are informed, demanding, and have increasingly raised expectations about the type of experience they have with your products and services. Access to information and mobility enables your customers and prospects to form well-developed opinions and perceptions about your brand and what to expect.

Alarmingly, consumers are also taking the advice of complete strangers through online forums and other social media channels, from individuals with no substantive credentials regarding financial services as opposed to actual employees of a bank. So the game has changed for marketers and now the focus is on understanding the entire journey, and most importantly, determining the points of influence where a brand can be most impactful.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Fractional Marketing for Financial Brands

Services that scale with you.

Where Does The Journey Begin?

The journey is more complex than the funnel because it is non linear. Additionally, great experiences with other brands – not just other brands in financial services – but from completely different industry verticals are informing the opinion of your customers on what to expect from you. The bar of expectations will only continue to increase.

It is therefore important to understand how your customers are thinking and feeling, as well as what they are doing when something triggers the need or desire for financial services.

The journey starts with an event or situation that triggers a potential need or desire. This impetus could be a life event, such as having moved out of their current bank’s footprint or something seemingly benign as being disappointed with mobile app functionality. Regardless of the trigger, it gets consumers thinking about their financial services needs.

Is Your Bank On The Short List?

When this impetus occurs, there are banks, credit unions and other financial organizations that are already in the consumer’s mind. These are the ones that are considered first. They may be there because the consumer was influenced by recent advertising, or has simply been exposed or been influenced by the brand in the past. If this past experience was positive, they are often more than likely to be a brand enthusiast.

Next the consumer explores these ‘top of mind’ organizations, as well as others. At this point, the consumer is in active evaluation. It’s important to be a top of mind brand because you have a better chance of being chosen during the explore phase.

During active evaluation, the consumer has a very short list and they choose to validate one or more brands before committing to choosing a winner. This can happen a number of ways, including peer reviews online or talking to family and friends. So, by the time a potential client walks into your branch or goes online to open an account, they have already narrowed down their choices tremendously, or as in most cases, have already made the decision to open their account. At this point, they are now looking for validation of the brand experience they believe will be delivered.

Is Your Messaging And Actual Experience Aligned?

”The guidance, support, and timely communication during the onboarding phase can easily dictate whether you will have a long-term relationship with your client or if they will just end up being part of your attrition statistics.”

Although the actual account opening process could take the least amount of time, the experience is critical. The guidance, support, and timely communication during the onboarding phase can easily dictate whether you will have a long-term relationship with your client or if they will just end up being part of your attrition statistics.

During this initial use of your products and services, your new customer is forming strong opinions with every interaction. These opinions factor into the next time a financial institution is chosen. This is very critical because they are measuring their expectations of your brand, what you said you will do, how it will make them feel, and seeing if it matches up to reality.

If the experience falls short of expectations, you will lose this customer. The highest rate of attrition is within the first year of a new relationship, and most concentrated within the first few months. So, the question is, how well have you aligned your onboarding practices to the transactional metrics that help create a stickier and more profitable customer, and how well have you customized your onboarding to the messaging and the promised experience you have communicated?

You want brand enthusiasts, which is why every interaction in every channel matters. Your new customers, particularly those in the Gen Y and X segments, are sharing these experiences with their friends and family, and increasingly through social media. Make the most of every single touch-point with a client.

Are You Showing Up At The Critical Moments?

During each phase, a consumer is interacting with a variety of channels and sources to move from phase to phase. It may be a website or a relationship manager, or even seeing a news story. It is important to combine these channels with the points of influence throughout the journey to determine your marketing messages.

Where can you interrupt the journey and get your brand in front of the consumer? Is your bank or credit union showing up during those points of influence when decisions are being made? Do you know how to best message your clients with the right content through the right channels?

These are all important questions to consider as you map your journey to your specific consumer segments.