Even as mobile banking applications continue to replace daily transactions and inquiries, 88% of American adults feel they still need a physical branch location to go to for banking needs, according to research by CARAVAN® Omnibus Surveys from ORC International.

Surprisingly, when asked the importance of a physical bank branch five years from now, the sentiment remains consistent – with 84% saying a physical branch will still be important. While banking channels will continue to change or improve over time, the study also showed that Americans foresee having similar banking needs five years from now as they do today (whether in a physical branch or online/mobile):

- 84% want access to a live person to discuss banking needs, 84% also expect to need the same five years from now

- 86% currently use online access for bill paying and functions such as transferring funds and 88% foresee doing the same in the future

- 68% use paper checks to make payments, and 62% foresee doing the same in five years

Change comes slowly, but there will also be an increase in mobile and app usage, with 6 in 10 stating a need today and nearly 7 in 10 projecting a need in the future. This is not surprising, as over 75% of Americans ages 18-44 say having mobile functionality is already important to today’s current banking environment.

“As consumers continue to embrace digital technologies for simplifying daily tasks, consumers want the ability to interact on-the-go and on their own schedule via mobile and online offerings, as well as the option to be able to have face-to-face engagements for more complex issues such as investments and mortgages. The future of banking lies in the right mix – branches and technology – enabling a true omnichannel experience,” states Marina Stein, Senior Research Analyst for ORC International.

So how is the banking industry responding? From the branch examples found by The Financial Brand, the industry is trying to improve the customer experience by simplifying design, removing friction, integrating new technologies and trying to introduce more consumers to alternative digital delivery channels. In the majority of examples, this is being done in a much smaller footprint than in the past.

For a much deeper dive into the redesign of the physical branch, the Digital Banking Report provides an in-depth look at how banks and credit unions are changing branching strategies to reflect consumer needs and today’s digital capabilities.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

CIBC’s Runway Model Branch

CIBC worked with design consultancy allen international to develop a state-of-the-art branch design that would be a template for future full-service and small teller-free convenience branches. The expansion of this design template includes teller-free convenience stores – including airport kiosks.

Digital displays not only offer product advertising but also show local community information. In an era of constantly changing technology, the new branches also offer the flexibility and agility to be able to accommodate the next big tech developments.

With the growth in digital banking transactions and the move to smaller branches, these new agile formats are confirmation that branch banking still has a major role to play in the development of deeper relationships between bank and customer and prove the saying “one size and shape does not fit all.”

OdeaBank Flagship Combines Form & Function

With its transparent exterior and curved lines, I-AM created a design for Odeabank that is both welcoming and attention grabbing. The inspiring design of the flagship branch has already become an iconic structure within Istanbul.

A feature of the branches is to use the latest technology throughout the banking process in order to provide the most efficient and rewarding customer experience. A range of digital tools – touch-tables, tablets, iPhones and interactive screens – are routinely available in waiting lounges and entrance halls to welcome customers and facilitate engagement with the bank’s products and services.

HSBC Goes Big With Digital Flagship

Covering two levels, the 12,000-square-foot HSBC Liat Towers Orchard branch is positioned as HSBC’s flagship branch, showcasing the bank’s digital banking and wealth management capabilities. What sets the Liat Towers Orchard branch apart is its design and use of technology to deliver a unique customer experience and an environment where customers can spend time discussing their financial needs.

The branch showcases an ‘enticing’ media display before you even enter the premise. An in-house team of bankers worked in collaboration with Spacelogic who provided design consultation and construction services.

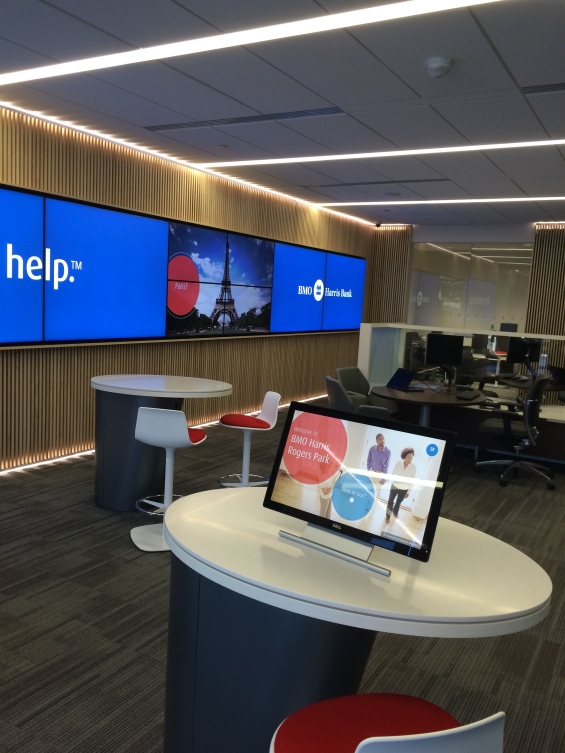

BMO Integrates Smart Technology With Human Touch

BMO Harris Bank opened its first-ever ‘Smart Branch’, combining a number of digital tools in the Rogers Park neighborhood. The new branch features:

- Video tellers equipped to provide customers with live on-demand interactions with bankers on the video screen

- Smart ATMs that offer customers options for Mobile Cash withdrawals without use of a debit card

- Customers have instant on-demand access to a wide variety of specialized bank professionals via video streaming, for help with mortgages, retirement planning and other needs

- Bankers armed with tablets to help customers with the new technology available in the branch and provide assistance for all of their financial needs.

Bank of China Modernizes Customer Experience

Bank of China launched their Branch of the Future pilot at Shengfu in the city of Guiyang, the capital of Guizhou province. In conjunction with the bank, allen international transformed the retail banking experience from the decades-old, traditional, service-dominated operation to a branch that for the first time provides staff with the platform to deliver a truly customer-orientated experience. Specialized retail-orientated training was included that placed BOC ahead of their national competitors.

One of the unique elements of this branch was the showcase of digital technologies and the launch of a new sub-brand called ‘Smart Banking,’ partnering with China’s largest mobile technology providers.

Cariparma Crédit Agricole Creates Welcoming Environment

DINN! and Cariparma Crédit Agricole wanted to dramatically change the retail banking in order to be more customer-centric, by planning a warmer and cozier environment. The “My House Bank” concept reinvents the banking experience through the innovative design and the leading-edge digital technologies.

Design elements, such as the lowering of the ceiling, casual seating areas and the constant use of the wood, created a contemporary, yet warm setting. The lighting system was designed to create different environments. For example, there is a broad light spectrum in the central areas to accommodate the customer entering the branch area, while in the perimetral area the light is weaker, in order to create a touch of privacy of typical domestic setting.

Umpqua Introduces Newest Version of Bank Store Concept

Umpqua’s Fox Tower store is the newest iteration of the company’s neighborhood store model. A smaller location built to reflect and engage the city, the store includes flexible meeting spaces, interactive digital product and app features and rotating products from some of Portland’s most compelling local businesses.

“Umpqua’s approach to banking is decidedly different: we believe it should be an interesting, enjoyable experience that reflects how important our finances are in our daily lives,” said Ray Davis, Umpqua Bank president and CEO. “Our new Fox Tower location is the latest expression of our bank store model, designed to celebrate and showcase what makes Portland unique, and how smart financial choices can serve the community’s residents and businesses.”

The smaller than normal 2,782 square-foot space includes the following:

- Community Spaces – The store is designed to serve as a central meeting center for customers, neighboring businesses and local organizations. It’s outfitted with community meeting rooms, an electronic recharging station, free Wi-Fi, and a lounge area.

- App Wall – A large-format interactive touchscreen first launched at Umpqua’s award-winning flagship store in San Francisco, the App Wall features bank products and services as well as a collection of in-house and curated mobile apps recommended by the staff.

- Mobile Service – Store associates are equipped with laptops allowing them to open accounts or serve customers anywhere within the store environment.

- Local Blends and Library – Customers can recharge with a cup of Umpqua’s signature coffee blend or Smith Tea while enjoying a curated selection of books and periodicals in the store’s reading library.

- Local Spotlight – Umpqua also showcases its Local Spotlight program at the Fox Tower store. The program demonstrates the company’s commitment to small businesses by showcasing and selling products from local companies each quarter

BOQ Creates Branch WOW!

Building a better Bank of Queensland (BOQ) meant building branches that created a WOW! experience. To create an experience their customers would love meant engaging with customers on their terms, when they wanted, and how they wanted … operating side by side and never across a desk or behind a barrier.

According to BOQ executives, this new look included:

- Always side by side, in partnership with our customers (never across a desk/counter)

- Customer is always in control and chooses how they interact with us

- Self service is always an option, but never a mandate

- Design aesthetic for customers

- Flexible, dynamic space for customer/community events

- Subtle moments of surprise and delight, leaving a smile

Ascend FCU Tackles Three Remodels

As with many organization Ascend FCU wanted to modernize their branches to better serve the digital consumer. They turned to Adrenaline to help them convert a flagship office, a traditional branch as well as an Express branch.

Going beyond just a redesign, Adrenaline also introduced new branding elements and improved sales process. To welcome members, a virtual greeter armed with iPads and supported by staff created a tech-forward but inviting entry experience. Members can sign-in digitally, and staff can use the iPads to begin quality, solution-oriented conversations.

To convert idle waiting time to engaged learning time, Adrenaline designed a curved feature wall to be a unifying visual anchor and destination for digital brand storytelling. Multiple seating options from lounge to high-bar allows members to migrate where they feel most comfortable. And a kid’s corner provides relief for busy parents and promotes early adoption for young members.

![Ascend_1500x1000-MJ11[1]](https://thefinancialbrand.com/wp-content/uploads/2015/06/Ascend_1500x1000-MJ111-565x377.jpg)

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Regions Introduces Video Tellers and Universal Bankers

Among the features of the Regions Bank Concept Branch models introduced at two university locations is a new Video Teller service. Video Tellers connect customers with a Regions representative via live video chat. In addition to processing most teller transactions, these representatives can help customers with account maintenance and general inquiries.

Video Teller representatives are available to customers during extended hours on weekdays (until 9 p.m. ET), Saturdays, Sundays and most holidays. Video Teller machines also provide customers 24/7 access to most ATM transactions such as cash withdrawals and balance inquiries.

Inside the main lobby, there is an open layout. The new layout does not include traditional teller lines. Instead, customers are welcomed directly by Regions’ Universal Bankers who can help them with all of their branch banking needs. Universal Bankers provide a variety of services ranging from cashing checks and accepting deposits to helping customers develop plans to reach their long-term financial goals.

The New Concept Branches will help Regions develop further branch designs by combining service and technology innovations with feedback from customers.