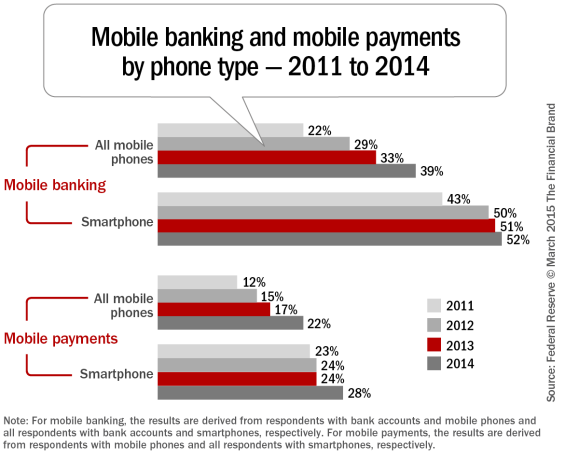

As of December 2014, 39% of adults with mobile phones and bank accounts reported using mobile banking according to the Federal Reserve’s 2015 Consumers and Mobile Financial Services Report. This was an increase from 33% a year earlier. The report is the Board’s fourth looking at how consumers access mobile banking and mobile payments. It is also the fourth year of consistent growth overall.

The growth, however, is almost entirely attributed to the growth of smartphone owners, where penetration continues to skyrocket (71% of all mobile phone users in 2014, compared to 61% in 2013 and 52% in 2012). This correlation is reinforced by the fact that 33% percent of consumers said getting a smartphone was the main reason for using mobile banking and for beginning to make mobile payments.

So, the question is whether the growth in mobile banking is simply a reflection of improved hardware capabilities as opposed to a response to a better solution being offered by banks and credit unions? And if this is true, there could be an overall usage plateau on the horizon since use of mobile banking by this increasing segment of smartphone owners has remained stagnant since the survey’s inception (52% in 2014, compared to 51% in 2013 and 50% in 2012).

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

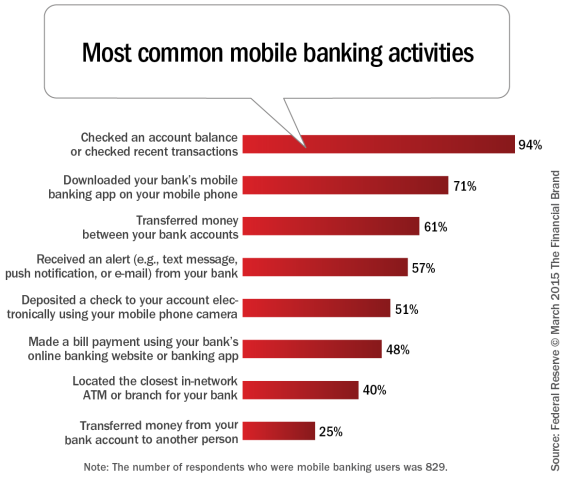

Mobile Banking Activity

The most common mobile banking activity performed continues to be the checking of account balances or recent transactions, followed by transferring money between accounts. More than half of mobile banking users received an alert from their financial institution through a text message, push notification, or e-mail–making this the third most common use of mobile banking.

The report also found that consumers who use mobile banking are becoming more comfortable with remote deposit capture. More than half of mobile banking users had used their mobile phones to deposit checks, compared to just 38% in 2013.

When the report looked at high-intensity users (mobile banking users who have conducted mobile banking tasks more than 10 times during the month), it was found that more active mobile bankers conducted tasks at the same or higher rates than the masses. More specifically, high-intensity users reported making bill payments using their bank’s online banking website or banking app and transferring money between their own accounts at higher rates than all mobile banking users. High intensity users were also found to be demographically similar to the larger group of mobile banking users, but had slightly larger percentages of younger and minority mobile banking users.

While the range of activities has increased, the frequency of mobile banking use has only increased slightly over the past year. The median reported usage increased from four times per month in 2013 to five times per month in 2014. Median usage for those with bank accounts who reported using mobile banking in 2011 and 2012 was also five times per month.

Mobile Payments Activity

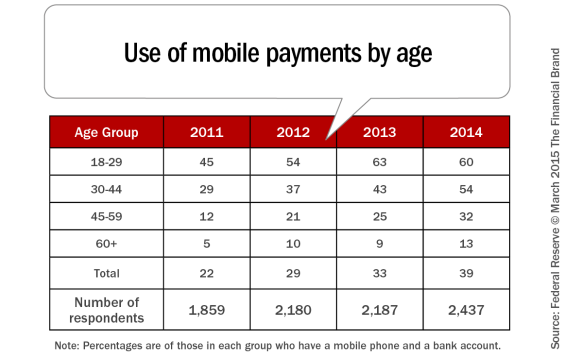

As would be expected, mobile payments activity is less common than mobile banking. Based on the responses to a rather broad definition of mobile payments, 22% of all mobile phone users made a mobile payment in the 12 months prior to the survey, up from 17% in 2013, 15% in 2012, and 12% in 2011.

Rates of mobile payment usage are somewhat higher among smartphone users, with those who reported having made a mobile payment in the previous 12 months increasing to 28%, up from 24% in 2013 and 2012, and 23% in 2011.

For smartphone owners who reported using mobile payments, the most common types of mobile payments were paying bills through an online system or mobile app (68%), followed by making online or in-app purchases (54%). Paying for a product or service in a store was the next most common type of mobile payment (39%). As shown above, age demographics play a large part in the acceptance of making payments with a mobile device.

Although using a mobile phone to pay for a retail purchase at the point-of-sale (POS) is still less common than paying bills or making an online or in-app purchase, this type of payment is gaining in momentum. Developments in technology, the entrance of new market participants (Apple Pay, etc.), and increased familiarity with mobile payments in the marketplace may be contributing to this trend.

Hurdles For Growth

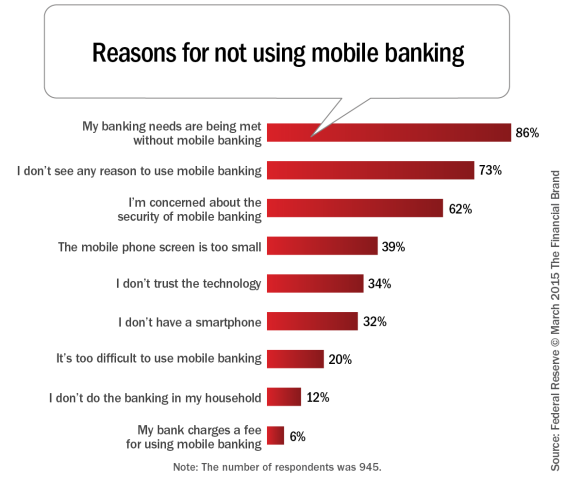

According to the report by the Federal Reserve, an ongoing challenge to growth of either mobile banking or mobile payments appears to be consumers’ limited demand for them. “Many consumers said their needs were already being met without mobile banking or payments, that they were comfortable with non-mobile options, and that they did not see a clear benefit from using either service,” said the study.

Surprisingly, around one in five (22%) of those with mobile phones and bank accounts indicated they didn’t even know if their bank or credit union offers mobile banking. The good news is that the share who did not know if mobile banking was available from their bank decreased from 28% in the 2013 survey. The share that said their bank does not offer the service decreased as well—from 6% in 2013 to 4% in 2014.

Among those consumers who do not use mobile banking, reasons included the belief that their banking needs were being met without mobile banking (86%), they did not see any reason to use mobile banking (73%), and the concern about security (62%). “The incidence of reasons for not using mobile banking was generally consistent between the 2013 and 2014 surveys. However, in the 2014 survey, concerns about the security of mobile banking decreased from 69 percent in 2013,” stated the report.

When consumers who do not use mobile banking were asked what mobile banking activities they would be interested in performing if their concerns were addressed, their responses largely mirrored those of current users. Reinforcing the possibility of a mobile banking use plateau on the horizon is the fact that 59% of those who do not use mobile banking indicated that they had no interest in performing any mobile banking activities even if their concerns were addressed.

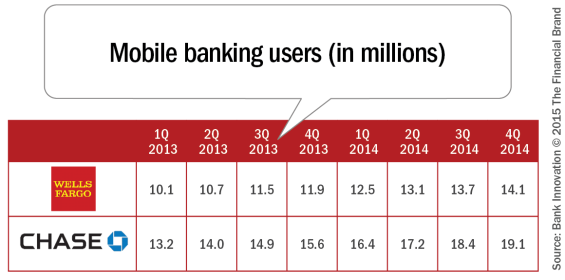

The impact of this plateau is also being seen at the banks with the greatest penetration of mobile banking users. As was reported by Bank Innovation, the torrid growth rate mobile banking users at these organizations has even begun to slow.

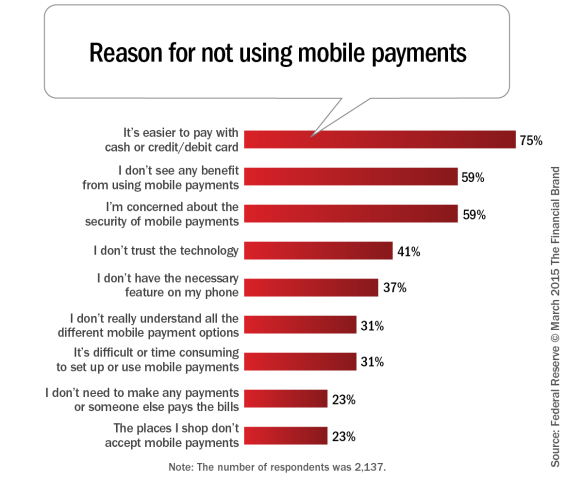

Among those who do not use mobile payments, the primary reason not adopting the technology is that they prefer to use other means of making payments. According to the study, 75% reported that it is easier to pay with other methods, 59% did not see a benefit from using mobile payments with the same proportion citing security concerns.

Among those who do not use mobile payments, the primary reason not adopting the technology is that they prefer to use other means of making payments. According to the study, 75% reported that it is easier to pay with other methods, 59% did not see a benefit from using mobile payments with the same proportion citing security concerns.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The incidence of reasons for not using mobile payments was relatively the same as in previous years, with the exception of security issues, which dropped from 63% in 2013. Also, fewer respondents reported that not having the necessary features on their phone (46% in 2013), which makes sense given the increased penetration of smartphones over the past several years.

“When consumers who do not use mobile payments were asked to indicate all the mobile payment activities they would have an interest in using if their concerns were addressed, 65% indicated that they simply had no interest in using mobile payments even if their concerns were addressed,” according to the report. This is similar to the responses regarding mobile banking, indicating that some consumers either have no interest in utilizing new technology or they have not been given adequate benefits to change old ways.

Moving Beyond The Plateau

Being an avid follower of banking trends and the founder of Finovate, Jim Bruene from NetBanker believes some of the reason for slowing acceptance is nothing more than consumer reluctance to try new technology. “Every new banking technology of the past 40 years (including ATMs) have struggled to get more than 50% adoption,” stated Bruene. “That’s not easy to solve. Education helps. But many users just need time to get on the bandwagon.”

More importantly, however, Bruene believes mobile banking growth could be more hampered by flawed mobile banking UI/UX. For him, the problem is poor design relative to other non-banking mobile services. He specifically mentioned:

- Poor mobile login

- Clunky mobile UI (he mentions the lack of a “go” button on Bank of America’s mobile login screen)

- Lack of historical data

- Lack of search

I would like to provide additional suggestions that could make mobile banking apps closer in usability to non-financial favorites:

- Balance availability without login

- Integration with mobile tools like my address book

- Customized experience based on frequent transactions (like an ATM, provide shortcuts based on what I do most)

- Information overload (I don’t need/want my investment portfolio on my mobile device)

- Contextual offers and location awareness

- Expanded alerts and notifications

The above are far from an exhaustive list, and I realize that some institutions have done a better job than others in addressing some of these customer experience issues. But, for the general mobile banking user to increase engagement and loyalty to today’s mobile banking solutions, they will need to catch up to the best non-financial mobile experiences.

Those organizations that move fast and promote their differentiation will benefit from the increased market share, engagement and potential for increased revenue and reduced costs.