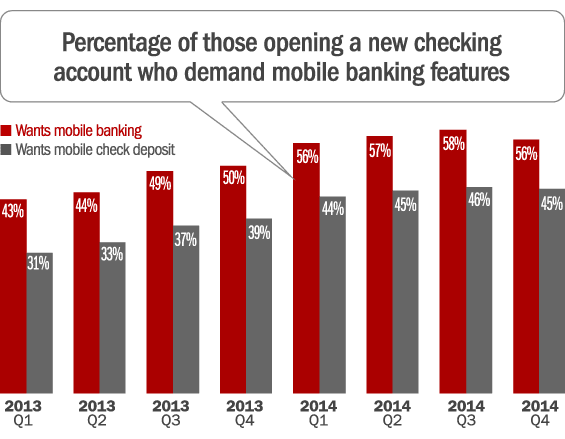

More than half of consumers shopping for new checking accounts indicate that they want their new bank or credit union to provide mobile banking. Nearly half now want mobile check deposit. Millennials are much more likely to be interested in mobile services compared to older consumers shopping for checking accounts.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

All of but six institutions currently listed on FindABetterBank.com offer a mobile solution. To resonate with prospects, they need to feel comfortable that you provide a functionally equivalent mobile app compared to whomever they reference as “good.” Most banks’ and credit unions’ offer similar functionality, so shoppers must believe your app is sufficient for their needs, so you should consider including product reviews.

About 80% of institutions listed on FindABetterBank offer mobile check deposit. No credit unions and only a handful of banks (5%) charge fees for mobile check deposit. Fees range from $0.25 to $1.00 per deposit. Most customers will use mobile check deposit infrequently and therefore won’t be too annoyed with the transaction fees, but there will always be competitors providing mobile check deposit for free. Fees for a “value-added” services associated with mobile check deposit might be more palatable — services like expedited deposits, deposit for checks over a minimum amount.

Not all consumers care about mobile payments right now, but many Millennials do and BofA and Chase are in front in terms of promoting mobile payment capabilities. For example, Bank of America’s logo appears with ApplePay on the storefronts of retailers that accept ApplePay mobile payments. Chase was one of the first to promote their QuickDeposit mobile check deposit service, and now they’re also taking charge with their QuickPay P2P service. It’s clear why Millennials think of big institutions when they think of mobile banking solutions… big budgets and brand name awareness.