A report by the Sells Agency finds that changes in life circumstances are the primary reasons consumers switch banks, and that preferred banking brands have an big advantage when it comes to gaining new business.

Based on research conducted through the agency’s Bank Clarity arm, the three top reasons why consumers switch banks include:

- They moved (41%)

- Their marital status changed (14%)

- There was a change in their job status (6%)

These three reasons can be classified as life circumstances.

Only 20% of survey respondents said they switched banks because they were dissatisfied. 6.8% of respondents blamed inconvenient locations as the reason behind their switch. One in 20 said they switched because they were unhappy about their prior bank getting acquired or merged away. A paltry 3.5% said they were attracted to their new bank’s products.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Do People Know Where They Will Bank Next?

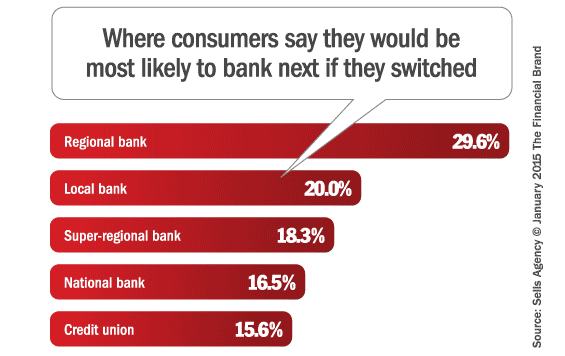

Of those surveyed, 57.5% said if they had to change banks today, they have a bank in mind they would most likely switch to. The other 42.5% have no preference, and would have to shop around. Of those who know where they would switch, regional banks were by far the most popular choice. You’ll notice in the chart below that credit unions are essentially on par with large national banks.

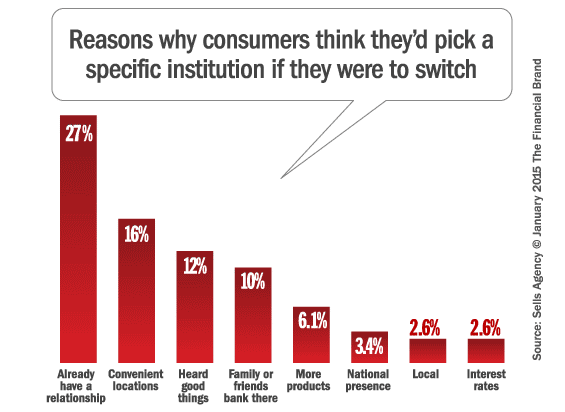

For those consumers who know who their next bank will be, there is one big question: Why that bank?

For 27% of consumers, they already have a secondary relationship with a bank, which they would switch their primary account to if they had to. Other top reasons are: convenient locations (15.7%); seen, heard, or read good things (12.2%); and family or friends use that bank (10.4%). Two of these responses — family or friends who use that bank, and convenient locations — are consistent with the top reasons people chose to do business with their primary bank. For those with a preferred next bank, their top four answers are associated with familiarity. Their familiarity is due to either a pre-existing relationship with the bank, frequently seeing the bank’s nearby locations, their family or friends’ satisfaction using that bank, or the relaying of positive information about that bank through different media and advertisements.

For those without a preference for their new bank, what would influence their bank choice? Of those surveyed, the most important factors affecting their decision include reasonable fees (25.9%), convenient locations (20%), free checking (15.3%), and interest rates (10.6%).

Are All Banks the Same?

One in four consumers say convenient branch locations are the primary reason they are chose their current bank. Only 5.5% said they chose their current banking provider because it was “local,” and even fewer (3.5%) cited the bank’s “good reputation.”

When asked what differentiates one bank from another, 30% of survey participants said that “service quality” is what sets their primary bank apart. A startling 9.5% said “nothing.”

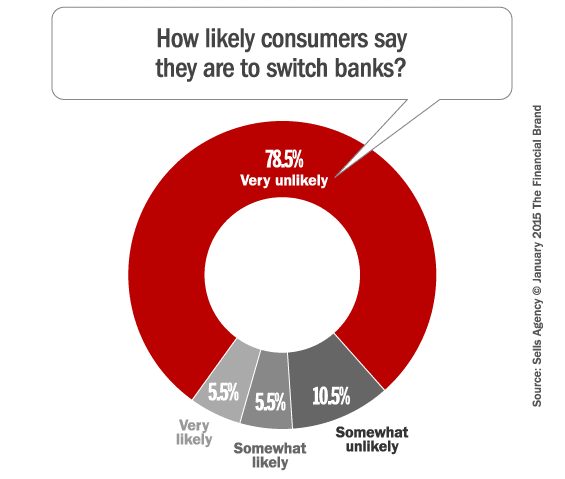

Reality Check: If nothing sets banks apart, then what is going to keep consumers with one provider or another? But conversely, why would they bother switching? Maybe that’s why the majority of those surveyed (78.5%) said they are very unlikely to switch banks in the next six months.

Those surveyed who have a bank in mind they would most likely switch to are substantially more likely to change banks in the next six months than those who don’t know where they would switch. Among those who know where they would switch, 9.6% are very likely and 7.8% are somewhat likely to switch banks in the next six months. This is a drastic difference from those who don’t know where they would switch, which are 0% very likely and 2.4% somewhat likely to switch banks in the next six months.

However, just because most of those surveyed said they are not likely to switch banks in the next six months, that doesn’t mean they won’t. As stated before, 61% of people who left their previous bank for a reason other than dissatisfaction — they left because of a disruptive event in their life circumstances. Life circumstances, such as a move or job change, are often unpredictable and can cause consumers to switch banks whether it be a divorce, marriage or moving to a new job.