EY (is it not called Ernst & Young anymore?) released its 2014 Global Consumer Banking Survey recently. For a better review of it than I’ll provide here, see the summary on The Financial Brand, or download the report directly.

The report goes to some lengths to establish the connection between the level of trust consumers have in their banks and their intentions to refer their banks, as well as to open new accounts.

No argument from me. (Well, not about the correlation or even causal relationship between trust and strength of relationship, that is. As for intention to refer, c’mon people. It’s 2014–it’s time to stop asking consumers about their intentions to refer, and to start tracking their actual referral behavior. You don’t pay your salespeople on prospects’ intentions to buy your products and services, do you?)

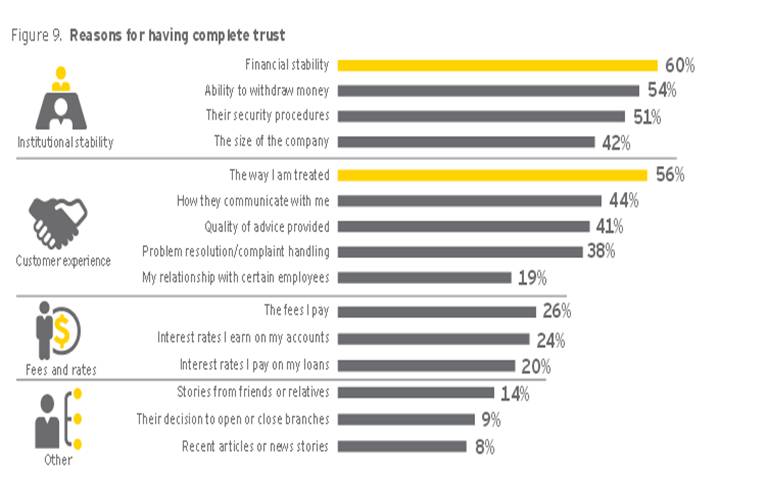

According to the EY study, 44% of consumers have “complete trust” in their primary financial services provider (the vast majority of whom are banks). What caught my attention were the reasons why consumers who have “complete trust” do so:

Source: EY 2014 Global Consumer Banking Survey

Source: EY 2014 Global Consumer Banking Survey

The most frequently cited reason for having complete trust? Financial stability. Second most-frequently mentioned reason was a “customer experience” factor, “the way I am treated.” But a larger percentage of consumers cited “institutional stability” factors (e.g., ability to withdraw money and security procedures) than did those who listed “customer experience” factors (like how they’re communicated with, and the quality of advice provided).

I guess the “customer experience” isn’t that important after all, eh? A larger percentage of customers said size of the bank was a driver of trust than the those who mentioned problem resolution or their relationship with bank employees. (I guess size does matter).

Given the results of what drives trust–and the importance of trust in driving customer relationships and buying behavior–it seems out of place for EY to not just title the following section of the report “The experience is what matters,” but to title the entire report “Winning through customer experience.”

According to EY’s study, “customer experience” isn’t all it’s cracked up to be.

My take: “Trust” is way too complex a construct to boil down to measuring with labels like “trust completely” and “have moderate trust,”

What exactly is it that consumers “completely” trust their bank with, or to do? To “be there in the morning”, and to “have the right amount of money in the account”? Or is it “to always provide me with advice that’s right for me and not just the bank’s own bottom line?” If nearly half of all consumers “completely” trust their bank to provide the latter, they’re fools.

I would like to have seen EY segment the data to see if there were different groups of consumers who place higher emphasis on experience-related factors vs. institutional factors vs. rates/fees. (EY: I’d be happy to do this if you’re willing to share the raw data with me).

The bigger issue here is that the list of dimensions used to identify what drives “complete trust” is not a comprehensive, mutually exclusive set of factors.

But wait: The most frequently-cited reason for opening an account was “customer experience.” Where were the institutional factors like “financial stability” and “ability to withdraw money”? Why would these institutional factors be drivers of trust, but not be reasons for opening an account?

—————

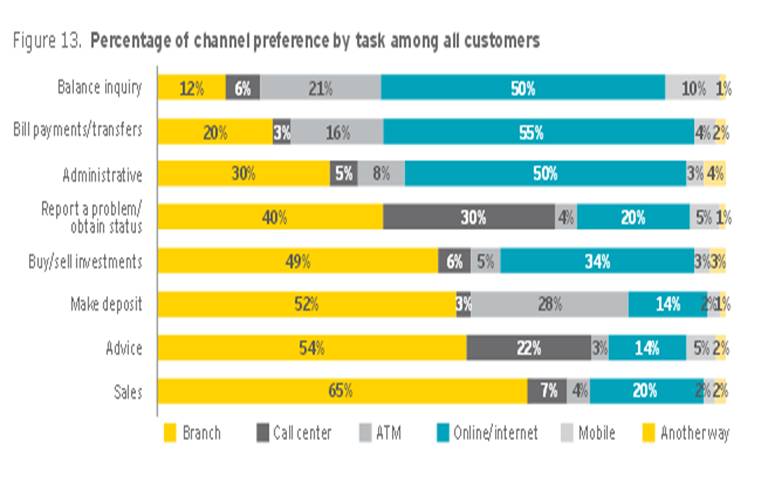

Speaking of reasons for why consumers open accounts….sorry, Brett King, but I didn’t see “mobile capabilities” anywhere on the list of reasons why consumers opened an account. I guess it’s just not very important. As a matter of fact, very few consumers listed the mobile channel as their preferred channel for a range of financial tasks.

Source: EY 2014 Global Consumer Banking Survey

Source: EY 2014 Global Consumer Banking Survey

Yep, more consumers prefer to make deposits through the call center than through a mobile device. As a matter of fact, a larger percentage of consumers would prefer to buy and sell investments using an ATM than with a mobile device (side note: If I’m ever behind you in a line at the ATM, and you start buying and selling investments, I’m going to kick the crap out of you) (side note 2: when 1% of people say they prefer to do a balance inquire “another way,” what do they mean? Writing a letter and asking the bank to mail them their balance?).

My take: Again, without some segmentation here, the top level results are deceiving.

I’ve also become very skeptical about “preferred channels” and adverse to asking consumers this question. First off, it means nothing. Second, it misses a reality about consumers’ experience: The preferred channel is the channel that is most convenient to use at any given moment.

—————

Bottom line: The most important takeaway from the report, however, is the second “opportunity” defined by EY: Help consumers make financial decisions.

I’ve written on this blog that “the next wave of banking competition is competing on performance. That is, who best helps the customer manage and improve their financial lives — and not who has the best rates or fees, or who claims to have the best service.”

If your bank or credit union is helping consumers make better financial decision, it won’t matter how large your institution is, or the location of your branches.