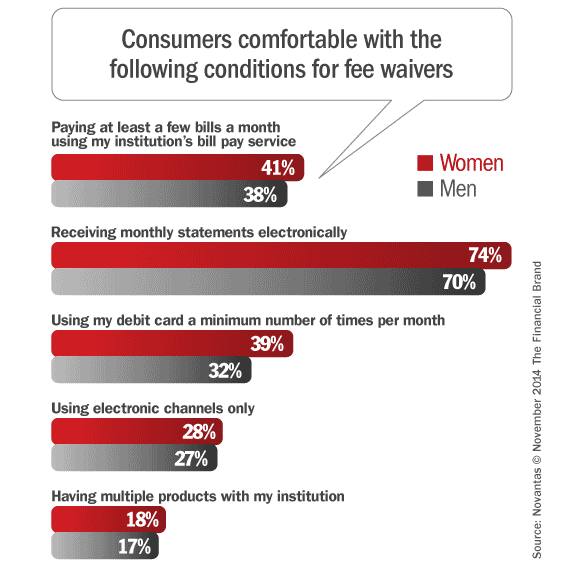

A study on FindABetterBank.com surveyed active bank shoppers to understand their expectations when it comes to waiving monthly service fees. Overall, about 65% of all respondents don’t want their next checking account to have a monthly service fee at all. But women were more likely to choose a free checking account, a checking account with lower fees, or one that requires specific behaviors to waive fees. This observation also explains gender differences in why people switch banks and how they manage their cash.

Fractional Marketing for Financial Brands

Services that scale with you.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Females are more sensitive to account fees compared to men. 70% of women who were in the market for a new bank or credit union responded “I don’t want this account to have a minimum balance requirement,” compared to just 58% of men. In addition, another study that Novantas published earlier this year revealed that 27% of women were shopping for a new checking account because they were paying too much in fees, compared to just 23% of men.

Men use banks more than women do… for some activities. 58% of men withdraw cash from an ATM once a week or more compared to 52% of females. Men were also twice as likely to say that they selected their institution because of their convenient ATM locations (15% of males compared to 7% of females).