Your credit union has a social media presence on Facebook, and Twitter, YouTube, maybe Google+ and Pinterest too. You’ve experimented with a content marketing strategy and attempted to integrate financial education into your online marketing activities. You are posting content often, and tend to link to interesting and useful articles hoping to position your credit union as helpful and knowledgeable. But…

You’re struggling to engage the audience. You’re having a hard time trying to post material that is really memorable, entertaining, educational and original on an ongoing basis

Sound familiar?

Currency Marketing, an agency specializing in credit unions, believes they have a solution for these content marketing woes. Their new product called It’s a Money Thing is designed to take financial education to the next level.

Currency, a Canadian marketing firm best known for its Young & Free marketing program for credit unions across the US and Canada, is no stranger to the social media space. Using an integrated marketing strategy that leaned heavily on social and digital channels, they have successfully helped credit unions attract more than 150,000 members — mostly Millennials — in recent years. Currency is aiming to capitalize on their first-hand knowledge and experience with content marketing in the new initiative — It’s a Money Thing.

“It’s through our work with Young & Free and the evolution of social media and content marketing that we began to realize that there was a huge void of quality, sharable financial education content,” says Tim McAlpine, Currency’s president and creative director. “This lead us to create the It’s a Money Thing content subscription service.”

According to McAlpine, most credit unions were very apprehensive about using social media for marketing and education purposes in the early stages of the Web 2.0 craze.

“They really needed a lot of hands-on guidance from a third-party agency or specialist,” McAlpine recalls. “Today, that’s not the case. Most credit unions manage their own presence on Facebook, Twitter and YouTube under a broader social and content marketing strategy.”

The problem, McAlpine says, is that credit unions today aren’t creating their own content.

“Instead they are mostly linking to articles and videos created by others and not hosted on their own websites,” McAlpine continues. “This does nothing to help their Google rankings.”

Many credit unions are looking for good-quality content they can use for seminars and classroom teaching opportunities — e.g., in branches, at local high schools and colleges, but they lack the internal resources to execute materials with the right message, tone, style and design.

Fractional Marketing for Financial Brands

Services that scale with you.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Financial Education Content With a Subscription Model

A recent survey from credit union think-tank Filene included a set of five financial literacy questions for young adults. Only 8% of the participants answered all of the questions correctly. In contrast, 70% of the participants rated themselves as having high financial knowledge.

“The lack of basic financial knowledge among young adults concerns me,” McAlpine admits. “This lack of financial aptitude and overconfidence in financial matters does not bode well for the future. We want to help credit unions be a part of the solution.”

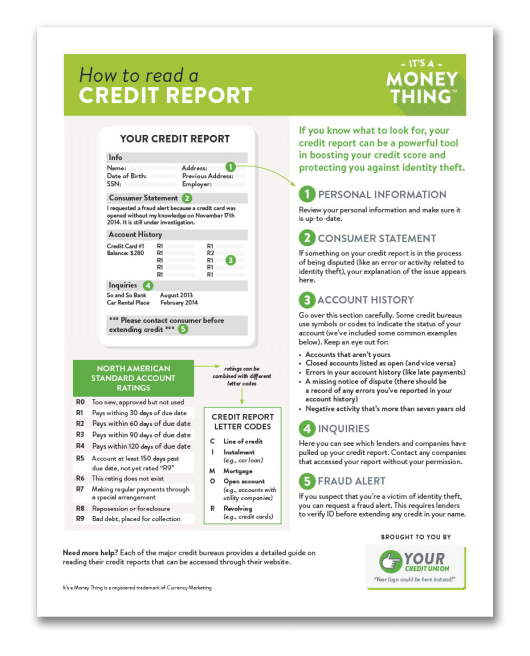

For as little as $500 USD per month, a credit union can have a kit of financial education materials delivered every month — a sort of “content marketing care package.” Each monthly content pack tackles a specific financial topic and includes a video, infographic, article, presentation and handout branded with the credit union’s logo. Each content pack includes a high-quality animated video that can be posted to the credit union’s social media channels and included in presentations (live seminars and online webinars).

It’s a Money Thing – Foiling Identity Theft

The topic of identity theft is explored in this content pack from

“It’s a Money Thing.” The pack also includes a infographic.

Articles supplied with the monthly content kits can be posted to the credit union’s website and distributed through print and email newsletters. The topic is expanded into a presentation that’s suitable for taking to high school and college classrooms. Also included is a single printable and shareable 8.5″x11″ page.

Pilot Tests Prove Promising

Twenty U.S. and Canadian credit unions are currently using the new Currency content system so far. These credit unions are posting their customized content on popular social media sites, on their blogs, and on their websites.

Twenty U.S. and Canadian credit unions are currently using the new Currency content system so far. These credit unions are posting their customized content on popular social media sites, on their blogs, and on their websites.

Fox Communities Credit Union in Wisconsin is one of the early adopters to utilize It’s a Money Thing. “We love what we are receiving so far,” says Amanda Brown with Fox Communities. “It’s obvious that our members and staff are liking it too. We are using the pieces within each pack in many different ways.”

For instance, Fox Communities took the infographic artwork they were supplied and turned it into a custom email. “We sent it to 31,000 of our members and we got amazing results,” Brown says. “That’s way more than we get with our normal emails we send. We had a 26% open rate and 6% total click through. We are thrilled — shocked actually.”

Laurissa Grubb with Blue Eagle Credit Union in Virginia, says the content that comes with It’s a Money Thing is informative quality content, in a variety of formats. “It’s easy to digest in quick bites,” she says. “It helps my small marketing department provide a beneficial and appealing resource without taking much of my time.”

Gene Blishen, CEO of Mt. Lehman Credit Union in British Columbia, says Currency’s financial education content augments his organization’s marketing strategy. “It fits our credit union because the messages are relevant and the approach is professional yet humorous,” he explains.

McAlpine at Currency is pleased with the progress of the pilot program so far.

“It’s exciting. We’re learning right along with the participating credit unions. The opportunity is threefold. We believe that credit unions can lead the charge in community and online financial education. We also believe that credit unions can be doing far more to position themselves as a relevant and trusted banking choice. And, finally, credit unions need to open a conversation with the next wave of potential credit union members, otherwise the current membership will just continue to age. We believe by testing, measuring and learning together, that we can continue to improve our product and also improve credit unions’ profile and relevance and, ultimately, help young people learn valuable financial lessons.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Another example from a content pack in the “It’s Money Thing” subscription service, Credit Score Breakdown.

There are two ways to sign up for It’s a Money Thing, and each starts with a one-month free trial.

Option 1: Visit the website for It’s a Money Thing, and sign up for your free trial. Pricing ranges from $700 per pack if you subscribe quarterly and is as low as $500 per pack if you subscribe monthly and pay for a year in advance.

Option 2: Get involved in a special research pilot being conducted through the Filene Research Institute based in Madison, Wisconsin. Filene member credit unions receive a 16% discount and if you pay for a year in advance, the price is as low as $416 per month. Filene membership is not a requirement for pilot participation. Visit Filene’s website for more information.