Bankers covet tech-savvy, mobile-minded consumers, a segment Javelin Strategy & Research dubs “Moneyhawks.” Moneyhawks demand anytime, anywhere, cutting-edge digital access to banking products. Besides just satisfying their appetite for tech, these consumers exhibit a lack of loyalty that makes this group even more tricky for financial institutions to attract and retain… profitably.

According to Javelin Strategy & Research, there are 31 million Moneyhawks in the U.S. While they only represent 13% of the U.S. adult population, they control 41% of the deposits and 33% of investable assets. Javelin says 20% of Moneyhawks are at high risk of leaving their primary bank or credit union, putting an estimated 103 million financial accounts that put $1.1 trillion in deposits into play, plus another $5.8 trillion in investable assets. That represents 72% of deposits held by potential switchers, and 71% of investable assets.

Moneyhawks hold significantly greater deposits than other segments, and typically have a wider array of financial products such as car loans, mortgages, credit cards, etc. And their digital expectations will shape how Americans will bank, pay, borrow, save, and buy for years to come. Clearly this is a juicy segment for banks and credit unions, and the stakes are enormous: revenue, profitability, cost savings, acquisition and retention (among others).

Yet Moneyhawks present a bit of a conundrum for financial institutions keen on achieving cost savings. On one hand, Moneyhawks are expensive to serve because they engage more frequently through all channels, but their “mobile-first” mindset — the reflex to reach for a smartphone rather visiting a branch — provides financial institutions opportunities to trim costs.

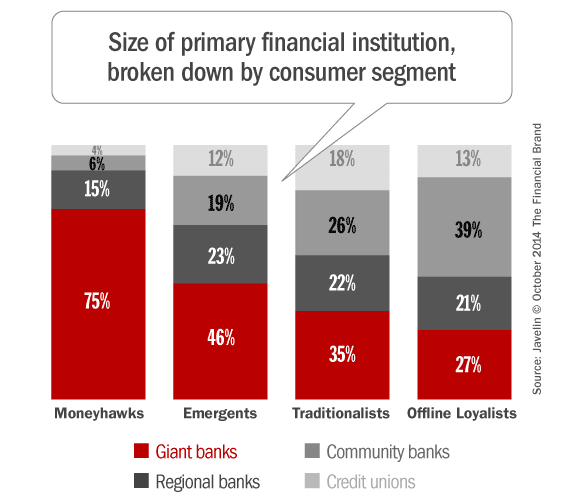

Moneyhawks tend to gravitate towards megabanks. Javelin says 75% of Moneyhawks identify one of the nation’s four largest banks as their primary financial institution. Bank of America (35%), Chase (18%), and Citibank (8%) each claim a disproportionate share of Moneyhawks, but other players like US Bank, BB&T and Capital One are on the radar for potential switchers.

Most Moneyhawks are relatively new to their financial institution, with 37% switching within the past three years. Moneyhawks were significantly more likely than consumers overall to have switched away from Chase (14%), Citibank (11%), and Capital One (6%). About 17% switched from Bank of America, but that is comparable to the switching rate for consumers overall.

The risk for smaller institutions is stark: Only one in ten Moneyhawks is currently with a community bank (6%) or credit union (4%). Unfortunately for them, over 57% of the potential switchers said they were likely to take their business to one of the nation’s four giants.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Javelin breaks consumers down into four distinct categories:

- Moneyhawks – Wealthy, vigilant, demanding and engaged, especially through digital channels

- Emergents – Younger consumers who demand digital services, strategically important but not necessarily profitable

- Tradtionalists – Affluent, older, security-minded, who value online banking and branch services

- Offline Loyalists – Loyal, longstanding consumers who like branches and face-to-face service

Moneyhawks are the most fussy and demanding. Moneyhawks give their primary financial institution significantly lower satisfaction scores than consumers overall for online banking (56% vs. 65%), mobile banking (53% vs. 57%), branch banking (61% vs. 69%), ATMs (63% vs. 67%), and call center services (48% vs. 57%).

Banks and credit unions targeting Moneyhawks must keep three things in mind, says Mark Schwanhausser, Director of Omnichannel Financial Services at Javelin Strategy & Research. “Prepare to excite them, to disappoint them, and to have to fight to keep them. The Moneyhawks are demanding and are willing to try services that their financial institutions lack. Their allegiance cannot be counted on.”

“The goal is not to devise digital services that satisfy a broad spectrum of customers, it is to target your highest- value, most profitable customers — the Moneyhawks,” Schwanhausser continues. “They not only are the most profitable customers today, but they also will pioneer the behavior that others will adopt in time.”

“To compete, financial institutions not only must cater to their existing Moneyhawks,” adds Schwanhausser. “They must also strive to win a disproportionate share of these demanding, fickle consumers and entice other segments to adopt their digital behavior.”