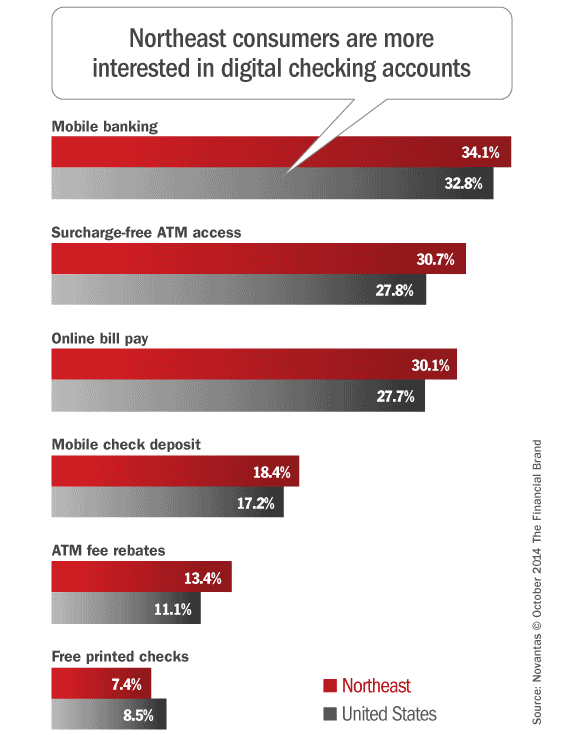

In September 2014, mobile banking was a “must have” feature for about one-third of shoppers of FindABetterBank. But more mobile-centric checking account shoppers in the northeastern U.S.* want additional features, indicating their banking behaviors have begun to swing to digital channels more so than those in other regions.

Wanting to be able to bank on a mobile phone is a big step towards becoming a digital banker. But many people don’t use their banking app for much more than checking balances.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

What Digital Bankers Want

To transact digitally. Lots of consumers are happy to check balances from their phone, but are unwilling to deposit checks. Until someone is willing to complete 100% of their transactions digitally, they’re not a digital banker. Shoppers in the northeast are more likely to say they must have mobile check deposit and online billpay than any other region in the US.

Unfettered ATM access. A characteristic that we’ve identified with experienced mobile bankers is that they don’t want to be tied down to using specific ATMs – shoppers that must have mobile banking are much more likely to want surcharge-free ATM access or ATM fee rebates. Shoppers in the northeast are more likely to say they must have these features than other regions of the US.

Paperless banking. Digital bankers don’t have much use for legacy features that come traditionally with checking accounts like free printed checks and unlimited check writing. Shoppers in the northeast were least likely to say they must have these features compared to other regions of the US.

*Northeast US defined as New York, Pennsylvania, New Jersey, Connecticut, Massachusetts, Maine, Rhode Island, Maryland, New Hampshire and Vermont.