Since the financial crisis, the focus of most bank and credit union strategic planning processes has been on managing risk, cutting costs, and meeting regulatory requirements. While these are important initiatives, most financial institutions believe it is time to shift gears, moving forward to create a new vision of revenue growth focused on an enhanced customer experience.

In a report from KPMG, 2014 Banking Industry Outlook Survey, 100 senior U.S. banking executives stated the need for change on a strategic, operational, and structural level in order to compete now and in the future. Despite continued regulatory constraints and rising costs, there was a recognition that strategic priorities need to be better aligned and that investment in technology was needed to provide a better customer experience.

Drivers of Revenue are Blend of Old and New

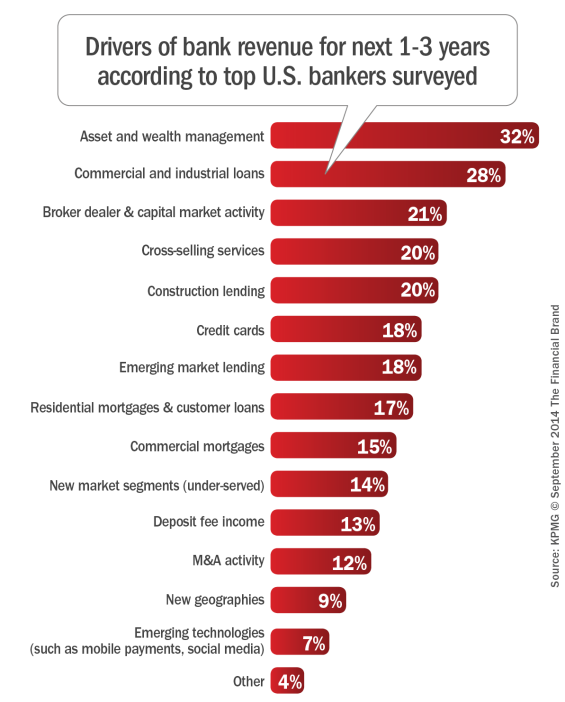

The KPMG research found that as banks search for revenue growth, they are combining older strategies with newer opportunities. For example, increasing capital requirements have lead many of the larger banks to focus on traditional sources of revenue, such as asset and wealth management. This is a valid strategy, since asset and wealth management services provide both fee generating opportunities as well as opportunities for cross-selling of additional financial services.

For smaller institutions, the focus should also be on engagement and cross-selling initiatives, which leverage an established consumer base while providing the potential for growth in credit cards, mortgages and even underserved markets. While acquiring new households and entering new markets may make sense for some institutions, organic growth is the primary focus for the near term.

Read More: Bigger Challenges & New Priorities Face Banking Industry

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Segment Revenue Opportunities Vary

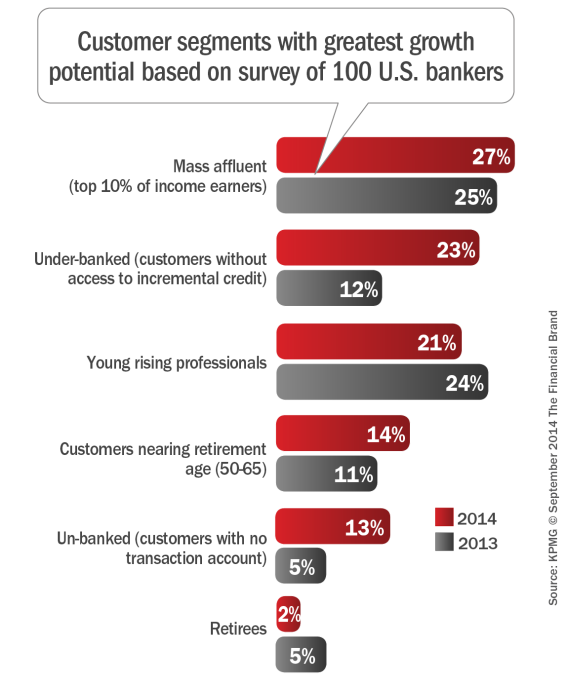

Because of the focus by the largest banks on asset management and wealth services, it makes sense that the top income earners also are viewed as representing the greatest growth opportunity (27 percent of the executives surveyed). The challenge could be that almost all organizations would love to target this consumer segment, with the cost of gaining a new relationship potentially inefficient.

What is a bit surprising from the KPMG research is that banks are also recognizing the potential revenue opportunity of the unbanked and underbanked segments. In fact, these customer segments more than doubled in survey responses from 2013.

According to the FDIC, 8.2 percent of U.S. households (about 10 million households and 17 million adults) are unbanked, and 20.1 percent of U.S. households (about 24 million households and 51 million adults) are underbanked. Beyond the size of these segments, another reason for the increasing interest in these segments is that unbanked and underbanked households spend more money on fees than other customer segments, including fees for check cashing services, overdrafts and non-home-bank ATMs.

According to the study, the best way to take advantage of these segment opportunities is for institutions to leverage advanced analytics that will provide a deeper understanding of consumers based on demographic, geographic, product ownership and behavioral variables. This will allow for customized products and services and personalized marketing and servicing strategies based on consumer needs.

Read More: The Mass Affluent: An Elusive Bank Target

Consumers in Control of Revenue Model

In the past, financial institutions could pretty much control the terms of the consumer relationship. Today, empowered consumers are setting the terms of who they bank with and how banking will be done. In a digital world, the consumer can switch providers with the click of a mouse or the push of a button on their mobile device.

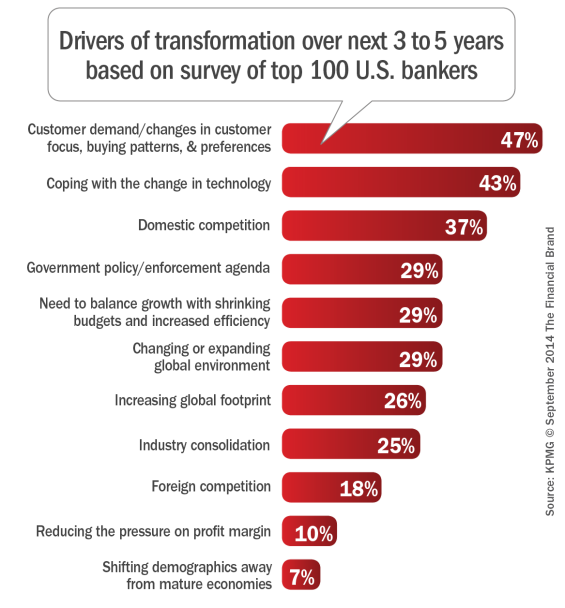

The impact of the changing consumer banking relationship is reflected in the KPMG survey results, where 47 percent of respondents believed changing consumer demands, behaviors and channel use would be the primary driver of transformation in the next three to five years. The next two drivers of transformation were believed to be changes in technology and new competitive forces.

In response to these changes, KPMG recommends that financial institutions provide consumers with a seamless experience that delivers tailored advice, products, and services. According to KPMG, “Channel integration is an opportunity to really understand the customer, streamline systems and focus attention on the most profitable segments.”

Investment in Branch Systems Continues

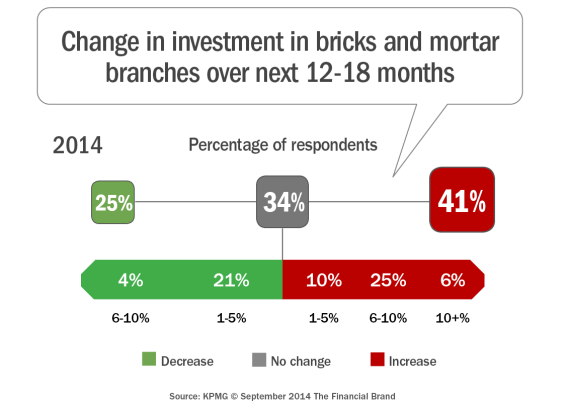

One of the most hotly debated and imprecise components of a future revenue model is the composition and structure of distribution in the future. While the drop in branch transactions and the exponential growth of online and mobile transactions can’t be denied, the commitment to bricks and mortar by bankers continues unabated.

In fact, despite a great deal of logic that could be argued against the growth of physical facilities, 41 percent of the respondents indicated that they will be growing their brick and mortar branches over the next 12-18 months, with 6 percent indicating a growth of more than 10 percent. Only a quarter of bankers surveyed indicated that they would reduce branches in the near future.

For some financial institutions, it may be a matter of ‘who blinks first’ with regard to closing offices. For other organizations, there may be the belief that ‘if you build it, they will come.’ At still others, there may be the belief that a completely redesigned (and reduced footprint) physical facility will generate new traffic not seen for years.

What is definite is that the distribution system of yesterday needs to be adjusted to contribute to the revenue needs of tomorrow.

Read More: Banks Can’t Close Branches Fast Enough

Growing Revenue in the Future

The revenue aspirations of financial services executives surveyed by KPMG may be considered to be rather aggressive given the flatlining experienced over the past several years (net of extraordinary revenue and cost reduction events). An improving economy will have a positive impact on revenues while regulations will continue to add costs.

Still, there are opportunities for those institutions that improve their ability to proactively meet consumer needs, leverage less expensive channels, introduce new value-added services and differentiate themselves in the marketplace.

![Revenue_growth_expectations_over_next_12months_9-30-2014[1]](https://thefinancialbrand.com/wp-content/uploads/2014/09/Revenue_growth_expectations_over_next_12months_9-30-20141-565x507.png)

To build a more secure revenue model in the future, KPMG recommends:

- Put the needs of consumers at the center of the decision making process and when launching new products and services

- Leverage advanced analytics to understand the needs of different segments, developing customized products and services to meet these needs

- Deploy a seamless channel approach that offers consumers a consistent and differentiated client experience across each organization touch point

- Update core platforms to enable data sharing and the elimination of internal silos that negatively impact the consumer experience

- Invest in a single IT platform to standardize processes, create efficiencies, lower costs, improve the flow of information, and provide a common and consistent view of data throughout the enterprise

- Recognize that digital technology can improve the customer experience