Checking accounts represent the anchor relationship for banks and credit unions. They are the foundation of the majority of new household acquisition campaigns and allow for cross-sell opportunities into other lines of business (e.g., savings, credit cards, loans, investments, etc.).

Unfortunately the market for new checking households is rather finite, with only 9 percent of households switching checking account institutions annually. Another 7.5 percent of consumers open their first checking account in any 12 month period.

So, how do consumers decide on a primary financial institution for their checking account? What makes them switch? What can financial marketers do to influence the decision-making process?

To find the answers to these and other questions, AOL partnered with Oliver Wyman on a study, “Making the Switch: Checking Path to Purchase.” Their research explored the motivations, influences and behaviors of consumers who recently switched banks and opened a new primary checking account.

The analysis found that marketing, negative experiences and life events drive switchers into the marketplace, but that traditional methods of reaching out to checking account shoppers no longer works. As a result of shifts in the consumer mindset and shopping research patterns, financial organizations need to do more to be in consideration when a consumer wants a new checking account.

The study collected insight from more than 1,700 participants who were either switchers, first time account openers or people who started – and then abandoned – the account opening process. Actual online clickstream history was observed during the 90 days prior to beginning their account opening application process to understand motivations and actions.

Below are insights that can help product managers and financial marketers improve acquisition efforts.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

An ‘Always On’ Brand is Important

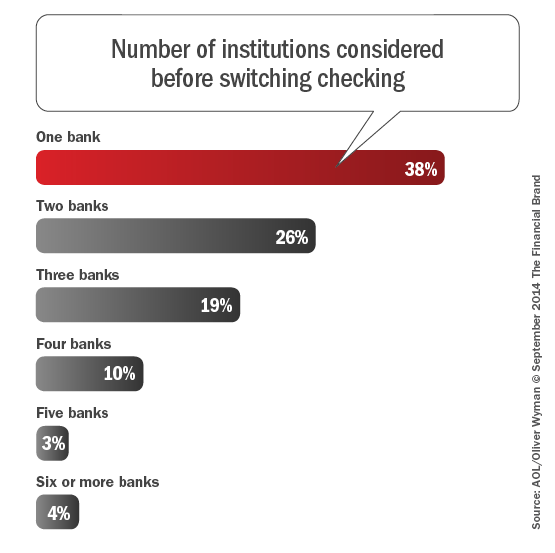

Two out of three potential switchers have only one bank in mind when they start thinking about switching to a new bank. After switching, 38% report only having seriously considered one bank. Of those who were certain of their interest in one bank brand as they began to think about a new bank, 90% did in fact open an account at that institution.

In other words, to be effective in acquiring new checking households, your brand must in the consumer’s mind 24/7/365. A different set of consumers are shopping for a new financial institution at any time and they are moving through the decision-making process at an increasing pace. It is therefore important to have your brand accessible when the consumer is ready to switch.

As mentioned by Paul Kadin, Head of Category Development for AOL, “While 40% report being influenced by an offer, it is inefficient to try to find ‘hand raisers’ if your brand’s differentiators are not already well understood. For marketers, this means reallocating advertising tactics towards building ongoing awareness of your organizations’s value proposition – very clearly highlighting differentiating features – and less towards campaigns with commoditized promotional incentives.”

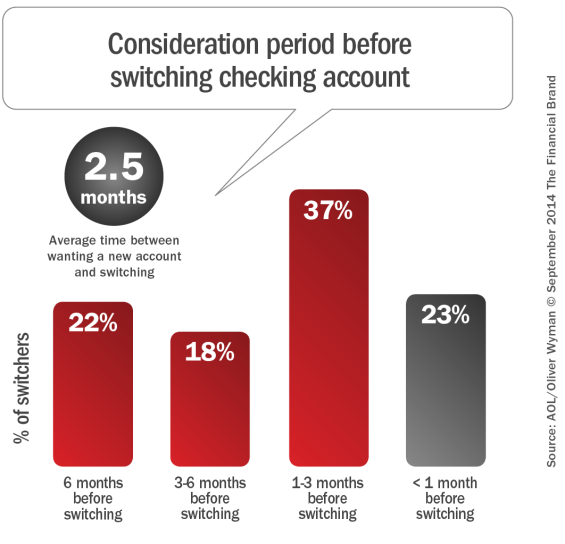

The Shopping Process is Short

The AOL/Oliver Wyman research found that a consumer considers switching their account for an average of 2 1/2 months prior to making a decision to purchase. As mentioned above, two-thirds of these consumers have a new institution already in mind when they are thinking of changing organizations and 38% only consider one firm. The implication is that by the time most financial institutions determine a consumer is shopping for a new checking account … it may be too late.

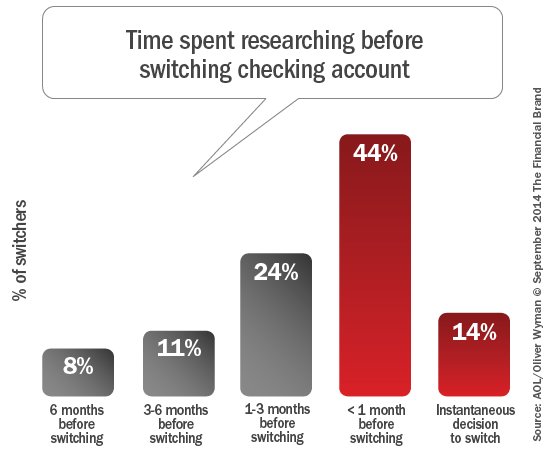

Once a consumer moves from the consideration phase to the shopping process, the decision as to where to open a new account is quick. In fact, 58 percent of consumers make their decision in less than a month. This rapid shopping process again illustrates the importance of an ‘always-on’ brand and the importance of digital channel marketing to be where consumers are shopping for a new primary financial provider.

Once a consumer moves from the consideration phase to the shopping process, the decision as to where to open a new account is quick. In fact, 58 percent of consumers make their decision in less than a month. This rapid shopping process again illustrates the importance of an ‘always-on’ brand and the importance of digital channel marketing to be where consumers are shopping for a new primary financial provider.

The Checking Path-to-Purchase Is Not Linear

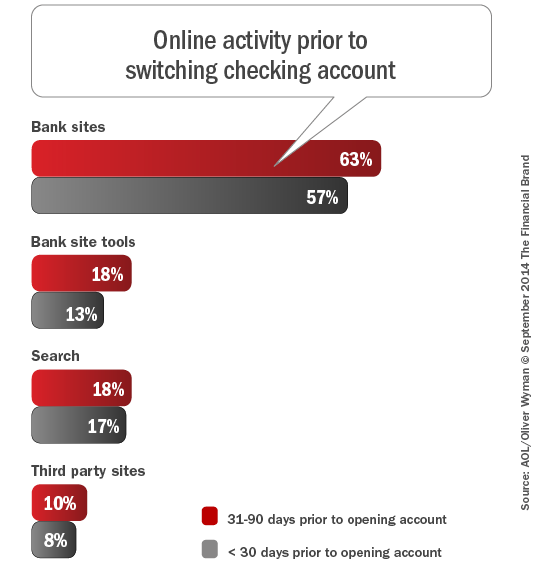

The path-to-purchase for financial services is no longer predictable. For checking accounts, the AOL study found that 80 percent of consumers visited at least one bank or credit union website prior to purchase, with 63 percent visiting multiple sites. Overall, only 26 percent of consumers utilized product information pages and other tools on these financial brand websites, 30 percent used branded or generic search terms and 15 percent used 3rd party information sites like Bankrate.com in the 90 days prior to opening a new account.

This makes it more challenging for financial marketers who want to be where a consumer is shopping for a new checking account. The researchers suggest that marketers must challenge assumptions about behaviors consumers exhibit prior to purchase, and reorient strategies around actual behavior. While digital retargeting should be part of this process, no single strategy is enough to reach all shoppers.

According to Matthew Sharp, Senior Manager, Consumer Analytics & Research at AOL, “Consumers aren’t as predictable as we’d like them to be. That said, our research doesn’t discount the importance, or even the potential effectiveness, of digital retargeting when used as one ingredient of a digital media mix. However, if used exclusively, organizations will fail to reach the majority of their prospects early enough to count.”

Checking Switchers Are Influenced In Many Ways

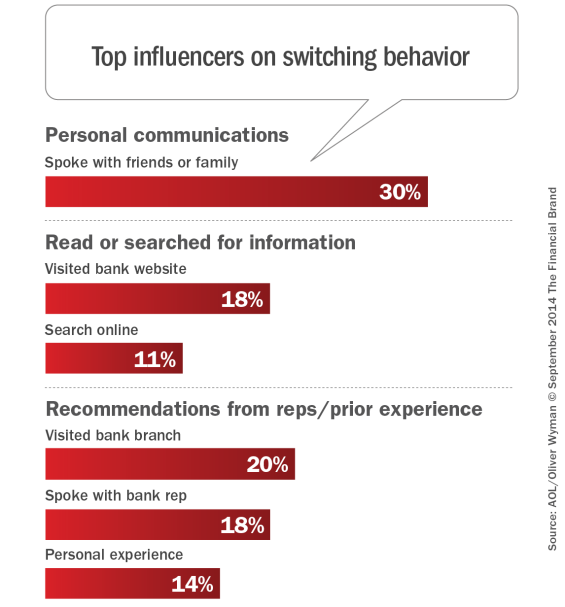

Of those people who switched banks, 44 percent said personal recommendations from friends, family and co-workers assisted in their purchase decision – by far more than any other factor, including advertising. The importance of personal recommendations also was evident when switchers were asked what were the top influences on their choice of financial institution. Thirty percent put ‘personal recommendations’ as one of the ‘top five’ influences.

The AOL/Oliver Wyman research found that social media was not effective. In fact, virtually no switchers visited a financial institution’s Facebook page on the path to deciding on a new checking provider.

This points to the importance of delivering a positive customer experience. It also illustrates the potential of leveraging current customers to become advocates and evangelists, specifically for checking products and services. When surveyed, checking switchers said they cared most about common brand attributes and product features. Consumers also care about the organization’s reputation, the cost of the product, and convenience (which can be defined by mobile banking capabilities).

Evaluating Checking Options is a Multichannel Experience

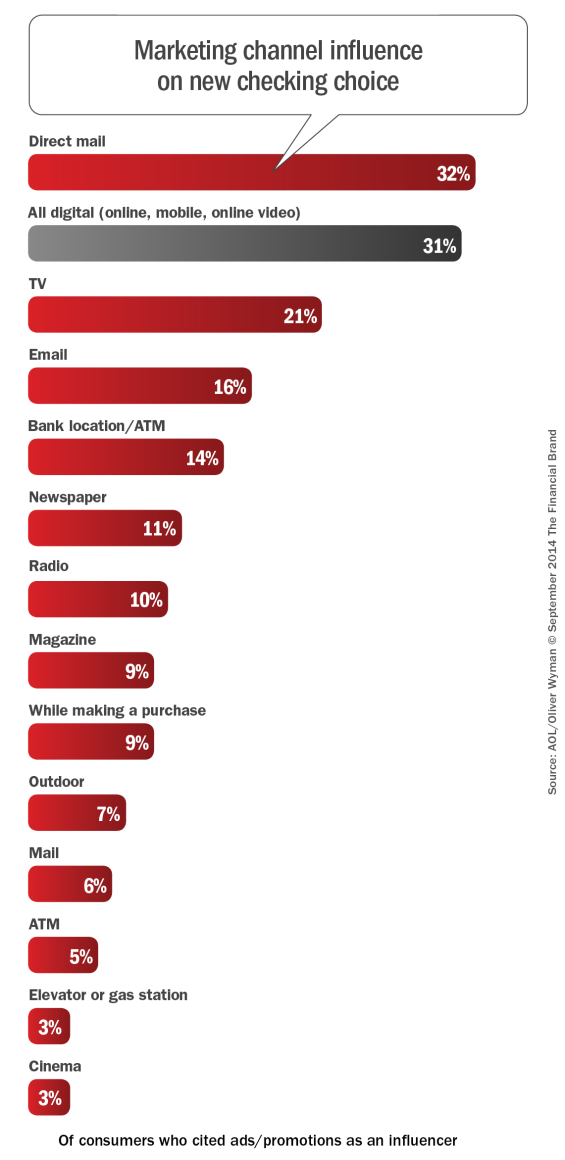

Despite the power of recommendations from friends and family, traditional marketing still has an impact both as a brand builder as well as a way to stay in the consideration set of institutions when a consumer is looking to switch banks. For those household who mentioned that marketing or advertising had an impact on their decision, direct mail continues to be the foremost channel mentioned, followed by all digital channels, TV and email.

What also must be considered is the channel used to shop, which is no longer just a desktop computer. With more shopping being done via mobile devices, the importance of targeted and concise digital marketing becomes more important.

“Data from comScore and others has shown that mobile usage is highly incremental to computer usage, resulting in a larger overall pie of time spent online,” stated Sharp from AOL. “Understanding consumers’ mindsets and motivations for using different devices is key to executing relevant messaging across screens. For new account opening, banks must provide easier, more convenient mobile experiences.”

Branches Still Play a Role

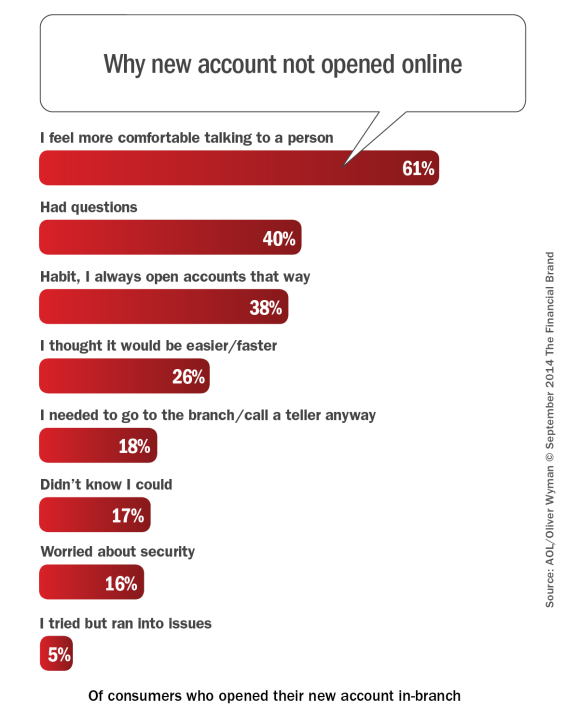

Despite all the talk about digital channels, the AOL/Oliver Wyman research found that more than seven out of ten bank switchers reported that they opened their checking account in a branch. While this may seem to support keeping branches, the study found that the branch was used in many cases because a more convenient online alternative was either not available, too cumbersome or does not meet the needs of the switcher.

About one in five first-time checking account households wanted to open online and ran into problems. Of those who abandoned the bank shopping process, 40% said it was too much of a hassle. Among those who persevered and switched banks, 60% said they did so in a branch because they had questions and preferred speaking with a real person. Thirty-eight percent actually described opening an account in a branch as a ‘habit.

The Biggest Secret

Plain and simple, acquiring new checking households is an ongoing process, impacted by your organization’s impression in the marketplace, brand recognition, marketing prowess and even convenience. Through the years, the percentage of brand new checking households entering the marketplace, checking account shoppers and switchers have remained surprisingly steady.

The secret to success is to generate new customers and members at a rate that is incrementally superior to your overall marketshare. In other words, get more than your share of new business. To outperform your competition requires focusing on a great checking customer experience that people will talk about, finding ways to keep your brand front and center 24/7/365 with traditional as well as digital channels and to measure results.

For many financial marketers, attribution models fail to account for the influence of online channels when the process ends in a physical facility. This results in an overstatement of the influence of the branch and an understatement of other channels. This significantly biases branch utilization models as does the impact of not having an easy to use online/mobile account opening tool.

“Differentiation has been the holy grail for decades,” states Kadin from AOL. “But, given that many switchers are reacting to a negative experience at their current bank, emphasizing a commitment to customer satisfaction with powerful proof points would be appropriate.” He adds, “The hassle factor of switching has to be attacked with the same urgency other industries have demonstrated. Even if documentation has to be verified in a branch, having a simple mobile and online application process with full paperwork ready to be signed in branch demonstrates a commitment to a better experience.”

New customer acquisition has never been more challenging or rewarding. Only those who understand the changing dynamics of the process will succeed in the future.

About the Research

AOL partnered with Oliver Wyman and worked with InsightsNow and Compete to collect attitudinal and behavioral data for 1,743 respondents. The total sample contained 868 switchers, 500 abandoners (consumers who intended to switch, but did not) and 375 first-timers (consumers who opened their first-ever checking account). The study also identified consumers who opened accounts with national banks, regional banks, local banks or credit unions and online-only banks in order to analyze differences between those segments.