The perception for many young consumers is that the national banks offer the best mobile banking services. Is it just a coincidence that young consumers on FindABetterBank.com are more likely to select a national bank over a community banks or credit union? Not likely. If national banks’ grip on branch-share dominance wasn’t already tight enough, the strength of their digital channels enables them to expand into new markets without big investments in new branches.

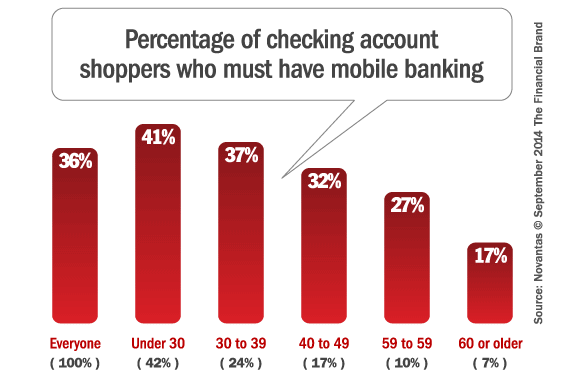

In a recent BankChoice Monitor survey of consumers shopping for new checking accounts on FindABetterBank.com, 36% of shoppers say they must have mobile banking with their next checking account — shoppers under 30 are more than twice as likely to require mobile banking compared with shoppers over age 60 or older. On FindABetterBank, shoppers 50 or older are the most likely shoppers to select small institutions and shoppers under 30 are more likely to select national banks.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

National banks are winning more customers that want to bank digitally. Today, many young consumers’ shopping for checking accounts consider mobile banking to be more important than having branches nearby — and many believe that national banks offer better mobile banking solutions. As demand for mobile banking continues to grow, national banks will be in a better position to compete in markets where they don’t have large branch networks because many shoppers will consider digital channels more than branches.

Small institutions appeal most to a minority of people shopping for checking accounts today. A handful of small banks and credit unions perform well with younger consumers. But most do much better with older shoppers. This is partly because a higher percent of small institutions have checking products geared towards senior and features like access to surcharge-free ATMs resonates with this group. The problem for small institutions is that only 17% of people actively shopping for checking accounts are over 50 years old.