For financial institutions looking for ways to generate revenue, cross-selling current customers continues to be one of the most reliable, tried and true methods. Any financial marketer knows cross-selling is more cost-effective than adding new customers. It also creates more engagement, increases share of wallet and promotes customer retention.

The opportunities are almost endless. Unfortunately, for organizations that are still structured in product silos, the result can be an endless array of ineffective product-centric communications delivered to a somewhat finite number of households without regard to the customer experience.

Building an effective cross-sell process does not need to be difficult. While more and more organizations are using unstructured internal and external data, an organization can have success using data already in customer file. The key is to take a customer-centric approach as opposed to a product-centric approach.

Cross-Sell Myths and Realities

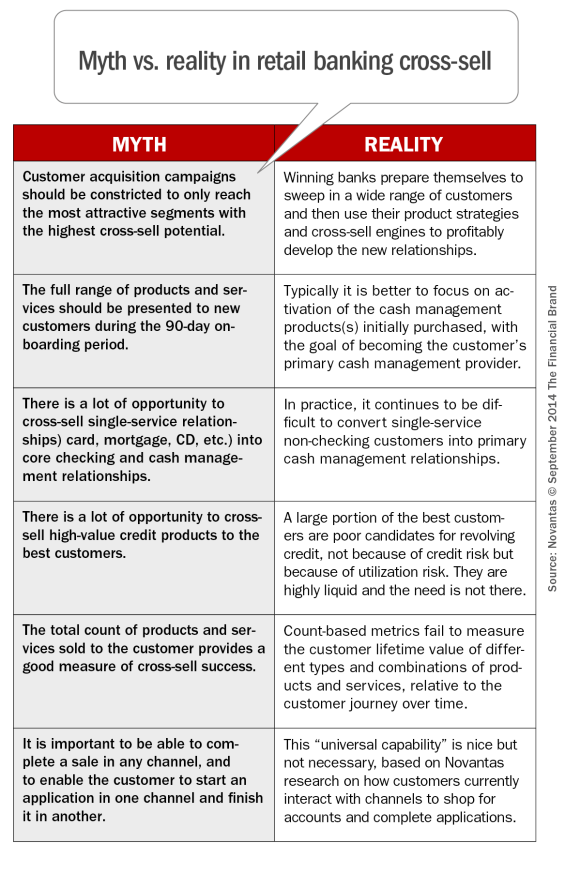

According to Novantas there are six prevalent myths, or misunderstandings, that seriously degrade cross-sell performance. These myths include – 1) Developing programs with too narrow a reach or focus; 2) Trying to sell too early in a relationship; 3) Trying to sell a single service credit customer a checking product; 4) Believing any non-credit customer needs loan services; 5) Believing that cross-selling effectiveness is a ‘numbers’ game; and 6) Believing that an omnichannel sales strategy is an imperative.

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers. Read More about Send the Right Offers to the Right Consumers This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness. Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats As banks and credit unions seek to dispel these myths and improve cross-sell effectiveness, there are eight ways to reduce the consumer and institutional confusion and improve the effectiveness of cross-selling programs. Follow these, and the results will more than offset the extra effort required.

As banks and credit unions seek to dispel these myths and improve cross-sell effectiveness, there are eight ways to reduce the consumer and institutional confusion and improve the effectiveness of cross-selling programs. Follow these, and the results will more than offset the extra effort required.

Send the Right Offers to the Right Consumers

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

1. Continue Acquisition Efforts

While cross-selling a current customer or member is both less expensive and more efficient than generating a new household, acquisition is still the lifeblood of growth and prosperity in financial services. Without an ongoing acquisition process, it is difficult to gain brand recognition in the marketplace which is needed for when a consumer starts shopping for an alternative financial services provider.

Acquisition efforts should not just include traditional direct marketing and mass media, but should expand to digital channels where more and more households are shopping for new financial services. In addition, don’t forget to utilize all of the resources at your disposal to improve your acquisition efforts, including customer-facing teams, branch signage, ATM messaging, etc.

Finally, don’t just focus on the ‘best’ potential customer (emerging affluent and mass affluent). All your competitors are targeting the same households. Mass market consumers are also needed to help offset the high fixed costs of the branch system. As mentioned by Novantas, even customer relationships that are unprofitable on a fully-loaded basis can at least contribute to covering fixed costs.

2. Maximize Account Opening Opportunities

Either online or in the branch, the account opening process may be the only time you have your new accountholders undivided attention. Have you maximized and optimized this opportunity by asking questions that can guide the sales process? Do you have a discussion flow process that can take the answers provided and connect them with consumer financial solutions that ‘make sense’?

It is time for banks and credit unions to convert the new account opening process from an operational procedure to a sales discussion. In virtually all instances, the consumer has either entered your branch or begun the new account opening process online because they want to do business with you. Allocate as much time as possible to setting the stage for the consumer desires of, ‘Know me,’ ‘Look out for me,’ and ‘Reward me.’

One approach recommended by Novantas is to sell product bundles, where components can be selectively activated by the new household or, alternatively, promote relationship pricing benefits to drive additional sales at the new account desk.

3. Build Engagement Before Selling

If a household opens a new account and never uses the service, your organization has added a costly dormant account with no revenue potential. The objective is to establish your organization as the primary financial provider for the consumer. As part of the onboarding process, it is important to sell as many ‘go with’ services as possible.

The onboarding period is when you need to promote activation and usage of the service(s) opened, e.g. setting up direct deposit, establishing both online and mobile banking, building a set of alert notifications, setting up bill pay and automatic savings and reinforcing debit and credit card usage, etc.

Building customer engagement sets the stage for the introduction of new product solutions that meet the needs of the new accountholder. Learning how a new household uses their account allows you to develop event-based selling opportunities that will ‘make sense’ to the customer later.

4. Focus on Checking Services

The foundation for deep financial relationships begins with the checking account. While there are many households that may get introduced to your organization through a new mortgage, new personal loan or new credit card, it is very difficult to get these households to open a new checking account that will be the center of their financial behavior as an add-on to a credit relationship.

Novantas experience indicates that it is an extremely tough proposition to convert single-service loan or investment/CD customers into core checking relationships. Even with today’s expanded data sources, response rates are typically less than 2% for direct marketing campaigns to stand-alone customers.

One of the traditional methods used by financial institutions was to ‘force’ the opening of a checking account to facilitate the payment of loans from a checking account. This strategy usually results in a costly 28-day dormant account where deposits are only made in time for the loan payment. The only way around this challenge is to build product bundles or relationship pricing that benefits the consumer. The relationship benefits are usually best when they accrue to the initial account opened as opposed to the checking account itself (loan discounts, activity offers, etc.).

5. Don’t Overwhelm Your Best Relationships

Most organizations have built ‘next most likely’ models over the years that provide a good list of prospects for cross-selling. Combine these targeted lists with new digital channels that allow an institution to reach out to households more efficiently than ever and you have both a great opportunity … and a difficult challenge.

The good news is that there is the opportunity to cross-sell applicable services to the best prospects through a number of channels. The bad news is when multiple product areas within an organization use the same lists to reach the same prospects with several unrelated offers. The result – marketing overload.

It is more important than ever for organizations to coordinate activities between product areas taking on the view of the consumer. Instead of trying to meet the goals of individual product areas, organizations should prioritize the marketing messages from the consumer perspective, leveraging customer lifecycle models and automated marketing management software that builds a common sense cadence and sequence of communication.

6. Avoid Mistargeted Campaigns

Similar to the challenge of not overwhelming your best customer relationships with too many offers is offering your best prospects an inappropriate product or service. This occurs when organizations use purchase propensity and next-logical-product models to identify the “best” customers who may hold high balances with the organization yet have little need for credit.

To avoid having HELOC and credit card offers sent to households that have no need for credit, it is best to utilize outside insights to determine where the household is in their financial services lifecycle. If a household has never had a credit product, or illustrates credit is used for convenience only, it may be best to avoid marketing to them.

Again, using a product-focused approach as opposed to marketing from the customer perspective leads to cross-sell campaigns with an unproductive product push.

7. Maximize Sales Channel Effectiveness

When it comes to sales channels, more is not necessarily better.

According to Novantas, many organizations are funding projects to allow customers to both start and complete applications across all channels. While they note that this may be a good objective, it does not reflect how new-to-the-bank customers behave. Novantas research confirms that about two-thirds of consumers prefer to shop for a new checking relationship online, but that 85% to 95% proceed to open their new accounts in the branch.

In other words, while the shopping process is done digitally, many consumers complete the process in a more traditional manner. Novantas recommends that, given the scarce resources available in many organizations today, there may be better investments than building an omnichannel sales capability.

8. Understand the Customer Journey

It is more important than ever to understand the customer journey of the financial consumer. This journey usually begins with a traditional checking account and progresses through increased engagement to ancillary services and then to an expanded relationship through the use of product bundles and relationship pricing.

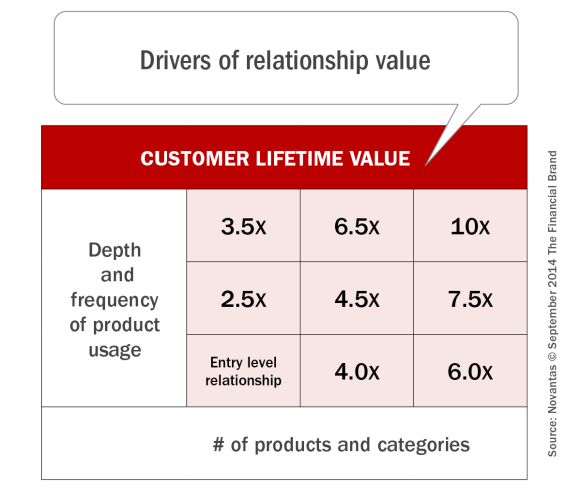

As opposed to marketing all services to all of the best prospects, organizations should leverage ‘real time’ insight to cross-sell of credit, investment, and insurance products based on triggers that predict customers’ likelihood to both buy and profitable use of a product. Performance measurement should also be structured around this journey.

Novantas recommends that financial institutions should determine: 1) which cross-sell outcomes are most desirable relative to customer needs; 2) what is the appropriate blend of channels, messages and offers for any customer; and 3) which customer interactions are critical in closing the business.