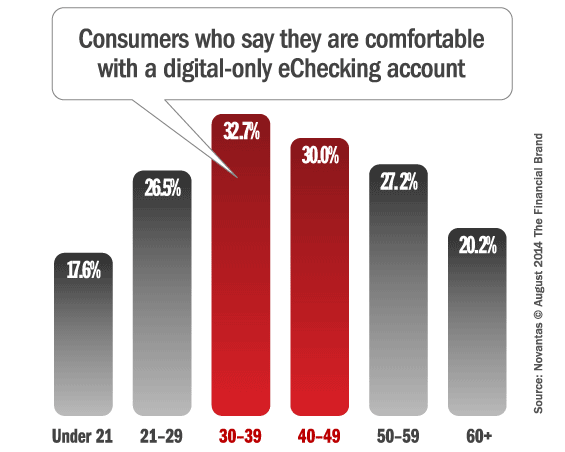

In a recent BankChoice Monitor survey, only 24% of Gen Y consumers currently shopping for checking accounts are comfortable with an account that requires they only use electronic channels like mobile banking and ATM machines, compared to 33% of Gen X consumers aged between 30 and 39. In fact, even checking account shoppers aged between 50 – 59 are slightly more likely to be comfortable with these types of checking accounts.

Some traditional institutions offer “e-Checking” accounts similar to direct banks like Ally — free, provided that customers receive statements electronically and only use electronic channels for their transactions. It’s clear why these accounts appeal to banks: customers cost less to service than customers who visit branches and call contact centers. Marketers typically target this product towards younger consumers, but the sweet spot for these e-Checking accounts is really Gen X consumers.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Characteristics of Gen X Consumers Comfortable With E-Checking Accounts

Most will set-up direct deposits. Two-thirds Gen X shoppers comfortable with eChecking plan to set-up a direct deposit with their new checking account. Twenty-eight percent report that they’ll have more than $2,000 in direct deposit per month.

Slightly lower average incomes. Only 20% of Gen X checking shoppers comfortable with e-Checking accounts report earning $100,000 or more, compared to 23% of Gen X checking shoppers who aren’t comfortable with these types of accounts. Higher income shoppers ($200,000 or more a year) comprise this gap – only 2% of high income shoppers are comfortable with e-Checking accounts.

Evenly split by gender. Overall, the survey indicates that more women are currently shopping for checking accounts than men (52% to 48% respectively). But men are slightly more comfortable with e-Checking accounts, evening out the percentage to 50%-50% male/female split for shoppers comfortable with e-Checking accounts.