The gender stereotypes surrounding technology are well known — men are more technology-savvy and easier to sell using technology messages. This may be true for some product categories such as HDTVs, but it does not hold true for mobile banking apps.

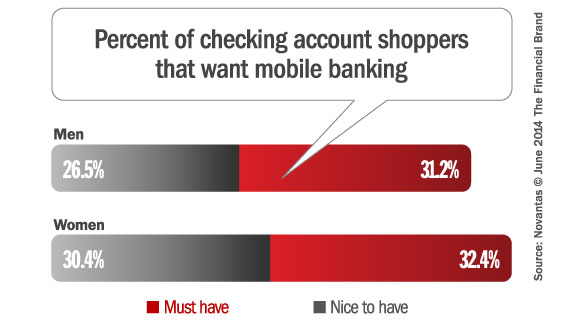

In June 2014, a BankChoice Monitor survey of people shopping for new banking relationships found that 63% of females want their new bank to provide mobile banking compared to 58% of males. As marketers, we should break sexist techno-phobic stereotypes and make sure mobile banking apps have functionality that appeals to women.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Running balances. A recent BankChoice Monitor survey revealed that women maintain lower balances than men: Make it easier to make purchases throughout the day by presenting running balances, so transactions are debited immediately. This will enable customers to make purchases later in the day without wondering whether they’ll have enough funds to cover it.

Mobile payment options. In addition to maintaining lower balances in their checking accounts, according to a recent survey by BankRate, women also carry less cash then men. Therefore, having cashless options like mobile P2P will have more appeal to women.

Easy to connect with a person. Many mobile apps from banks and credit unions don’t make connecting with someone in the contact center an obvious option. Providing a simple push-to-talk option to let customers call with questions can potentially save a trip to the branch. Both men and women will appreciate this functionality.

Geo-locate closest branch and ATMs. Given that women tend to carry less cash then men, they may need access to an ATM when they’re in less familiar places. For safety and convenience, use the GPS functionality of smartphones to help customers find the closest branch or ATM.