It is no secret that The Financial Brand is a fan of Simple. Since their introduction, we have written no less than five articles over the years, applauding their brand positioning, their account opening process, their lack of fees, their mobile app, their integrated PFM strategy, their social media engagement and their exceptional customer support. While these qualities definitely set Simple apart from most traditional banks, it’s their constant focus on innovation that is most impressive.

Even after the acquisition of Simple by BBVA earlier this year, the bank’s vision hasn’t changed … to give customers control of their finances, using modern tools to help them spend smarter and save more with unequalled service from ‘real people.’ In short, using innovative technology to improve the overall customer experience.

Many wondered what may change when BBVA acquired Simple. With only 6 months since the acquisition, the answer to that question may be, “A lot and very little.” It is clear that the infusion of funds has provided Simple with the financial capability to hire additional people and provide the foundation for growth needed for what can still be considered a start-up enterprise. Alternatively, at least over this very short period of time, Simple continues to improve their features and benefits while not impacting their focus on personalized customer service.

It can be debated if Simple is a bank or a technology company. Even their URL reference (Simple Finance Technology Corp.) could lead some to wonder if Simple is more of an innovation lab with a huge testing platform (100,000+ customers) or a prepaid card banking organization.

Below is a selection of innovations introduced by Simple over the past year.

Read More: Easy Banking: The Simple Strategy

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

The Financial Brand Forum Kicks Off May 20th

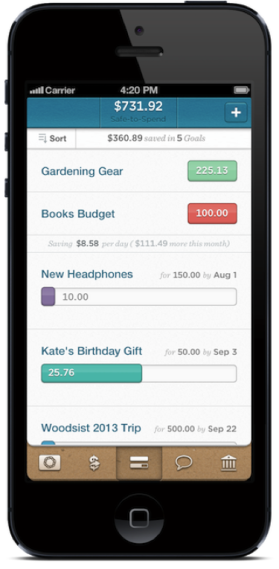

Goals for the iPhone

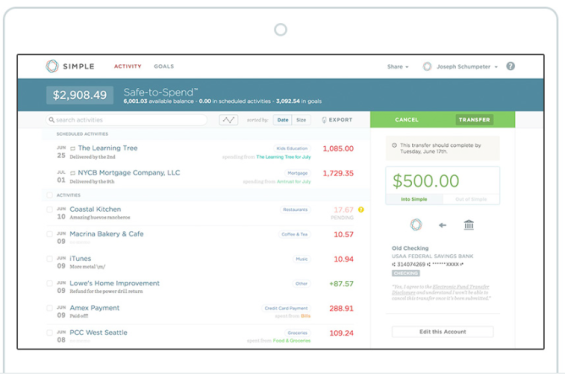

Introduced in the summer of 2013, the ‘Goals’ feature for the iPhone allowed a customer to automatically set aside a little each day for larger expenses, naming the goal and total amount to be set aside on their mobile device. Expanding the web-based Goals feature to the iPhone also allowed for on the go envelope-style budgeting, setting aside chunks of money, giving the customer spending limits and keeping tabs on how much was spent each month.

Pairing Goals with the Safe-to-Spend feature from Simple provided the customer an accurate picture of how much they could really spend on their mobile device in real-time. Together, Safe-to-Spend and Goals gave the customer an easy but powerful way to organize their finances and encourage saving using their iPhone.

The iPhone Goals feature also made it easy to transfer funds between Goals and Safe-to-Spend, pause or resume goals, associate a particular transaction with a Goal and even create new goals.

Partnership with Braintree and Dropbox

While Simple has usually developed new features and benefits internally, they also embrace the ability to build partnerships to bring best-in-class enhancements to their customers quicker than would otherwise be possible. This was the case when they partnered with Dropbox and Braintree to improve their payments functionality.

Integrating Dropbox into Simple for iPhone enabled customers to attach any image, PDF, or text file from their Dropbox account to specific transactions for improved record-kepping. With Dropbox’s Chooser SDK, customers were able to securely access Dropbox files from within Simple’s iPhone app.

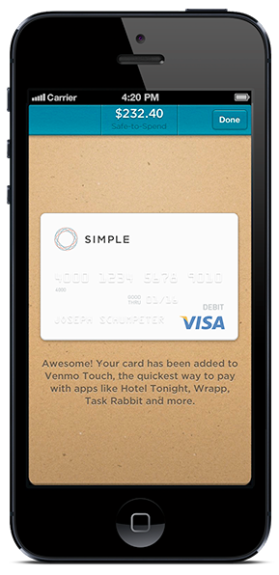

In a first of its kind partnership, Simple allowed customers to add their Simple Visa® Card to Venmo Touch. Once enrolled, this allowed customers to securely use their Simple Card – without typing in the card number – to make purchases within some of the most popular mobile apps.

Simple Insights

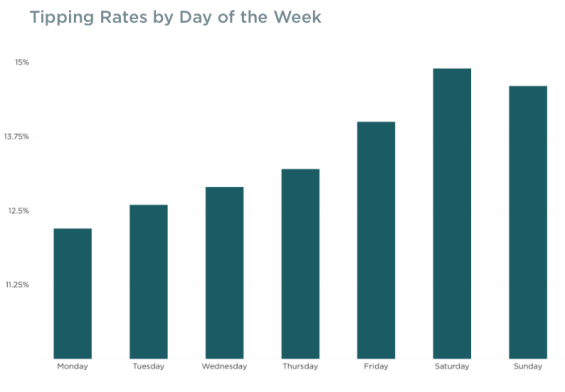

In a quest to continuously build a community of Simple users, ‘Simple Insights’ was introduced. Simple Insights is a semi-regular blog posting about anonymized customer spending data that may be of interest to Simple customers. Over the past six months, Simple has discussed why there are unusual spikes in certain categories of spending at certain times (like introductions of new technology), and what is the usual tipping rate by state, city and category of purchase.

Read More: Happy Anniversary Simple Bank

Instant Transfers

With Instant Transfers, a customer is able to set up a connection with another Simple customer so that they can send each other money instantly, wherever they are. With Instant Transfers, there’s no need to write a check, and all of the transfers are automatically categorized just like Simple card transactions.

This innovation allows customer to seamlessly split expenses with housemates, or reimburse a friend instantly. When a customer wants to quickly send money to someone with a Simple account, this feature makes it easy, hassle-free and fee-free. When introduced, Simple stated that Instant Transfers opened the doors to additional shared banking tools geared to people who share expenses.

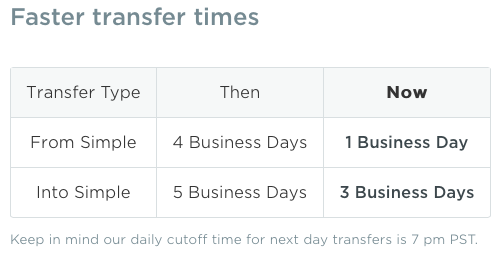

Faster Transfers

For the digital customer base Simple serves, speed of transacting is of primary importance. As a result, Simple recently reduced the times for transfers between banks. Early in the history of Simple, external bank transfer times were 5 – 6 days – obviously not acceptable to most Simple customers. To alleviate this delay, Simple improved their transfer times by 75%.

What sets Simple apart from the competition is around fees. Some banks charge a fee for transferring money to external accounts, and only offer accelerated transfers at a premium. For instance, Bank of America and Wells Fargo charge $3 to move money to another bank. And, if you want that money to arrive the next business day, the fee shoots up to $10 per transfer.

External transfers to and from Simple continue to be free for customers.

As with many of Simple’s updates, there were more changes made around transfers beyond just the timing. At the same time they did the following:

- Updated visual cues to give a clearer sense of where money is moving

- Improved language around transfers to make setting up account links and submitting transfers easier

- Listed dates for when the transfer amount will be deducted from the customer’s account and when it will arrive

- Having a timeline for when the customer will be able to access the money

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

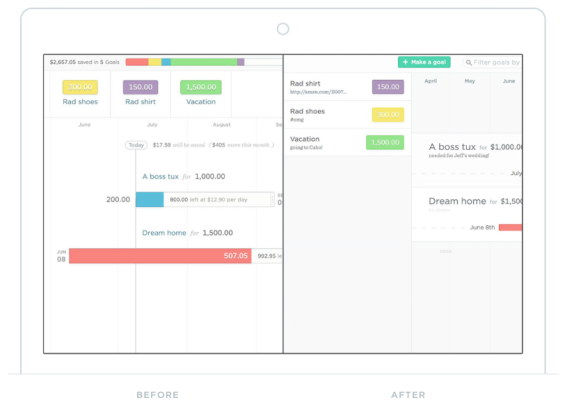

Revamping Goals

Already looked on by many as having one of the best integration of goals within a banking platform, Simple completely revamped their Goals platform. Making the Goals process easier to use, Simple consolidated the Goals information into a single form, allowing the customer to add and edit new goals with ease.

In addition, Simple added a number of new organizing capabilities, like the ability to add memos to Goals (the customer can use a hashtag, link, personal note or memos to organize saving). They also have provided the ability to color code Goals, making it easier to sort and scan what the customer is saving towards or spending.

Innovating Banking … The Simple Way

Simple serves a base of more than 100,000 customers, with rapid growth in both customers and employees continuing since the acquisition by BBVA. In several interviews and public appearances, it is clear that BBVA believes in Simple’s vision and the course they have taken to transform the industry. The main difference is that BBVA gives Simple the resources, scale, and autonomy they need to accelerate their growth.

Simple currently functions as a separate business within the BBVA structure, with the team that has brought Simple to this point remaining in place. By joining forces with BBVA, Simple and BBVA can jointly gain end-to-end ownership of the customer experience, from mobile apps to the entire BBVA service offering. This provides flexibility to grow on many fronts while continuing to innovate.

One of the lessons that Simple continues to emphasize through social media is that while they can improve banking by introducing incremental shifts in old paradigms, to really move banking forward they need to break the mold and build something new. In so doing, they are able to create a unique banking experience that’s easy, beautiful, and even delightful.

With the backing and innovative spirit of BBVA, it appears we have only seen the tip of the innovation iceberg at Simple.

Editorial Update (June 13, 2021): As of mid-2021, Simple has shut down and will not resume operations, according to company statements.