While most Gen Y consumers will use all banking channels as a matter of convenience, it’s clear that their banking behavior is more-and-more centered on their mobile devices.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

In recent BankChoice Monitor surveys fielded by Novantas, checking account shoppers were asked how often (if at all) they log onto their institution’s online banking websites and mobile banking applications. Overall, consumers use traditional online banking more frequently than on mobile apps, but the data indicates that Gen Y consumers are banking less on their PCs and depending more on their mobile devices for banking activities.

Habits, Trends and Patterns of Gen-Y Mobile Banking Consumers

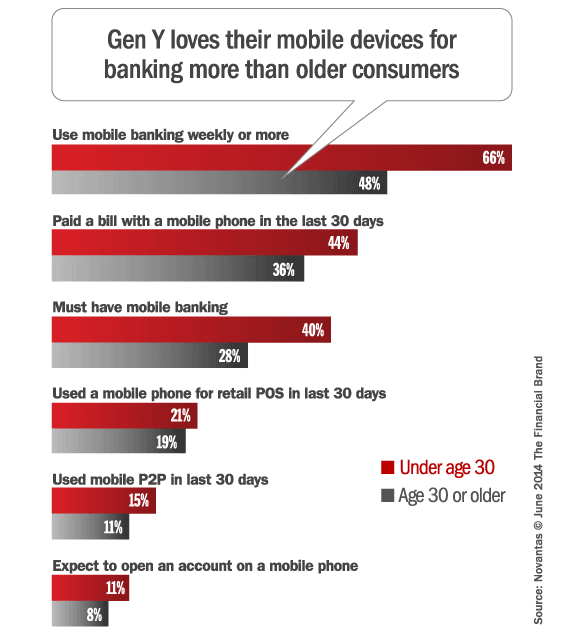

Gen Y uses mobile banking applications more frequently and online banking less frequently than older consumers. Gen Y consumers are 38% more likely to use their mobile banking application on a daily or weekly basis and 11% less likely to use online banking on a daily or weekly basis compared to older consumers.

Gen Y wants mobile banking apps more than older consumers. 40% of consumers under 30 indicate that they “must have” mobile banking versus only 28% of older checking account shoppers. At the same time, Gen Y consumers are 32% less likely than older consumers to indicate that they must have traditional online billpay.

Gen Y uses their mobile phones for payments. Compared with older consumers, our surveys indicate more consumers under 30 have recently used their mobile device for billpay, P2P and retail POS payments.

Gen Y consumers are more likely to expect to open their checking account using their smartphone or tablet. It’s still early days for mobile account opening, but 11% of Gen Y consumers said they expected to open their account using a mobile device compared to 8% of shoppers who are over 30 years old.