According to an annual study by Forrester entitled, ‘2014 US Mobile Banking Functionality Benchmark,’ each of the five largest banks in the country fall into a narrow scoring range of meeting or exceeding consumer mobile banking expectations. Chase and U.S. Bank tied for the top spot, followed very closely by Wells Fargo, Bank of America and Citi. The scoring is based on dozens of individual criteria measured across the following categories:

- Range of touchpoints

- Enrollment and login

- Account and money management

- Transactional features

- Service features

- Cross-channel

- Marketing and sales

While each institution do the basics well, such as providing account information and offering a wide set of transactions across a range of devices and platforms, most continue to fall short of global peers in offering self-service features, money management tools and cross-sell functionality, according to Forrester. Examples of gaps include a lack of pre-login insight, an inability to manage card fraud or receive customer service via mobile, limited budgeting tools and minimal contextual cross-selling.

Read More: 20 Best Mobile Banking Apps

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Big Five Do The Basics Well

According to senior analyst Peter Wannemacher, all of the large banks do the ‘basics’ well, earning overall scores over 50, indicating they are meeting customers’ basic needs and expectations. “Certain features have become fundamental to customers’ mobile banking activities, and the banks we reviewed do a solid job of offering these features in a way that help users conveniently achieve their goals,” stated Wannemacher in his blog. “For example, the transaction history screen is one of the most visited areas of most banks’ mobile apps, and most large U.S. banks now let mobile users easily filter, sort, and search their past transactions.”

He also noted that four of the five banks reviewed let customers add a payee from within the smartphone app. While all of the banks evaluated ranked close to each other in total scores, there were differences in areas of strength among them.

For instance, top performer Chase (earning the highest score in the Forrester evaluation for the third straight year) was recognized for providing a wide range of transactional features such as transfers, bill pay, P2P payments as well as strong cross-channel guidance for customers to contact Chase, find ATMs and locate branches. “Our customers told us they want information presented to them in a clear, relevant way,” said Gavin Michael, head of Digital for Consumer and Community Banking at Chase. “They want speed and simplicity,” he continued.

A recently released app adds some personal touches, like a localized log-on screen that shows one of 18 different images from an iconic San Francisco cable car to the Brooklyn Bridge, depending on where a user is. The app also offers a greeting at the top of the screen based on the time of day.

When it comes to the app’s functional aspects, Chase has attempted to simplify the user interface, with a faster log-on setup, and a main page that features four tabs at the bottom for accounts, paying bills and making transfers and deposits. A “more” button leads to other options, like an ATM locator, customer service, and creating alerts.

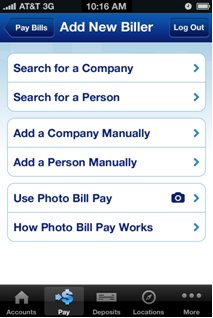

Alternatively, this year’s co-winner U.S. Bank was cited for offering innovative functionality such as the ability to take a picture to enroll in billpay and pay a bill, using the contact list in a phone to pay another person, and for being significantly better than the other banks evaluated at providing product analysis and digital cross-selling. U.S. Bank advertises loans and lines of credit within the ‘transfers’ screen of its app.

US Bank Photo Bill Pay

“Customer feedback provides the foundation for all of our innovation efforts, as we always start by creating value for the customer,” said Chris Peper, vice president and mobile channel manager at U.S. Bank. “We have built an agile development platform that helps us adapt to the rapidly changing marketplace, and has allowed us to quickly drive new features from our innovation labs to our customers’ fingertips,” added Rakesh Nambiar, senior vice president and head of digital banking delivery at U.S. Bank.

Read More: What Makes a Great Mobile (Banking) App

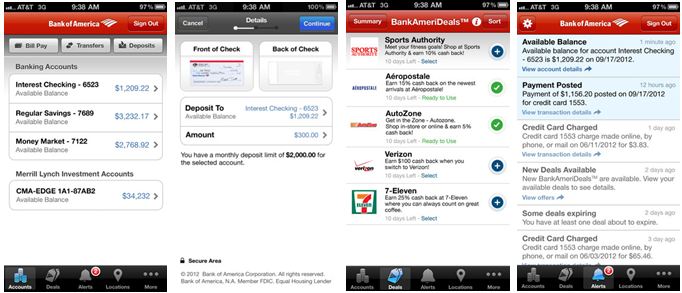

Bank of America Addresses Mobile Weaknesses

Third place Bank of America underscores how all of the top banks are making mobile banking a top priority. While BofA already allowed customers to enroll in online and mobile banking directly from its apps without having to do so first on a PC, it recently introduced an app update that significantly improved the self-service features and lack of acquisition strategies noted in the Forrester study.

“We listen actively across many channels … social media listening, call centers, page level and in-app feedback.” – Hari Gopalkrishnan

New self-service capabilities include a clean, intuitive navigation menu that helps customers find functions via multiple access points, and an easy way to report and replace lost or stolen debit and credit cards and order copies of paper checks. There is also easier access to routing and account numbers, visual tutorials that offer a step-by-step guide that encourages adoption of new and existing features, and an easier way to view available credit, account balance and BankAmeriDeals savings opportunities.

The app allows customers to set appointments at local banking centers with a specific financial advisors, while providing reminders, calendar synchronization and a list of documents required. It also lets select customers “click” to get a call for their banking questions. Finally, it provides enhancements for paying bills and making transfers, allowing users to add a recipient directly from their contact list for seamless P2P payments.

Bank of America also uses a less intrusive alternative to customer and product acquisition sending targeted and personalized offers based on customer profiling. “We don’t want to annoy customers with things they already have. Based on our understanding of a customer, we can send personalized offers and lead a customer through the acquisition of programs, loans and account opening,” states Hari Gopalkrishnan, ecommerce, architecture and segments technology executive at Bank of America.

“Being responsive to customer needs is more important than coming in first place, and is less about chasing technology for the sake of technology and more about prioritizing customers wants,” Mr. Gopalkrishnan said.

All of the large banks reviewed (and most banks in general) are on a continuous mission to improve mobile banking functionality. The ongoing question is whether they can keep up with consumer demand and competitive pressures.

Importance of Enhanced Mobile Functionality

As noted, all of the banks reviewed earned overall scores indicating they are meeting customers’ basic needs and expectations. Yet when it comes to more innovative features, there’s room to improve. From pre-login insight, to social media integration and the ability to purchase services within the mobile app, most banks fall short of customer expectations. Interestingly, some smaller banks such as BBVA Compass, PNC, USAA and Bank of the West offer enhancements not found at some of the larger institutions.

It is expected that leapfrogging of capabilities and functionality will continue as new innovations are introduced. An ongoing challenge will be to balance enhanced functionality with security and simplicity. As noted in a Federal Reserve report, seven in 10 who don’t use mobile banking cite security as one of the reasons they don’t do so.

Non-traditional institutions such as Moven, Simple, GoBank and T-Mobile, while not major threats from a size perspective, also are challenging the industry by introducing combinations of functionality, simplicity and contextuality that appeal to millennials and consumers comfortable with digital banking.

An Accenture study found younger consumers in particular have a willingness to consider banking with major non-banks if they provided banking services. In total, 72 percent of consumers ages 18 to 34 would be ‘likely’ or ‘very likely’ to bank with at least one technology, telecommunications, retail or shipping/postal company they do business with if they offered banking services. More than half (55%) of consumers ages 35-54 and 27 percent of those ages 55 and older would be willing to do the same.

Read More: The End of Banking As Usual

Recommendations for Banks and Credit Unions

The research done by Forrester should provide a benchmark on the current state of top bank mobile banking functionality for banks and credit unions of all sizes. The research (and other studies like this) should also provide insight into best-in-class functionality as well as roadmaps for success.

Since no organization is in a position to introduce all possible innovations, institutions should build a prioritization checklist of what functionalities deserve resources based on internal discussion and customer feedback. Mobile application development recommendations offered by many organizations include:

- Simplify mobile applications whenever possible

- Increase engagement tools such as budgeting and money management

- Leverage integrated mobile capabilities such as the camera, contact lists, calendars, etc.

- Use contextually-driven features to improve consumer experience

- Deliver real time, location-based personalization

- Develop a digital wallet strategy and begin to make ‘small bets’ on potential outcomes

- Create rewards and seek to monetize mobile