The greatest mistake most institutions make when developing new digital capabilities is starting with the mindset, “if we build it, they will come.” Digital account opening is a tool like any other tool, and can be used well, or used poorly. To be successful, banks and credit unions need think seriously about what their goals are for starting new or growing existing relationships online, and how to support those goals with the right products, marketing campaigns, and risk strategy. But what should those goals be?

Every manager knows the difficulty of setting metrics. If you’re too conservative, you won’t meet your potential. If you’re too aggressive, you’ll cause yourself and your team months of pain. To help banks and credit unions get smart about digital account opening, here are five key digital account opening benchmarks from the Andera customer base:

Buy the Guide to Digital Account Opening

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

1. Volume

The key metric for digital application volume is not the number of applications initiated, but the number of applications submitted for qualification and decisioning. This is because you want to exclude applicants who click “Apply Now” on your website by mistake, or who want to check out how much work is required to apply for an account and then come back later (even though you want an understanding of these metrics).

The chart below shows the total number of submitted deposit account applications for the best performing 50% of banks and credit unions using the Andera digital account opening solution in 2013.

Volume Online Applications by Asset Size

| BANKS (Assets) | Average Application Volume |

|---|---|

| Less than $250 million | 543 |

| $250–$500 million | 372 |

| $500 million to $1 billion | 927 |

| $1–$2 billion | 2,012 |

| $2–$5 billion | 1,770 |

| Over $5 billion | 16,470 |

| CREDIT UNIONS (Assets) | Average Application Volume |

| Less than $250 million | 955 |

| $250–$500 million | 1,707 |

| $500 million to $1 billion | 2,320 |

| $1–$2 billion | 4,831 |

| Over $2 billion | 9,785 |

Data from 200+ Andera bank and credit unions clients. Application volume records the total number of complete applications submitted to the institution for qualification and decisioning, not application starts. Approval rate is the ratio of total accounts opened to submitted applications. Approval rate is determined primarily by the institution’s risk management strategy, and secondarily by post-submit abandonment associated with account funding and confirmation.

The asset size categories above aren’t perfect, of course, and benchmarks get harder to set as institutions get larger (a $50B bank is not the same as a $200B bank). Credit unions overall do a better job driving online applications than banks. In general, for every $1M in assets, 1-2 applications a year for banks and 2-3 a year for credit unions is a good rule of thumb, although factors other than size matter equally, if not more.

When setting application goals, be sure to consider the number and type of products you plan to offer online, your marketing budget, and your online presence and search rank. Are you planning to use digital account opening to create a fully functional branch, or only to offer a few select products to existing customers? Have you earmarked funds for digital advertising, or to optimize your website to drive site visitors to your digital application?

Do you serve customers all over the country, or are you a community-based organization whose customers choose you primarily for convenience, or, if you are a credit union, must come from a specific set of ZIP codes? If the latter is true, you may have to do a bit more work to raise awareness about the ability to open accounts online, or increase brand recognition outside of the neighborhood.

Read More: Mobile Account Opening Is Mobile Banking Imperative

2. Approval Rate

Often you’ll hear financial technology vendors say something along the lines of “we make ____ easy so bankers can stick to what they do best: banking.” But what is banking? There’s no single answer, of course, but to many in the industry, banking means risk strategy. In digital account opening, risk strategy is important not only for product qualification using debit or credit history, but also for identity verification and fraud prevention. Banks and credit unions vary significantly in their risk tolerance and also in the quality of applicants they attract, and so approval rates vary significantly across institutions.

The chart below shows the percentage of submitted deposit account applications that became opened accounts for the best performing 50% of banks and credit unions using the Andera digital account opening solution in 2013. The approval rate depends primarily on risk strategy, but also incorporates applicants who abandon during the account funding and account confirmation steps.

Mobile Applications Over Time

| BANKS (Assets) | Average Approval Rate |

|---|---|

| Less than $250 million | 55.6% |

| $250–$500 million | 54.3% |

| $500 million to $1 billion | 45.7% |

| $1–$2 billion | 53.4% |

| $2–$5 billion | 42.7% |

| Over $5 billion | 46.7% |

| CREDIT UNIONS (Assets) | Average Approval Rate |

| Less than $250 million | 61.1% |

| $250–$500 million | 57.3% |

| $500 million to $1 billion | 51.5% |

| $1–$2 billion | 57.1% |

| Over $2 billion | 62.9% |

Google Analytics data from nearly 3.5 million application starts from a representative sample of Andera bank customers.

Larger banks tend to be more conservative both in their qualification and their identity verification and fraud prevention strategies, and that tendency is reflected in their average approval rates. Credit union approval rates are higher on average than bank approval rates, a fact that may reflect a higher quality applicant pool, or a greater average tolerance for risk. Abandonment depends on the number of steps required of the applicant after submission, and may increase dramatically with particularly difficult processes, as when, for example, banks and credit unions require applicants to print, sign, and mail in a signature card before they can fully open their account.

When setting up their risk strategy for digital account opening, institutions must weigh risk aversion and against their desire increase their approval rate and open more accounts online, and collaborate with internal legal and compliance teams to overcome application pain points.

Read More: Understanding Mobile Account Opening Options

3. Mobile Applicants

Not too long ago “digital account opening” and “online account opening” were interchangeable terms. Today, there’s a new variety that can’t be ignored: mobile account opening. The chart below shows the percentage of application starts coming from a smartphone or tablet over time for banks and credit unions. The data was collected from over nearly 4 million deposit account applications from 2010 to 2013 across a representative sample of institutions unions using the Andera digital account opening solution.

Bank and Credit Union Mobile Applications Over Time

| BANKS | Smartphone | Tablet |

|---|---|---|

| July through December 2010 | 3.3% | – |

| January through June 2012 | 4.7% | – |

| July through December 2011 | 7.3% | 0.3% |

| January through June 2012 | 8.5% | 2.6% |

| July through December 2012 | 12.2% | 3.4% |

| January through June 2013 | 12.8% | 4.5% |

| July through December 2013 | 18.5% | 5.3% |

| CREDIT UNIONS | Smartphone | Tablet |

| July through December 2010 | 2.1% | – |

| January through Jun 2012 | 3.2% | – |

| July through December 2011 | 4.6% | 0.2% |

| January through June 2012 | 5.3% | 2.5% |

| July through Dec 2012 | 8.8% | 3.7% |

| January through June 2013 | 11.0% | 6.1% |

| July through Dec 2013 | 14.7% | 7.7% |

Google Analytics data from nearly 3.5 million application starts from a representative sample of Andera bank customers, and data from nearly 500,000 application starts from a representative sample of Andera credit union customers.

The percentage of credit union applicants coming from mobile devices is slightly lower than that for banks (24%), perhaps reflecting a slightly older or less tech-savvy applicant base. Still the percentage of mobile applicants for all institutions is too large to ignore. Unless your customer base is particularly old or particularly traditional (and you’re OK if that continues to be the case) you need to be ready for these applicants. If all your digital application can offer is a pinch and shrink experience, they may navigate away and try again another institution.

Read More: What Will Account Opening Look Like in 10 Years?

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

4. New vs. Existing

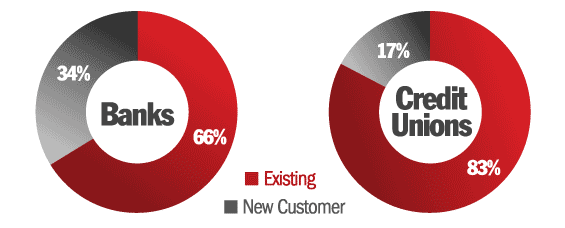

Digital account opening is an important platform for attracting new customers, but it’s also a great tool for growing existing relationships. In general, banks can expect about 2/3 of successful applications to start new relationships and about 1/3 of successful applications to deepen existing ones. Last year credit unions attracted a significantly higher percentage of new members than banks, a difference that may reflect the record growth in net credit union membership in 2013, or simply a tendency to use digital account opening more as a platform for expanding membership than for upselling existing members.

Sources of Online Applications: New vs. Existing Customers

Data from 100+ Andera bank customers and from 100+ credit union customers.

Banks and credit unions can increase the number of applications coming from existing customers with sidebar product promotions in online banking that link to digital applications. Features like single sign-on that let existing customers and members bypass some data entry and annoying identity verification can also help create healthier, stickier relationships, and give those who do apply a great experience.

Read More: Cyclical Trends: When Consumers Open The Most Deposit Accounts Online

5. Funding Sources

Funding is a key stage in online and mobile account opening. For most banks and credit unions it’s the single greatest cause of application abandonment, but it’s also essential to ensure account usage and engagement later on. Most online and mobile account opening solutions will allow applicants to fund via credit/debit, ACH Transfer, mailed check, and, if the applicant is already a customer, internal transfer from an existing account.

In general, the more choice the better: your institution should enable as many options as your digital account opening provider allows to make sure approved applicants won’t quit because they don’t see their funding method of choice. Most important, however, is enabling a funding method that will allow the applicant to complete their application how they started it—digitally.

The charts below show the percentage of 2013 deposit account applicants who choose to fund via ACH transfer or credit/debit, the two most common digital funding methods, and the amount of the initial deposit funded by each method, at banks and credit unions that made both funding methods available.

Funding Sources for Online Accounts – Banks vs. Credit Unions

| BANKS | Percent of Applications Funded By Method |

Percent of Total Amount Funded By Method |

|---|---|---|

| ACH Transfer | 31% | 68% |

| Credit/Debit | 69% | 32% |

| CREDIT UNIONS | Percent of Applications Funded By Method |

Percent of Total Amount Funded By Method |

| ACH Transfer | 25% | 67% |

| Credit/Debit | 79% | 33% |

Data from over 1200,000 applications at more than 70 Andera bank clients and 90 credit union clients offering applicants a choice between ACH Transfer and Credit/Debit funding. Note that maximum funding limits are often larger for ACH Transfer.

Unsurprisingly, when given the choice a majority of applicants choose to fund via the more familiar credit/debit method. This preference has been getting stronger over time. The percentages reverse for amount funded, however, because most institutions set a higher funding limit for ACH transfer because of the smaller cost to the institution, and the lower risk of fraud. Again, banks and credit unions must weigh risk of fraud against the desire to open more accounts with greater average initial deposits when making decisions about funding in digital account opening.

Learn More

Benchmarks can be extremely helpful to banking and credit union professionals looking to set goals or make projections, but in the end every institution is unique, and your goals should reflect your institution’s specific strengths and weaknesses.