In a report, “Banking with Women Customer: Strategies to Increase Digital Banking Engagement,” from Javelin Strategy & Research explores how gender plays a role in financial decision-making, the financial products women buy, what influences them as they decide whether to swipe a debit or a credit card, habits for handling essential financial chores, desire for smartphone-powered control, and need for better online and mobile personal finance management. The report is based on survey collected online from more than 6,000 consumers.

Javelin found that women engage in more activities that suggest a role in day-to-day, on-the-go money management, while men tend to get involved with complex, longer-term financial decisions. For instance, women are significantly less likely than men to own investment products but are more likely to owe on student loans.

Women represent 52% of the overall U.S. market. 90% make household financial decisions, and they monitor their money vigilantly. Many women handle financial matters differently than men, but there’s no single voice for women — no “soccer mom” or executive who singularly defines the idea target audience.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Digital Banking Preferences for Women

Women are more likely than men to say mobile apps and websites are easy to use and serve all their banking needs. But women are also slower to adopt new technology. According to Javelin’s research, women are less likely than men to be the first to try new technology (23% vs. 29%). Example: They’re a tougher sell on new technology like voice recognition.

“Although women are not as likely as men to try new technology first, they hold the key to mass adoption,” said Mark Schwanhausser, Director of Omnichannel Financial Services for Javelin Strategy & Research. “Banks need to incorporate online and mobile features that bolster women’s desire for simplicity and to avoid slipping into debt.”

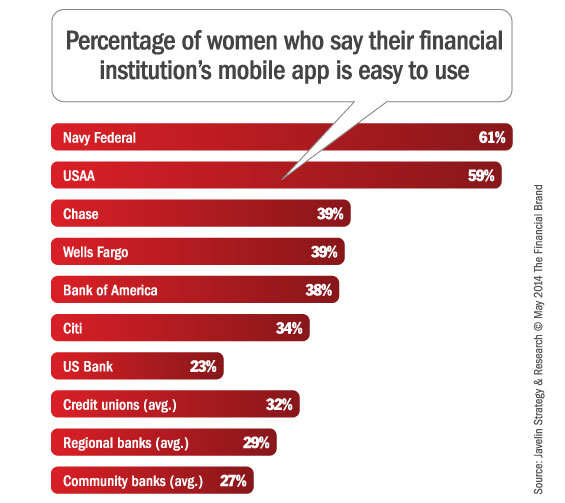

Javelin is quick to point out that on the mobile banking frontier, big banks are being hammered by both USAA and Navy Fed who have apps most women find easy to use.

To better connect with the women’s market, Javelin recommends financial institutions develop services that imbue women with a greater sense of control as they make daily financial decisions. Boost control through real-time oversight, trust in digital channels such as on-the-go personal finance insights and advice, mobile alerts, and location-based offers.

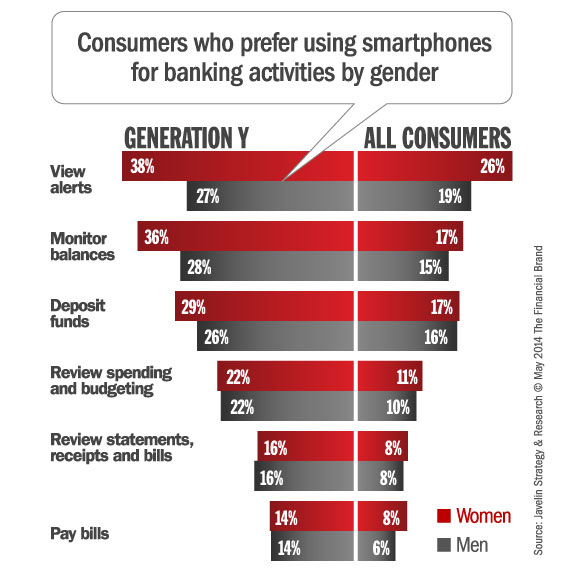

Javelin also recommends bank and credit unions learn how to target women with services that achieve mass adoption of digital channels. For instance, Schwanhausser points out that young women are more likely than young men to use their smartphones for banking.

“Smartphones — especially the camera feature — will attract women to banking services such as pay a bill from their checking account, depositing a check into their account, driver license to open a new account within minutes,” adds Schwanhausser.