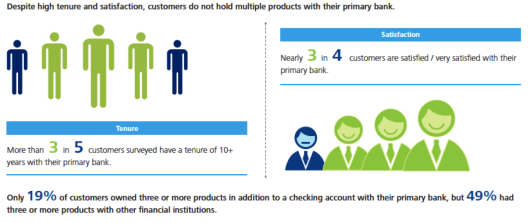

A Deloitte report entitled, ‘Kicking It Up a Notch: Taking Retail Bank Cross-Selling to the Next Level,’ found that only 19 percent of retail bank customers owned three or more products in addition to a checking account with their primary bank compared to 49 percent who have three or more products with other financial institutions.This supports the view that success in cross-selling targeting may need to move beyond traditional product ownership, satisfaction and tenure parameters to include a behavior segmentation approach that takes into account perceptions based on total account holdings.

While the Deloitte survey shows that banks have generally achieved long tenure and a high degree of satisfaction with customers, this success has not translated into multiple product relationships. In fact, the study found that there is a positive correlation between the number of products a customer uses and their desire to use multiple institutions.

Read More: 7 Common Sense Ways to Increase Bank Cross-Selling

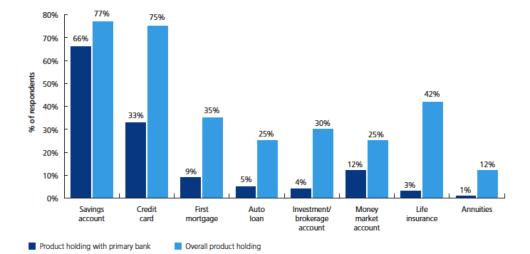

According to the study, customers only turned to their primary financial institution for a savings account on a consistent basis. In fact, while 75 percent of respondents owned credit cards, only 33 percent had one that was issued by their primary bank. Obviously, this could be the result of an inferior offer, poor marketing and/or the absence of a primary bank offered credit card, but it still illustrates a major opportunity gap.

Some of the other ‘opportunity gaps’ may be caused by poor cross-selling at the time of account initiation, poor customer education on the benefits of relationship consolidation or even beliefs that a primary bank is not the best place to build a specific relationship (wealth management or insurance products).

The research suggests that banks and credit unions may want to revisit traditional cross-selling strategies that focus on current product ownership, tenure of relationship and demographics to predict cross-selling success. Deloitte believes a deeper analysis of customer perceptions and motivations driving product purchasing may be needed, including a potential share of wallet segmentation scheme.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Share of Wallet Segmentation

“To remain competitive in a largely saturated market where revenue opportunities from new customers tend to be limited, deepening relationships with existing customers will likely remain critical to increasing banks’ top-line growth,” Deloitte says. “One important way this might be achieved is through more refined strategies and targeted execution of cross-selling programs.”

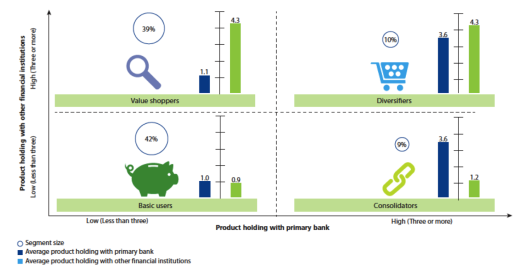

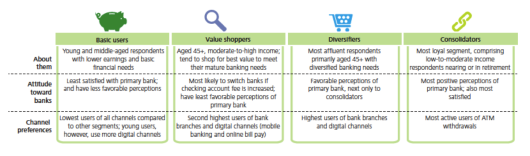

As a first step, respondents were grouped into four segments – ‘Basic Users’, ‘Value Shoppers’, ‘Diversifiers’ and ‘Consolidators’ – based on share of wallet.

The segments were then analyzed based on a number of dimensions such as demographics, perceptions, price sensitivity and channel use.

Finally, the segments were analyzed for product ownership patterns to identify opportunities for cross-sell success as well as ‘dead ends’, where investment could be wasted (no expanded ownership potential). Product ownership details are available in the full report.

Segment Challenges and Opportunities

Basic Users

As the name implies, ‘Basic Users’, despite the large size of this segment (42 percent of respondents), have limited financial means, less access to credit, and an average bank product ownership rate of 1.7. And while there is uniformity of income and product ownership rates, Deloitte suggests there are two groups of basic users; 1) young people whose product needs may evolve/grow as they get older, and 2) middle-aged and older customers whose needs and behavior are unlikely to alter over time.

“One way to attract young basic users could be through education. Providing information and advice on financial challenges, such as debt management, benefits of improving one’s credit score, and the importance of saving early for retirement may help banks become the go-to institution for this group,” Deloitte says.

To target young basic users Deloitte suggests use of social media and mobile banking and gamification that emphasizes improved money management.

“As young basic users progress in their professional and personal lives, their needs are likely to evolve. Banks could leverage their primary relationship to engage early with this group to provide products that meet their needs at various life events – education, marriage, purchasing a home, starting a family, investing, or retirement. This can allow their product needs to be met sequentially and appropriately, rather than pushing products prematurely with limited success or failing to cross-sell at all. A consultative approach as opposed to hard-selling may be particularly effective with this group.”

In addition, Deloitte suggests retail bankers could learn from product bundling strategies common in other industries, offering younger consumers in the Basic User segment the flexibility to purchase products in bundles as well as individually. For example, all add-on elements of checking account such as debit card usage, in-network ATM usage, paper checks, overdraft protection, and wire transfers can be priced individually. “Such a pricing approach will likely increase the affordability of the product, allowing Basic Users to pick and choose services that fit their wallet size,” says Deloitte.

Deloitte also advocates low-cost products such as prepaid cards with low usage fees, no minimum balance requirement or overdraft fee. While the younger part of this segment is relatively small and could be considered a long-term investment, banks and credit unions who connect early could enjoy relationship growth over time.

Read More: Cross-Selling to Gen-Y Banking Consumers

Value Shoppers

Value Shoppers, the second largest Deloitte segment (39 percent), are described as being the least loyal customers with only 1.1 products with their primary bank. A lack of trust among this category of customers means that they usually don’t believe their bank is ‘fair’, and are prepared to take their business elsewhere even over a ‘slight’ fee increase (6 in 10 will leave if fees increase $5 a month).

Nonetheless, Deloitte suggests targeting value shoppers can be an attractive proposition for banks.

“They have all the attributes that banks typically look for in high-value customers: financial strength, broad product needs, and higher channel engagement levels (67% pay their bills online and 58% use bank tellers) – the second highest among all the segments. Winning over this segment will likely involve changing their negative perceptions and incentivising product consolidation at the primary bank,”‘ Deloitte says.

The report notes that companies seen as having transparent pricing are best placed to win customers’ trust. This may require simplified fee structure, consistent communication or a better demonstration of value.

“Given value shoppers’ low affinity with their primary banks and their tendency to shop for the best offers, loyalty incentives could be effective in influencing them to consolidate some, if not all, of their financial relationships with primary banks,” says Deloitte. “Although banks have effectively implemented rewards programs at the individual product level, they will have to build a more holistic structure that incents customers to achieve the ‘preferred’ status in multiple product categories.”

Wells Fargo’s Portfolio Management Account (PMA) is provided as a good example of incenting customers for consolidating accounts with the bank. The PMA package begins with a checking account, which is then linked to other eligible Wells Fargo accounts, including savings, deposit, credit, mortgage, and brokerage.

Diversifiers

This group, according to Deloitte, is comprised of a significant proportion of mass affluent households (47 percent) and takes the highest average amount of bank products at 6.3, with about half from their primary bank. What they don’t have through their primary financial, institution is the likes of investments, life insurance, and annuity products.

“Banks seeking to grow relationships with ‘Diversifiers’ may need to target specific products where the segment relies on other financial players (investment brokerage, life insurance and annuities),” says Deloitte. “Retaining this segment will also likely require banks to shift from traditional pricing to value-added benefits.”

Advice given here includes personalized service at the branch level, access to dedicated financial advisors, and immediate resolution of any complaints.

Deloitte also suggests that banks could impress diversifiers by developing a better perception among the mass affluent base as a viable alternative for investment and brokerage services. The report highlights an example of Bank of America utilising its Merrill Lynch unit.

Read More: The Business Case for Onboarding

Consolidators

‘Consolidators’ are the banks’ most loyal consumers, holding an average of 4.1 products with 3.6 of the products at their primary bank. They clearly hold a positive view of their primary bank, often in terms of service and even fees.

“What strategy should banks use with consolidators?” Deloitte asks. ” Banks should retain them and leverage their loyalty by converting them to advocates.”

“Personalised attention to consolidators’ needs and prompt response to their concerns will strengthen their relationship with the primary bank, increasing the possibility of turning them into advocates,” says Deloitte. “Peer influence-based, community-oriented marketing holds the potential to create authentic customer relationships.”

The report goes on to suggest banks could create dedicated virtual space, both on websites and social media pages, for consolidators to share their experiences and influence the perceptions and buying decisions of other customers. “Banks may also consider devising reward programs to incentivise consolidators to help generate referrals.”

Additional Ways to Achieve Cross-Sell Success

While I have written many blog posts around the importance of cross-selling and the opportunities for success, Deloitte also emphasizes the importance of of changing current banks processes and functions to achieve success. Three aspects recommended by Deloitte are:

- Improve onboarding: It is critical to make the onboarding process efficient and effective since 75 percent of cross-selling occurs in the first three months

- Set cross-divisional goals: Set goals that ensure that lines of business stay coordinated and capitalize on cross-functional relationships

- Equip sales force: Combine incentives with training to improve sales force effectiveness

As shown in this recap of the well done Deloitte research report, banks need to move beyond product ownership and demographics to better understand the behavioral and attitudinal traits of customer segments. With this understanding, banks can redesign their channel and communication strategy and fine-tune product offerings to suit the needs of the different segments.

While the process may be challenging, it is clear the current strategies are not effective and need to be adjusted to remain competitive in a highly saturated market where revenue opportunities from new customers are limited and the importance of deepening relationships is paramount.

Additional Details of the Deloitte Research

The survey was conducted online by Harris Interactive during August 16-30, 2012. In total, 4,271 checking account customers aged 18 years or older participated in the survey. Responses were weighted across geographic regions, income levels, age, and gender groups to reflect the national population.

Definitions of “primary bank” as used in the Deloitte report refers to the bank where respondents have their primary checking account. “Other financial institutions” refers to other organizations at which customers have a financial relationship.

The analysis includes 12 different products sold by financial institutions beyond the checking account:

- Savings account

- Money market account

- Home equity line of credit

- Investment/brokerage account

- Credit card

- Auto loan

- Prepaid card

- Life insurance

- CD

- Mortgage

- Secured card

- Annuity