Most banks and credit unions have a new customer welcome or onboarding program that includes at least one letter, email and/or phone call to the customer thanking them for opening their new account. The goal of these programs is to start the new customer engagement process and to help stem attrition. Unfortunately, the vast majority of these programs fall far short of maximizing effectiveness since they don’t connect with the new customer early or often enough or use all available communication channels.

There is no more effective strategy than a multichannel new customer onboarding process that says ‘thank you’ and assists the customer in maximizing the value of their new account(s). By leveraging insight to communicate with the customer using both offline and online channels, you are more likely to increase engagement, foster a positive customer experience, differentiate your institution and build long lasting loyalty.

“The cost of each lost customer is as high as $400 or more when you consider the cost of acquisition and potential lost revenue.”

But what channels should be used, and when is the best time to communicate? The answer is … ‘it depends.’ Research has shown that the sequence and cadence of communication can be impacted by the service(s) that were accepted by the new customer when they opened their account and the channels that the customer is most likely to respond to. One thing is for sure, however. One contact and one channel is never enough.

According to J.D. Power & Associates, customer satisfaction and cross-sell success both improve as the number of customer contacts is increased up to 4 times, and is still effective if the customer is communicated with as many as seven times during the first 90 days. And since the customer does not receive, open or see all of the messages you may send, the actual number of ‘touches’ scheduled could be as many as ten during this early engagement period.

So how should a bank or credit union expand beyond just a mailing or phone call welcome program?

Email: The Power Channel for Effective Onboarding

Email can be one of the most powerful, and easy, digital channels to use to improve the success of an onboarding program. In fact, the effectiveness of expanding an onboarding program to include email could make most financial marketers increase their focus on requiring the capture of a customer’s email address at the time of account opening (still done less than 60% of the time at many organizations).

Going beyond just being a follow-up to a direct mail communication, email can work independently to improve usage of the new account and ‘go with’ service engagement. This includes use of the debit card, online bill payment, direct deposit, online and mobile banking, A2A or P2P transfers, mobile deposit capture and even the sign-up for personalized alerts.

One of the primary benefits of email is the speed of delivery. Unlike direct mail that may take days to produce and deliver, email can be in the new customer’s inbox almost as soon as they leave the branch or shut down their computer after opening an account online. How impactful would it be if a thank-you email like the one below arrived on the new customer’s desktop or on their phone almost immediately?

Source: Comperemedia

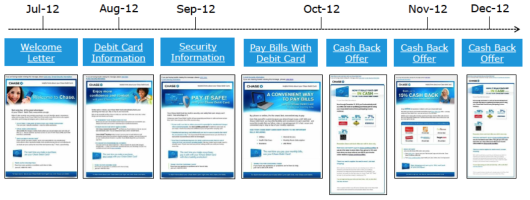

Other benefits of an onboarding email is that it can highly personalized and linked to engagement service product pages that encourage sign-up for services. The email sequence and message can also be easily customized to reflect the ‘next best’ service(s) for the customer to open. Since research shows that a new customer wants to be communicated to after they open a new account, concern about over communication is minimized. Below is an example of a 6 month sequence and cadence of email communication used by Chase. As can be seen, the focus is on product engagement as opposed to cross-sell or expansion of the relationship.

Source: Comperemedia

The impact of adding email to an onboarding program can be significant. Not only does the program benefit from the additional touch(es), but the more targeted and personalized communication allows an institution to provide a new customer a step-by-step process for making their new account tailored to their needs. It says, “We know you. We’ll look out for your best interests. We’ll reward you for doing your banking with us.”

In other words, done correctly, email can improve the customer’s experience in the first days of the new relationship.

The key is to make sure the customer is using as many of the engagement services as possible before you attempt to cross-sell additional products. Cross-selling too early can alienate the new customer, especially if you never thanked them for their business in the first place. Below are the services many of the larger banks in the country ask their customers to use before they begin cross-selling.

Source: Comperemedia

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Increase Email Effectiveness With Short-Form Video

According to a new report from REELSEO entitled, ‘2013 Online Video Marketing Survey and Business Video Trends Report,‘ 60 percent of marketers surveyed are using video for email marketing purposes and 82 percent found video email to be ‘highly effective.’ In another report from Invodo, the following projections and statistics stood out:

- 74% of all internet traffic in 2017 will be video

- 72.1 million smartphone users watched video on their devices monthly in 2013, and is projected to rise to 86.8 million in 2014

- 52% of marketing professionals name video as the content with the best ROI

- 64% of video viewers watch more than 3/4 of a video

- Search engine results favored video

- Using the word “video” in an email subject line boosts open rates by 19%, click-through rates by 65% and reduces unsubscribes by 26%

“Video in email can boost open rates by 20 percent and click-through rates by 2-3x.”

The use of video content in conjunction with email can significantly improve onboarding results. Not only is video the perfect medium for instructing the customer on how to use services such as mobile deposit capture and online billpay, but it can also educate on the benefits of setting alerts and enrolling in an institution’s rewards program. The key is to build videos for mobile-first viewing. This includes keeping the visuals large and dynamic (it is easier to scale up than to scale down in size) and to keep the length of video as short as possible to achieve your objective (welcome, single service engagement, etc.).

What is exciting about today’s digital video production capabilities is that content can be highly personalized, including using a customer’s name, account type, amount deposited, service(s) opened, next-best service that should be added, and can even include mobile and online links to take action. Below is a financial onboarding example from SundaySky, the creator of SmartVideo, that can help firms engage customers with personalized, real-time video experiences. Another firm that helps financial institutions connect with customers using personalized digital content is CUGrow.

Retargeting During The Onboarding Process

Unfortunately, while bank marketers build onboarding communications for customers, not all customers pay attention. And sometimes, when they do pay attention, they disengage before taking action. That is where digital retargeting comes in. Simply put, digital retargeting uses various channels to reconnect with prospects or customers who have disconnected during a communication process without taking the action desired. There are many forms of retargeting, each able to be used as part of an onboarding process to reengage ‘shoppers.’

- Site Retargeting: Using banner ads to reach customers who visited your site without taking action.

- Search Retargeting: Reconnecting with prospects or customers who used keywords that are relevant to your marketing efforts

- Email Retargeting: Using banners to reinforce a message that was sent via email

- Social Retargeting: Using ads within social media to reconnect with customers who received a direct message from you but did not take action

- Dynamic Retargeting: Combines the power of site and search retargeting to ‘follow’ customers as they browse the web

- CRM Retargeting: A method of reaching up to 30-40% of direct mail or email customer list with banner ads on their computer

- Mobile Retargeting: Similar to CRM retargeting, but where the retargeted ads are sent via a mobile ad

Each of the above strategies have been found to be highly effective based on reach, cost and performance. This is because you are reaching out to customers who have indicated a desire to search, shop and/or purchase the services you provide. Unfortunately, the challenge is that there is limited scalability of this strategy since it only includes people who have indicated an interest as opposed to a mass audience that many digital strategies include.

For financial marketers, retargeting is a great supplemental strategy to direct mail and email that can improve your onboarding results. The cost is one of the lowest of any digital marketing strategy and the impact usually provides a significant lift.

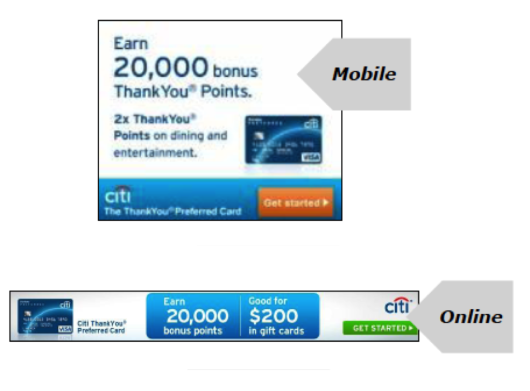

Reaching the Mobile Customer

All of the above strategies should be optimized for the mobile consumer since more media today is consumed on a mobile device than on a desktop computer. This includes email, video, web searches, social media, etc.

As a result, all onboarding communication that can be consumed on a mobile device should be direct and impactful. In other words, “What’s in it for me?” and “How do I respond?” In most cases, a financial marketer’s goal should be to minimize the keystrokes necessary to achieve the desired action. And if heavy written content can be replaced with visual or video content, all the better.

“One of the most effective, and underutilized, tactics for engaging with new customers in the onboarding process is with mobile ads and SMS messaging.”

By collecting the new customer’s mobile phone number and signing them up for mobile banking at the time of original account opening, the opportunity to help the customer maximize the value of their relationship and potentially receive real-time ‘surprise and delight’ communication is increased.

Leveraging your mobile banking platform allows for highly personalized and targeted communications at the point of mobile engagement. Your customer opens their new mobile banking application and they are provided information on the next best service to open and/or use. Done well, your customer will appreciate the reminder about how to best engage with your organization. Reinforcing other digital channel, potential ads for the following services are highly effective as part of onboarding:

- Online billpay

- Remote Deposit Capture

- Debit card utilization

- Alert designations

- Direct deposit

- Rewards program sign-up

- Account-to-account (A2A) and Peer-to-peer (P2P) transfers

As with all email and digital communications, mobile banking advertising can leverage direct links to enrollment landing pages, educational media as well as digital videos.

In addition to mobile ads within your mobile banking application, SMS texting can be very useful if used sparingly. The immediacy and attention grabbing qualities of this form of communication make SMS texts one of the most successful mobile strategies. Banks and credit unions have used this form of communication to remind customers about signing up for alerts (which uses the same channel of communication) as well as to deliver a ‘surprise and delight’ message.

For instance, imagine the impact of an SMS message (or mobile banking alert) informing a new customer that they can go to their nearest Starbucks or ice cream store to receive a free beverage or ice cream cone as a ‘thank you’ for opening their new account. Because mobile communications are in real-time, this message could be delivered the instant the new account opening process is done. Some institutions have also used this form of appreciation after a customer completes a satisfaction survey.

Just Do It

All of the above strategies have proven track records for decreasing attrition and increasing customer engagement, product use, profitability and loyalty. In fact, the impact of a second, third and fourth communication to the customer during the first 30-90 days improves results more than the initial communication. The key is to ‘Just Do It.’

If you don’t have an onboarding program today, there is no time better than the present to begin. If you already have an onboarding process, add one or two more touches and test the timing and effectiveness of the additional communication. Research shows that you won’t be disappointed.

Adding a series of onboarding email communications is not as difficult with a new customer because their relationship is minimal. Targeting and timing are relatively direct. Making sure there is a link and landing page (or video) with your email is important as is making sure that the customer does not need to go to another site to take action. Traditional web pages are not the best sales pages.

For each customer you engage and potentially save from becoming dormant or attriting, the financial impact is between $200 and $400 (when you take into account both the cost of acquiring and the lost revenue from an established account).