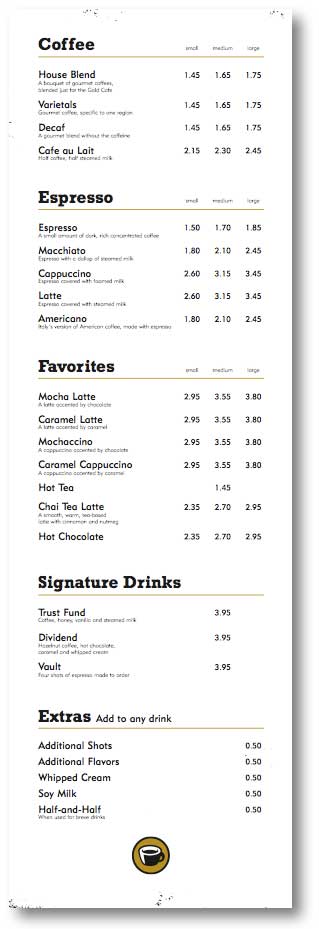

Since April 2006, Union National Community Bank’s Gold Cafés were heralded widely around the financial industry as a fresh innovation in branch design. The concept was a revolutionary combination: one part bank branch, one part upscale, fully-functioning café. There were espresso drinks, smoothies, menus, patio seating, checking accounts, loans, and even “financial baristas.”

Since April 2006, Union National Community Bank’s Gold Cafés were heralded widely around the financial industry as a fresh innovation in branch design. The concept was a revolutionary combination: one part bank branch, one part upscale, fully-functioning café. There were espresso drinks, smoothies, menus, patio seating, checking accounts, loans, and even “financial baristas.”

The Financial Brand made some inquiries with UNCB about the status of Gold Cafés after Market Insights Insider ran an article suggesting UNCB’s cafés may be closed. Well, now it’s official. After little more than two years into its Gold Café experiment, the bank has reverted back to a more traditional branch environment.

The Financial Brand made some inquiries with UNCB about the status of Gold Cafés after Market Insights Insider ran an article suggesting UNCB’s cafés may be closed. Well, now it’s official. After little more than two years into its Gold Café experiment, the bank has reverted back to a more traditional branch environment.

In an official statement, the bank says, “the focus needed to shift back to community banking from full-service retail coffee operations. The decision was made to eliminate the café service and continue to provide community meeting space.”

The branches will continue to offer free Wi-Fi and 7-day banking. You can still get coffee. Drip. Regular or decaf.

UNCB’s reversal could be construed as a referendum on the branch + café concept, a design approach that had gained some popularity in the first half of the decade. Branch designs from Umpqua Bank and ING Direct seemed to suggest financial institutions could transcend their boring caste by introducing experiences outside the banking world. Everyone wanted to be Starbucks.

The basic, overriding strategy aims to transform branches from banking centers into community hubs by making them warm, casual hangouts. You probably heard the retail maxim, “The longer they linger, the more they buy.”

Reality Check: Most people don’t want to hang out at the bank, no matter how cool it is. No matter how retail you make your branches, no matter how enjoyable the experience, the average consumer will never say, “Let’s go hang out at the bank.”

Shades of trouble with UNCB’s Gold Cafés were starting to show back in 2007, after Mark Gainer, CEO/UNCB, had some time to look back and evaluate the concept’s performance.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

“Banking is a very competitive but highly commoditized industry. We believed true differentiation was imperative for our successful growth.” — Michael Frey, President/UNCB

“I think we’re going to take a pause here for a while and grow these before we look into other markets,” he said. “There is a little bit of confusion; Is it a coffee shop or is it a bank?”

This is precisely the problem Jim Bruene, publisher of Netbanker, saw in the concept. “One of the biggest reasons to build branches is for their advertising value — placing the bank’s brand in front of thousands of commuters and errand-runners each day.”

“By calling it the Gold Café, UNCB lost the normal branding value,” Bruene noted.

Union National Community Bank serves residents of Lancaster County, Pennsylvania and maintains assets exceeding $477 million.

Key Takeaways:

- Just because UNCB’s Gold Cafés failed and Chase is throwing out WaMu’s Occasio branches does not mean you can go on building the same old, boring branches — just like you have for the last 20 years.

- Branches are a critical brand-building tool for financial institutions.

- Branding requires relevant differentiation. You need to create a unique experience, but you also need to stay focused on your core purpose: banking (i.e., not coffee).

“Financial Baristas”

Employees served as dual employees of the bank and the coffee operation — as experts on bank products and the preparation of espresso beverages, was the bank getting two jobs for the price of one?

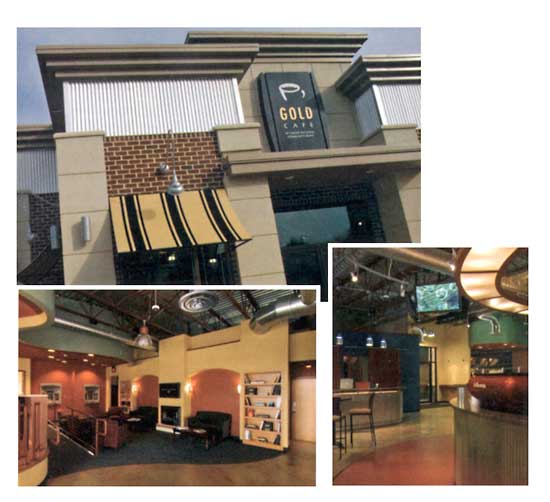

The interior space reflects something far from a traditional bank. The walls are painted in warm colors. Exposed ceilings, exposed brick, concrete floors, a fireplace, sofas, chairs and coffee tables stacked with books.

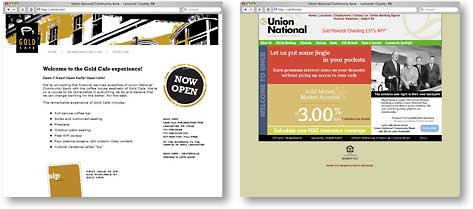

The bank had a contemporary-looking microsite supporting the cafes (left),

which was in stark contrast to the bank’s overall brand identity (right), as seen in the current website.