DigitalMailer took a look at twelve months worth of raw data from banks and credit unions using our email marketing engine. Here are the big trends the data revealed.

By Jimmy Marks, Creative Media Director at DigitalMailer

Trend 1: Early Birds Get the Worm

Financial institutions that sent emails to people in the early morning saw an open rate as high as 38.38%. That’s astounding, given that the industry average is in the 20-25% range. Those that send around 11 am also saw healthy open rates, as did those that sent messages in the 9-10 pm range. The lowest open rates typically occur around drive times (6-7 am, and 4-5 pm).

| Hour | % of Campaigns |

% Opened |

% Clicked |

|---|---|---|---|

| 12:00 AM | 0.09% | 21.13% | 2.88% |

| 1:00 AM | 0.02% | 6.39% | 0.18% |

| 2:00 AM | 0.02% | 0.59% | 0.00% |

| 3:00 AM | 0.02% | 0.00% | 0.00% |

| 4:00 AM | 0.14% | » 38.38% « | 3.10% |

| 5:00 AM | 0.14% | 22.75% | 0.93% |

| 6:00 AM | 3.46% | 21.01% | 2.45% |

| 7:00 AM | 4.47% | 20.97% | 3.35% |

| 8:00 AM | 10.77% | 24.53% | 4.47% |

| 9:00 AM | 8.33% | 23.99% | 4.68% |

| 10:00 AM | 10.44% | 24.84% | 3.40% |

| 11:00 AM | » 14.91% « | 30.01% | 2.19% |

| 12:00 PM | 8.11% | 28.85% | 3.98% |

| 1:00 PM | 6.91% | 26.50% | 3.85% |

| 2:00 PM | 7.20% | 26.89% | » 5.49% « |

| 3:00 PM | 8.07% | 26.74% | 3.36% |

| 4:00 PM | 7.60% | 25.23% | 3.03% |

| 5:00 PM | 4.44% | 23.57% | 2.38% |

| 6:00 PM | 2.42% | 27.38% | 4.29% |

| 7:00 PM | 1.29% | 29.58% | 3.57% |

| 8:00 PM | 0.71% | 26.96% | 2.17% |

| 9:00 PM | 0.14% | 32.40% | 3.22% |

| 10:00 PM | 0.05% | 31.90% | 2.04% |

| 11:00 PM | 0.24% | 26.71% | 0.96% |

Why are these times prime for opens? The answer lies in the schedule of your typical consumer. The “early-risers” are the readers that answer emails first thing in the morning. Those in the 11:00 hour are likely thumbing through their messages before (or during) lunch. And those that open messages in the 9-10 pm range? Reading before they drift off to sleep.

Consider the lives of your readers and where they’re bound to be when they get your email. Catch them at just the right moment and they might take action there and then.

( Read More: Cyclical Trends–When Consumers Open The Most Deposit Accounts Online )

Fractional Marketing for Financial Brands

Services that scale with you.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Trend 2: Less is More

The more email campaigns you send annually, the lower (and lower!) your performance stats will go. If you increase the number of email campaigns you send from 50 to 500 or more, you could see your open rates drop from over 35% to less than 20%.

The more email campaigns you send annually, the lower (and lower!) your performance stats will go. If you increase the number of email campaigns you send from 50 to 500 or more, you could see your open rates drop from over 35% to less than 20%.

The volume of campaigns sent has an even more profound affect on click-through rates. If you only send one email campaign a week, your click-through rate can top 7%. But once you start sending hundreds of email campaigns annually, you’ll see your clicks fall off a cliff — down in the 2% range.

More emails ≠ more clicks. There is a point of diminishing returns. Pay attention to the net number of clicks you yield per email and annually to find your sweet spot.

| Emails Sent Annually |

% Opened |

% Clicked |

% Bounced |

% Unsub |

|---|---|---|---|---|

| 25–50 | 35.41% | 7.32% | 3.79% | 0.13% |

| 51–100 | 32.88% | 5.80% | 3.65% | 0.15% |

| 101–500 | 31.21% | 4.28% | 3.94% | 0.12% |

| 501–1000 | 24.92% | 2.76% | 2.32% | 0.11% |

| 1001+ | 19.42% | 2.04% | 1.22% | 0.08% |

Trend 3: Sending on a Tuesday? You Just Missed Your Chance

Most financial institutions like to send on Tuesdays. And according to data from the last five years, this trend has remained very consistent.

Tuesday’s open rates weren’t bad. They were in the 25% range — average. But the top performers send emails on Mondays, Wednesdays and Fridays. Monday’s emails, strange as it may seem, get the highest open rate at 30.44% and the highest click-through rate at 6.49%.

| Day | Send Total |

% Send |

% Opened |

% Clicked |

% Bounced |

% Unsub |

|---|---|---|---|---|---|---|

| Sunday | 6 | 0.33% | 21.66% | 1.78% | 0.18% | 0.05% |

| Monday | 357 | 19.58% | » 30.44% « | » 6.49% « | 2.90% | 0.07% |

| Tuesday | 332 | 18.21% | 24.12% | 4.60% | 2.47% | 0.06% |

| Wednesday | 405 | 22.22% | 21.39% | 3.16% | 2.59% | 0.10% |

| Thursday | 328 | 17.99% | 24.17% | 3.37% | 2.16% | 0.12% |

| Friday | 344 | 18.87% | 22.72% | 3.59% | 1.92% | 0.05% |

| Saturday | 51 | 2.80% | 17.41% | 1.20% | 0.79% | 0.05% |

( Read More: Email Marketing Clinic: Ally Bank’s Tricks & Techniques )

Trend 4: Smaller Can Be Better

How does list size affect open rates? The trend line was pretty easy to spot: as list size increased, open and click-through rates decreased. Smaller lists (those with 25-100 subscribers) typically suggest targeted audiences and focused messages. Larger lists (those with 500-1000 contacts) are used for general announcements and newsletters.

The more you focus on a particular group, the more likely they are to respond to the message you’ve sent them. No big surprise there.

Trend 5: Top-Performing All-Stars

Take a look at how the all-stars perform, and you’ll see a range of open and click-through rates. Most notably, there is a $600 million financial institution getting nearly a third of their emails opened, with lower-than-average unsubs, while also generating an impressive 8.2% click-through rate!

| Asset Size of Financial Institution |

Emails Sent |

% Opened |

% Clicked |

% Bounced |

% Unsub |

|---|---|---|---|---|---|

| $1.0 billion | 1,234,687 | » 32.66% « | 3.76% | 1.94% | 0.04% |

| $600 million | 898,524 | 31.04% | » 8.18% « | » 5.38% « | 0.08% |

| $300 million | 965,391 | 27.72% | 2.69% | 1.38% | 0.09% |

| $500 million | 1,743,202 | 25.40% | 7.51% | 2.25% | 0.05% |

| $1.9 billion | 1,192,703 | 21.52% | 0.87% | 0.94% | 0.14% |

| $300 million | 1,711,925 | 20.73% | 2.09% | 0.57% | 0.05% |

| $750 million | 821,057 | 20.56% | 1.47% | 0.57% | 0.07% |

| $1.0 billion | 1,132,068 | 14.72% | 1.05% | 0.28% | 0.04% |

| $300 million | 1,085,671 | 13.19% | 0.50% | 1.68% | 0.21% |

| Grand Totals /Averages | 12,918,319 | 22.44% | 3.00% | 1.70% | 0.08% |

These senders have relatively low bounce rates. How do they make that happen? By…

- Making email addresses a staple of the new client enrollment process

- Making occasional “correct address” requests in OLB or at the branch

- Giving readers and customers the option to change an address from inside OLB or at the help desk in their nearest branch

- Tracking bounce statistics and looking for soft vs. hard bounces (i.e., a “full inbox” or spam filter vs. a bad or deleted address)

( Read More: Why I Never Got Your Email: Tips to Improve Your Email Campaigns )

Lessons Learned

The key takeaway from our Top Ten? Love your lists. Take good care of the data that goes into your subscriber lists and get new addresses when the older ones “retire”. Remember, email is a very valuable tool, but it’s only as strong as the lists you use to send.

The key takeaway from our Top Ten? Love your lists. Take good care of the data that goes into your subscriber lists and get new addresses when the older ones “retire”. Remember, email is a very valuable tool, but it’s only as strong as the lists you use to send.

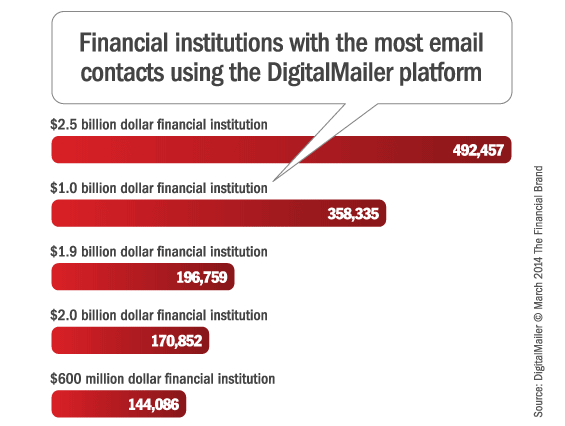

The Top Ten also have another piece of DNA that might skew the data: none of our top users for the past five years, nor the past 12 months, have less than $300 million in assets. The upper limit is as high as $2.5 billion, and the other clients in that list are anywhere in-between. These are large FI’s (one is an FI Advisory firm, for which we have no financial data), so they have hired people who are devoted to email list integrity, messaging and sending. For many of our other clients, we know this isn’t the case, which is exactly why they use our creative services division to create, implement and manage campaigns and data.