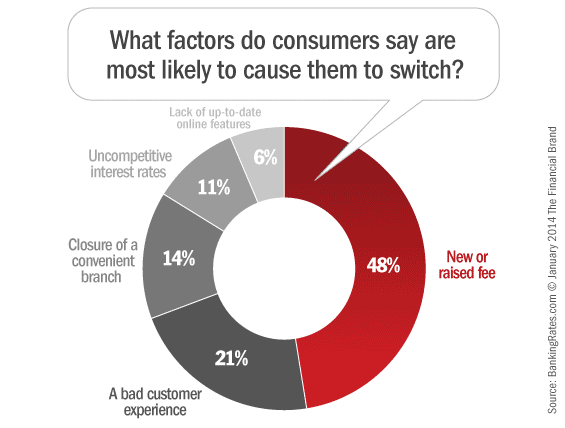

Personal finance site MoneyRates.com fielded a survey in late 2013 among 2,000 American consumers asking them what factors would be most the most likely to cause them to switch banks. Fees top the list, followed by bad service and branch closures — three things that financial institutions seem to be doing more and more of lately.

Let’s take a closer look at these factors, and cross-tabulate consumers’ responses against other studies.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Fees

One survey found that 60% of consumers would leave their current financial institution if they were charged fees and could not get free checking.

And yet, when asked what consumers like most about their current checking account, 31% have said it was the fees they paid that they were most pleased with.

In a 2012 study from Bankrate, only 39% of banks offered a checking account with no minimum balance requirement and no monthly fee, the standard definition of a “free” checking account. That’s down from 45% in 2011, and down substantially from its peak in 2009 when 76% of financial institutions offered free checking.

In the most recent MoneyRates.com Bank Fees Survey, the number of checking accounts with no monthly maintenance fee declined by 5% over the past year, to just 30.3% of all accounts. Meanwhile, the average monthly maintenance fee and overdraft fee increased.

According to another study conducted by the American Bankers Association, two out of every three consumers say they spend $3 or less in monthly fees for banking services — e.g., ATM and checking account maintenance fees.

Bad Service

A broad study of the US banking landscape found that a mere 2% of consumers felt the best thing about their current checking provider is the “good/great customer service” they receive. And Only 6% of consumers say their bank (or credit union) does a good job making banking simpler, easy and more user-friendly.

In MoneyRates survey, one in five consumers said they’d switch over a bad service experience, but only half actually do so.

Interest Bearing Accounts

In 2012, the average interest-bearing checking account offered a pathetic 0.05% in interest. With an account at the $250,000 maximum insured by the FDIC, that would amount to a measly $125 in interest per year. In MoneyRates.com latest survey on interest rates, the average interest on savings accounts was just 0.185%.

Branches

Consumers still prioritize traditional brick-and-mortar over the mobile channel, with 40% saying convenient branch locations were one of their top two priorities, and 38% citing convenient ATMs as one of their critical issues. However, branches today process roughly half the number of transactions they did just 20 years ago. According to an industry study on branch transactions, volumes have declined 45.3% since 1992. Why do consumers threaten to close their accounts if branches they don’t use are closed?

And branches are closing. Banks have been steadily shuttering branches over the past few years. Earlier this year, the FDIC reported that the total number of bank branches has declined for four consecutive years, with a total loss of more than 3,000 branches over that time.

Online Banking

When asked to rate their checking provider, 83% said online banking was either “excellent” or “very good.” 46% of consumers feel that the #1 or #2 most important thing they are looking for in a checking provider is easy online banking. And yet in the MoneyRates.com survey about switching triggers, consumers ranked this issue dead last.

What’s Really Going On Here

A very good study fielded in the fall of 2013 revealed that only 12% of consumers have switched banking providers in the last two years. One in ten had to do so because they moved to another area, and only 39% cited fees as the main reason.

Why aren’t more people switching? Why aren’t their words reflected in their actions? Why aren’t they following through with their threats to switch? What’s really go on here?

For starters, there is a big difference between asking folks if they might switch and whether they will actually switch. According to research from Deloitte, three out of four consumers (74%) say they are either “satisfied” or “very satisfied” with their primary bank. And 58% say their checking account offers them exactly what they need. In other words, consumers are generally happy with their checking provider, but they’ll take a survey and tell you what might make them unhappy.

Then there is consumer indifference about banking. Consumers don’t have a clue what fees they pay, nor which ones might have increased (or decreased) in recent years. They often can’t articulate why they chose their current institution, nor do they really know what might cause them to switch.

Surveys gauging intent and self-reported behaviors are notoriously unreliable. Consumers like to think they are in touch with their feelings, and that they know precisely why they do everything they do. They don’t. Consumers generally lack the level of self-awareness needed to accurately answer hypothetical questions.

Consumers participating in surveys about banking providers and products look at a list of options on a questionnaire and react emotionally. Ask them “Why would you switch banks?” and here’s how they process the choices.

Fees? “Well those will cost me money. That impacts my wallet directly, so I’ll say fees is at the top of my list.”

Bad service? “Banks should treat me like royalty. After all, I am giving them my money. If they spit in my face, I’ll dump them.”

Branches closing? “I don’t really go into my bank’s branch that much anymore, but I did originally choose them specifically because of that location, so yeah, if they closed it, I’d probably think about switching.”

Interest rates? “I don’t have any money saved, but if I did, I’d be looking to get the most for it.”

Lack of up-to-date online features? “If my bank became a technological dinosaur, I suppose I’d consider switching. But they already have online banking, online bill pay, mobile banking and mobile check deposit. I can’t imagine what they are lacking.”

Bottom Line:

Surveys gauge emotions, not actions or reality. And consumers are full of blustery talk, even though most won’t walk. Why? Because switching banks is a major pain in the ass, and consumers think most financial institutions are exactly alike. Why should they endure all the headache and hassle to switch when they have little reason to believe the experience will be incrementally better?