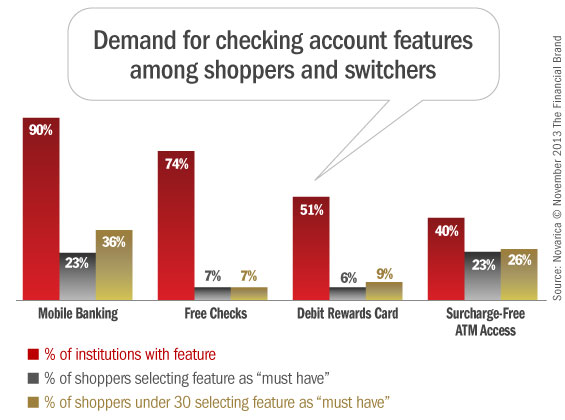

Debit reward cards were the least popular feature of shoppers on FindABetterBank in Q3 2013. Only 6% of shoppers indicated that debit reward cards were a “must have” feature.

Who does this feature appeal to? It turns out that young consumers are the most interested segment for these programs. In fact, among shoppers indicating debit reward cards are a “must have,” 42% are under 30 years old. However, 36% of shoppers under 30 demand mobile banking, and 26% say surcharge-free ATM access is critical.

Despite being so unpopular with today’s checking account shoppers, more than half of the institutions listed on FindABetterBank offer debit reward cards.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Free checks is another unpopular feature offered by 74% of institutions listed on FindABetterBank. In an environment where margins are compressed, unpopular programs persist — like debit reward cards and free printed checks — when evidence suggests demand is waning. Yet, surcharge-free ATM access — consistently one of the most popular features among checking account shoppers – is only offered by 40% of institutions on the site.

Banks and credit unions continue to add features (and costs!) to their offerings, but they rarely retire features that have become less popular. This is because most “product development” is a reaction to what competitors do, as opposed to listening to what prospects want. A few widely distributed articles about successes of a new program have more influence on product development than market research to understand customer needs. Competitive- and industry research is important, but an emphasis on listening to prospects/customers will help to identify new opportunities and flag programs that aren’t carrying their weight anymore.