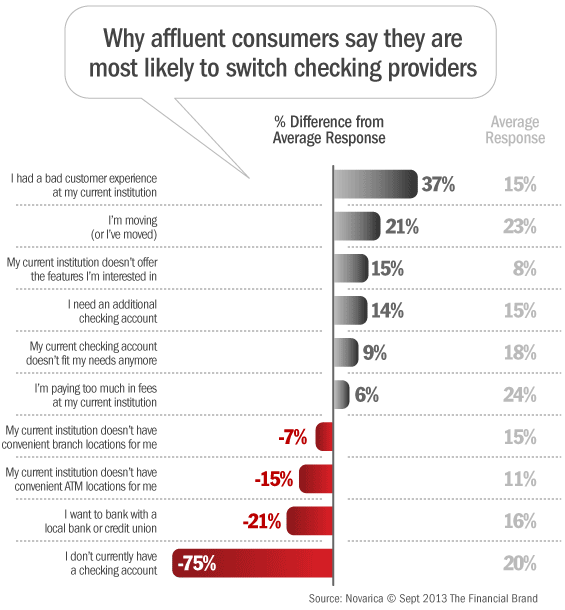

A survey of over 17,000 consumers shopping for new banks on FindABetterBank between August and September 2013 asked people why they want new checking accounts. Among the respondents, 3.7% of these respondents indicated their household income was $175,000 or more.

These gilded shoppers were much more likely to say a bad customer service experience motivated them to shop around than their less flush counterparts. Consumers who are well off were also more likely to shop around because they’re moving, want features their current institution doesn’t offer or because one checking account just isn’t enough to handle their highfalutin financial needs.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Fractional Marketing for Financial Brands

Services that scale with you.

Keeping these fortunate customers from switching is important. But shouldn’t branch staff and service reps treat all customers affably? Should there be a different set of rules for affluent customers that affords them special favors or more latitude? Many institutions provide fat-cats with personal banking services that regular Joes don’t receive.

However, what banks and credit unions really need are systems to detect when customers are planning to switch. For example, someone should ring a customer when their average number of transactions declines, or when their direct deposit isn’t being deposited. Studies suggest it costs over $200 of marketing dollars to acquire a new customer. It’s cheaper to keep customers from defecting.

Moreover, the same “smart data” systems that identify switching behaviors can also be used to determine how much effort should go into saving the relationship — like passing the fancy people on to branch managers for personal outreach… and using less expensive channels for everyone else.