Here’s a sneak peek at one chapter from a free, 100-page book on branch networks and the forces shaping branch design in the 21st century.

When The Financial Brand first saw the e-book about branch planning and design trends that EHS Design put together, we couldn’t believe our eyes. The book is a compilation of more than 40 essays written by Paul Seibert, Principal at EHS Design. He’s one of the world’s foremost authorities on bank and credit union branches, having spent the last 30+ years working with hundreds of different financial institutions on countless projects. His insights and experience have helped shape the experience in countless branch environments — perhaps as many as 1,000 (maybe more) across North America.

And he’s giving away 100 pages of branch design knowledge… for free.

(Disclosure: Yes, EHS Design is a regular advertiser on The Financial Brand, but that has no impact on the significance or value of this e-book, nor our decision to publish an article about it. EHS Design isn’t paying for this story. In fact, they were a little surprised when we asked if we could publish an excerpt from the e-book.)

The Financial Brand guarantees you won’t be disappointed if you download this book. If you don’t find at least one of the 42 chapters interesting and relevant, you will certainly know someone who will (e.g., your VP of Ops). Take a look and see if you don’t agree that this is one of the best free resources you’ve come across on the subject of branching.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Here’s a Sneak Peak: Branch Network Optimization

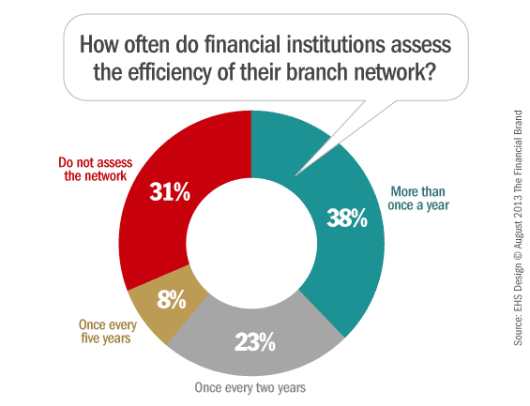

In the last few years, only a small percentage of credit unions and banks have given much consideration to optimizing the performance and efficiency of their branches and networks. In all fairness, they’ve had a lot of other issues to wrestle with: a brutal economy, new restrictions on fee income and changes in market dynamics. Yet when institutions do fix their gaze on their brick-and-mortar channel, they are often more focused on the next new market and branch rather than their existing network. This blind spot is costing some banks and credit unions millions in operating losses, and even greater lost growth opportunities every year.

In the past, many banks and credit unions tried to pursue one, single perfect branch model to fit all location requirements. This standardization yielded consistency, simplified decisions, and made the cost and logistics of branch design much easier. The problem with standardization was that, in some markets, branches were built far beyond their maximum potential; the investment did not produce a realistic, defensible return.

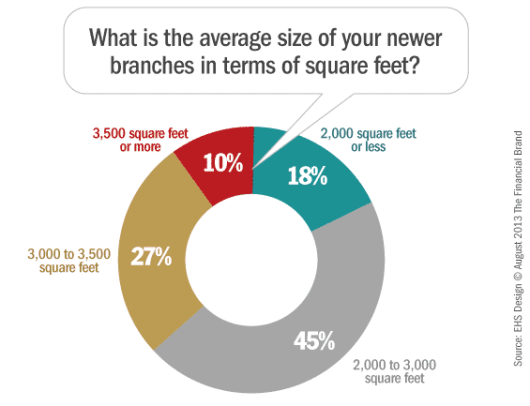

Back then, the average size of branches floated in the range of 3,000 to 5,000 square feet. But the average size of branches has been steadily declining over the past 10 years down to 2,000-3,500 square feet today for free-standing locations. This smaller size made it possible to build more branches with a greater density in large markets, increasing convenience and market penetration in target markets. But even then, many banks and credit unions have overbuilt — and continue to overbuild — their branches.

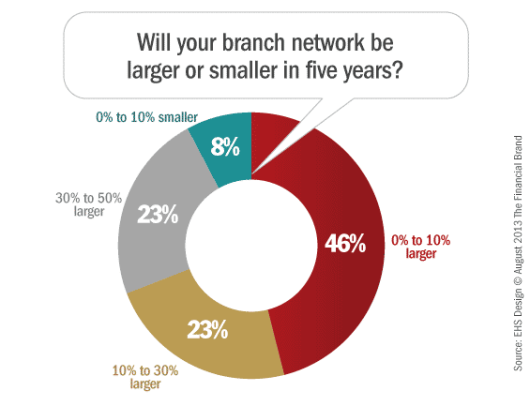

Some banks and credit unions are starting to size, staff and configure their branches based on specific target market characteristics rather than just applying a standard to every market. This means that branches can align with unique dynamics of each market and achieve break-even thresholds more efficiently. The process of detailed geodemographic analysis coupled with market financial product use analysis means that a branch can be constructed with the components that will maximize performance and evolve with market change.

Over the past 20 years, more institutions have been increasing the number of leased strip mall branches vs. owned freestanding branches because of the lower cost and the desire to be positioned adjacent to retailers with matching customer characteristics. What can be done in a 3,500-square-foot freestanding branch can often be accomplished in a 2,500-to-2,800-square-foot leased location. These smaller and lower-cost facilities mean more branches can be constructed, which can accelerate market penetration while providing a level of flexibility.

Detailed market analysis should be used to place and plan branches. Some markets may require full-service, free-standing branches to maximize target market share, while others would be most profitable with a leased strip- mall community financial center of 2,500 square feet or an express branch of 1,200 square feet. For some opportunities, a lending office with automated cash delivery may be the best option, as it has low capital and operating costs, as well as flexibility to facilitate expanding or following a market.

Branch networks are not stagnant. They are made alive by changes in demographics, products and services, regulations, mergers, competition, retail and transportation evolution and new opportunities. Understanding and responding to these changes regularly is key to driving growth in the right markets at the right time, reducing operating cost per member and maximizing member service and ROI.

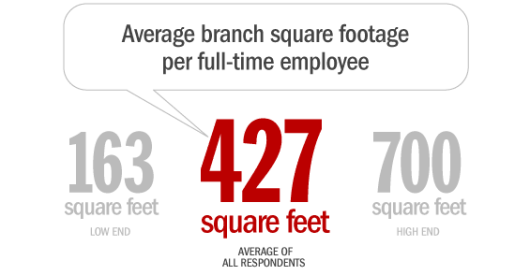

It takes less staff today to operate a branch. Years ago the average number of staff in a branch was between nine and 11. Plus staff handling special offerings such as small business and commercial banking, mortgages, and insurance. Today the average is five to seven plus the staff handling the special services. This staffing efficiency can come from cross-training tellers, simplifying the branch structure and transforming staff from process workers to knowledge workers and centralizing support.

One of the most impactful and productive ways to rebrand branches is by applying a strong merchandising program. Yet when asked, financial institutions are split on whether their branches project the desired branch image — half say yes, half say no.

The addition of new graphic messaging, video merchandising and kiosks can do a great deal to change the appearance of a branch and increase awareness of your products and services at a reasonable rollout cost. The proof is in the numbers. When surveys are conducted before and after the application of a brand-wrap, we find that product and service awareness increases 30 percent to 60 percent, which translates into increased use.