Your website is the epicenter of your marketing and communications efforts. You’ve carefully chosen the products and services you want to showcase in the high-traffic areas of your site, and you’ve crafted your message to appeal to your audience while connecting to online banking and other third-party sites. Then it’s gone in an instant, and all you can think about are the opportunities you’re losing every minute your site is disabled.

When a bank or credit union site goes down without a DNS failover page, website visitors only know that they can’t get to their institution’s website anymore. They don’t know why, and they don’t know the timetable for recovery. They’re lost, probably growing frustrated and most likely going to flood your call center with complaints.

But you can salvage at least some portion of the online user experience — at the most basic level while your IT department scrambles to wrangle your site — by creating a customized DNS failover page. You won’t be able to present all of the features of your full website, but you will still be able to send your customers to your most popular pages with minimal disruption.

Read More: 50 Of The Most Spectacular Website Designs In Banking

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Creating an Effective DNS Failover Page or Microsite

With a DNS failover page or microsite, visitors land on a customized page with their financial institution’s branding and an easy-to-find link to online banking, for instance, plus a message about the corporate site’s current problems. Consumers can go about their business knowing what’s going on and feeling confident their institution is working to resolve the problem. In this instance, the financial institution is offering a superior level of customer service and showing more respect to their website visitors.

The first step is implementing a DNS failover service, such as DNSMadeEasy or UltraDNS, that pings your IP address approximately every 2-4 minutes to ensure its accessibility. If the service detects an outage, anyone trying to access your website is re-routed to a failover page or microsite hosted in a separate environment that can be customized to suit your financial institution’s needs.

Here you can minimize the inconvenience created by the disabled main site. You’ll need to determine the most vital information to provide customers because you have limited space. Typically for financial institutions, this includes online banking and bill pay access, loan application forms, contact information, and explanations about the nature of the main website’s problem with timeframes for recovery, if possible.

These pages should incorporate all of the branding and style guidelines of your main site, and the domain should be a fully qualified URL (https://www.[yoursite].com) that assures visitors they haven’t landed on a phishing site. Your financial institution’s secure socket layer (SSL) certificate also can be applied to this failover page or microsite, and your IT department can continue managing the DNS. The DNS failover service continues to monitor your disabled website and automatically repoints back to it when the malfunction is corrected.

Pretty slick, yeah?

Read More: Scavenger Hunt Entices Customers To Explore Bank’s Remodeled Website

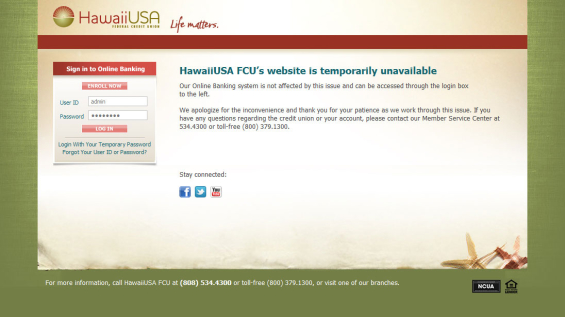

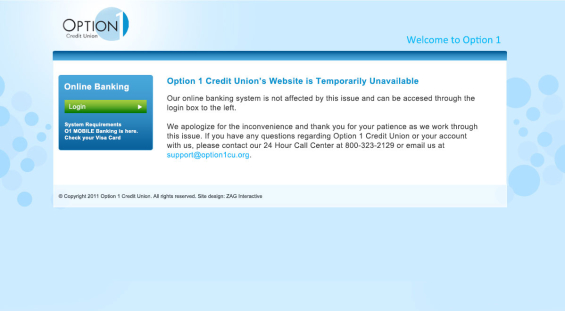

Two examples of DNS failover pages from credit unions.

Vendor Selection and Costs to Consider

A DNS failover page or microsite is as vital to your institution as your main website because it serves as your sole online presence when your site goes down. You don’t want to throw together an unprofessional alternative to your main site.

When you seek a vendor to create a failover page for your financial institution, vet them as carefully as you would if they were redesigning your corporate website.

- Experience is vital. Digital agencies should have experience setting up failover pages that reflect the essence of your main site’s look and feel while guiding customers to their online destinations as seamlessly as possible during an outage. This transition is a significant opportunity for your institution. If you fumble the exchange, you’re dealing with a wave of disgruntled customers.

- Good relationships with hosting companies. Your vendor should have a thorough understanding of what the hosting company offers, how it responds in emergencies and be able to explain why this hosting company is the best option for your financial institution. Anything less than a complete explanation indicates inexperience and inattention to detail on the part of the agency.

- Regularly scheduled page testing. Your vendor should spell out their protocol for testing failover pages on a regular basis to ensure they are working as intended. No one wants to experience the irony of a failover page that fails itself.

- Analyze the cost. Failover pages should not require a huge investment despite the important role they play in helping define your financial institution’s brand image. Typical fees include the setup charges and then ongoing site maintenance fees, which should be minimal.

When your website goes down, your financial institutions’s brand is in a vulnerable position. Take control of the user experience with a DNS failover page that keeps your customers happy and mitigates your losses.

Paul Andrews is the Director of Web and Application Development at ZAG Interactive, a full-service digital agency in Glastonbury, CT that has built hundreds of bank and credit union websites. To discuss your DNS failover page development questions or needs with ZAG, call 860.633.4818.