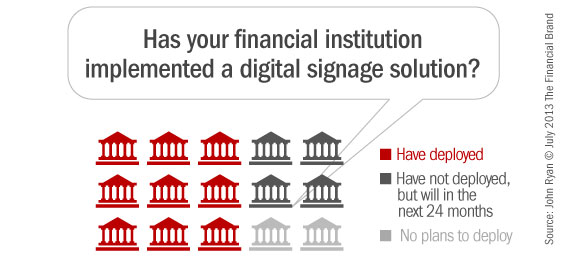

Three out of every five banks have deployed digital signage solutions, and nearly everyone will do so soon. But how’s it working out?

In a survey of 204 retail and marketing executives from large- and medium-sized banks around the world, nine out of ten say digital signage is an “important” part of in-branch marketing. Two thirds of those say it is “very important.”

The “2013 Digital Signage in Retail Financial Services” study is based on annual research conducted by John Ryan, widely respected as a leading provider of retail marketing solutions and messaging systems to financial institutions in both U.S. and European markets.

The 38-page report examines financial marketers’ attitudes toward branches, in-branch marketing, and a host of issues surrounding digital signage. Collectively, banks participating in the study operate 153,272 branches in 32 countries, spanning North American, Europe, and Australia.

About half of respondents said they developed a programming strategy prior to implementing digital signage. In the majority of cases, this involved a mix of bank and non-bank messaging. Approximately 1 in 5 financial institutions have chosen to exclusively run bank-centric messaging, while the majority (about 50%) balance bank to non-bank content at a ratio of about 3:1. A few financial institutions don’t run any content on their digital signage systems about the bank or its products.

Roughly 50% of all financial institutions said they felt “moderately satisfied” with their deployment of digital signage. Two in five were “highly satisfied, while only 5% expressed dissatisfaction.

Those who do not plan to implement digital signage say strategic fit, as well as up- front and ongoing cost, account for their decision.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Targeting, Segmentation and Localization

While financial marketers cite message localization as one of the top 3 reasons for adopting digital signage, most have yet to do so. Indeed, the number of banks that are localizing messages has actually decreased since the last survey John Ryan fielded.

Approximately two-thirds of financial institutions target their digital signage messages at the branch level. Half will use region-wide targeting. Roughly 15% have content in another language in their message rotation.

Among banks that engage in message localization, half say they have faced challenges in doing so.

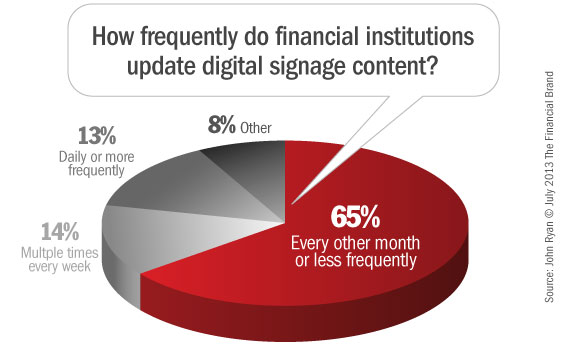

Only a third of banks update their messaging weekly or more frequently — down from about 50% from last year’s survey.

Read More: In-Branch Tablet Banking Kiosks: Ideas, Opportunities and Costs

Creating and Localizing Content Tops List of Challenges

Message localization topped the list of frustrations, with nearly half of banks naming it as a key day-to-day challenge.

Content management was also a notable challenge with cost of content creation and ease of use of the content management system remaining widely faced problems.

Daily management of a digital signage system requires anywhere from one to four full-time employees. In many cases, that is more than financial institutions had forecasted when embarking on their programs.

Read More: Q&A: Digital Signage Is About “Local Relevance,” Not CNN

Social Media Has Zero Impact

Social media has yet to influence digital signage content. No respondents reported using digital screens to convey social media feeds and less than 5% had explored integration of mobile devices.

To some extent, these findings parallel trends in retail. According to a recent study by ExactTarget, less than 10% of 100 Hot Retailers in the U.S. have begun promoting social media through in-store signage.