Step into a conference room at a bank or credit union and ask the management team who they think their competitors are, are more often than not you’ll hear answers like BofA, Chase, Citi and Wells Fargo…

Reality Check: Unless you’re a big bank, you probably aren’t competing against the big banks.

Listing off the biggest players in the banking industry (or just in your market) is not an adequate system for defining your competition. Yes, simply based on their heft and brand awareness, you will lose some business to banking’s behemoths, but that doesn’t mean they are true “competitors.” There is more to a competitive analysis than simply scale.

Reality Check: Not everyone who provides banking services is a competitor.

You’ll often hear banks and credit unions say they compete with Ally Bank or USAA. But when management teams at financial institutions talk about “the competition” in such vague terms, they are actually muddling the subject, not bringing clarity to it. Do you compete with Ally Bank for checking accounts or home loans? Do you compete with USAA for banking services or insurance?

Four Flavors of Competition

It seems most often, financial marketers are prone to view their competition through one lens only: threats. In other words, financial marketers fret over “Who can steal business from me?” Or, “With whom do I compete for new business?” But there is a more refined, robust way to break down your competition. Instead of the prevailing myopic model that only defines one flavor of competitor — the threat — there are actually four distinct types of competition.

1. Whom do we beat when we compete for new relationships? These are financial institutions you can attack. You want to frame all your offers through in context and comparison to competitors you can win against.

2. Who beats us when we compete for new relationships? These are the competitors you need to worry about. Stay away from dogfights with these competitors. There’s no reason to wage war with someone you know can crush you. You either need to change your products at a fundamental level to make them competitive, or pursue a different segment in the market where you’ll find greater success.

3. Whom can steal existing relationships from me? In the battle of attrition and inertia in the banking space, this is where loyalty programs come into play. How do you retain the relationships you fought so hard to win? To achieve net growth, you have to replace every relationship you lose. You need to identify your vulnerable relationships, where you are weak, where the other guy(s) are strong, and make the necessary adjustments.

4. From whom can I steal their existing relationships? When you can smell blood, you need to go for the other guy’s jugular. Your primary concern here is identifying as many existing customers as possible, then hammering them with targeted, direct marketing messages (e.g., ads that say “If you’re with XYZ Bank today…”).

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Read More: Differentiate Or Die: Boring Banks Need Brand Personalities

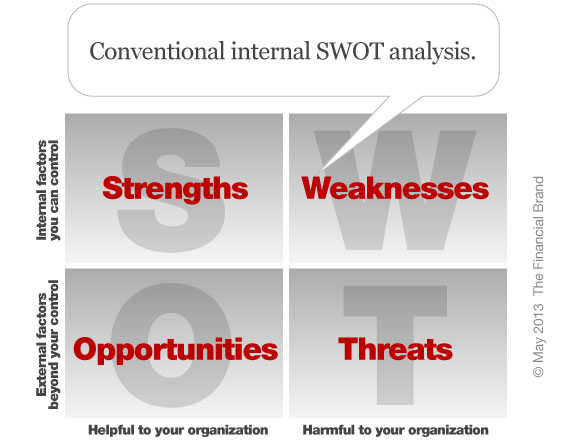

In essence, what we are talking about is applying a common SWOT analysis to everyone who competes for banking services in your geographic market(s), then prioritizing results based on the degree of opportunity or threat each competitor represents. For each competitor, you have to ask:

- What are their Strengths? What do they do better than you?

- What are their Weaknesses and shortcomings? What do you do better than them?

- What Opportunities are there to win/steal business from them?

- What Threats do they represent? How can they win/steal business from you?

With a conventional internal SWOT analysis, you are looking at the world exclusively through the eyes of your organization — What are our strengths? What are our weaknesses? When applying the SWOT analysis to your competition, you turn the tables around — What are their strengths? What are their weaknesses?

Read More: Antes vs. Drivers: 3 Steps to Find Relevant Differentiation

Be Realistic and Be Honest

Reality Check: Simply because you juxtapose your brand against the Big Banks (e.g., “We’re small, local, nice and not greedy”), doesn’t mean the Big Banks are your competition. You may use Big Banks as a foil to position yourself as an alternative or antidote, but your competition is the next “small, local, nice and not greedy” bank down the street.

This is concept is particularly difficult for some credit unions to accept. Back in the day when every credit union was tied to a single sponsor or industry-specific field of membership, credit unions didn’t have to worry about competing with one another. But these days it seems nearly every credit union has a community-wide charter, so — like it or not — they now are all now competing for the same new members.

Credit unions are comfortable competing with banks, but they aren’t used to the idea of competing with other credit unions. The reality is that once a credit union has a community charter, they are trying to steal members from other credit unions.

Read More: Is It Time For You To Rebrand?

Boiling It Down, Bringing It All Togeteher

Once you’ve done all the hard legwork, it’s time to digest the results into something tangible that staff can relate to. Use a template similar to the outline provided below, and you can build a sales playbook for front line employees. When the subject of another competitor comes up with a customer, the service rep will have a good idea where they stand and what to say.

| Product/Service | Who can we steal business from? And why? |

Who do we need to defend ourselves against? And why? |

|---|---|---|

| Checking accounts | ||

| Auto loans | ||

| Home loans | ||

| Home equity loans/lines | ||

| Credit cards | ||

| Business checking | ||

| Business loans | ||

| Mobile banking | ||

| Product 1 | ||

| Product 2 | ||

| Product 3 |