Recently, Intuit announced they will be piloting a version of Mint as a white-labeled application for financial institutions. So we fielded a survey to consumers who said they were planning to open a new checking account in the next 90 days about their use of- and interest in personal finance management (PFM) tools.

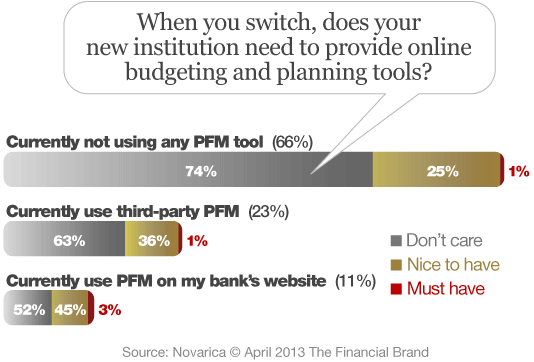

Overall, 34% of current bank shoppers use PFM tools. 11% take advantage of PFM tools provided on their primary institution’s online banking website and 23% use websites like Mint.com. Interestingly, 35% of respondents that use PFM on third party sites indicate it would be “nice to have” PFM tools on their new institution’s website.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

But… The business model of third party PFM sites is to make money by helping users find products that have benefits they’re not receiving with their current relationships. Does Intuit’s move mean that Mint is not meeting their business objectives?

Financial institutions have two main rationales to offer PFM tools to customers: cross-sell opportunities, and to provide another “sticky” feature to encourage customers to remain with the institution. Yet we haven’t seen great examples of institutions successfully cross-selling products through PFM, and very few current PFM users identify PFM as a “must have” feature when shopping for a new bank.

Bottom Line:

PFM doesn’t appear to be very sticky.

PFM needs to be more push than pull. It needs to be a seamless part of the product by intelligently using customer data to advise customers and to serve-up relevant offers. PNC’s Virtual Wallet, Simple.com and Moven.com provide three examples of PFM that are integrated with the product, not a bolted-on afterthought feature to existing products. This integration is the direction PFM must take to truly succeed and become sticky with consumers.