Nearly 20 million Americans attend college each year. Of those, close to 12 million (60%) borrow to help cover costs. There are approximately 37 million borrowers with outstanding student loans today.

As of October 2012, the average student loan debt outstanding was $26,600, which is 1.7 times higher than it was in 2005.

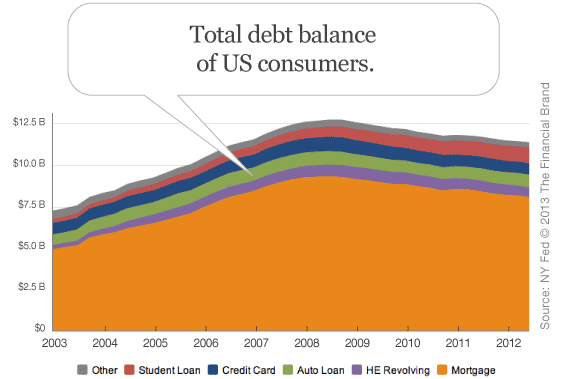

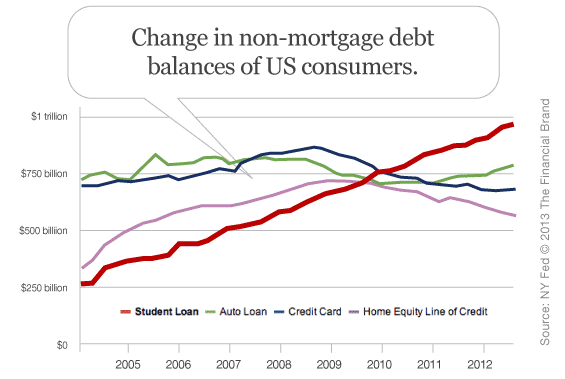

Over the course of the past four years, the student debt total has risen by $327 billion — an increase of 51.2% — while the other forms of debt have fallen by a combined $1.7 trillion.

The Federal Reserve Bank of New York says there is somewhere between $902 billion and $1.1 trillion in total outstanding student loan debt in the U.S. today. Roughly $864 billion is outstanding federal student loan debt while the remaining $150 billion is in private student loans. Around 85% of Student loans are backed directly by the US Government.

1. There is a Crisis

Many financial marketers don’t know there is a crisis in student loans. Many banks and credit unions don’t pay much attention to this segment of the lending universe because they don’t offer student loans themselves. But by the time you’re finished with this article, you’ll see there are big problems (and perhaps big opportunities) in the student lending space.

Pat Bator, senior market and product development analyst with Raddon Financial Group, says the student loan market eerily parallels what happened in the mortgage markets five to six years ago.

“There is far too much debt relative to income levels, and it could be argued that the ROI on a college degree is not what it once was,” Bator writes in RFG’s blog. “There is a good possibility that we could experience the same type of collapse in student lending as was seen in mortgage debt, although in this case the debt holder is primarily the federal government, so the impact would not be felt as directly by financial institutions.”

“Think hard before you decide to enter the arena of student lending,” he cautions.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

2. Student Lending is Bigger Than Credit Cards, Auto Loans and Home Equity Lines

As you read this, U.S. student loan debt has passed the $1 trillion mark. It is the largest source of unsecured consumer debt in the country, surpassing credit cards and also outpacing auto lending. Student debt is the only kind of household debt that continued to rise through the Great Recession and now has the second largest balance after mortgage debt.

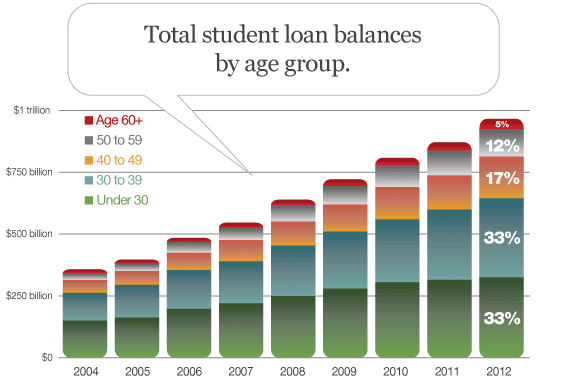

3. Borrowers of All Ages Owe More on Their Student Loans and for Longer

Between 2004 and 2012, the total student debt in the US almost tripled, an increase of 14% per year. About two-thirds of the total student debt is held by borrowers under age 40: one-third by borrowers in their 20s, and one-third by borrowers in their 30s. Older people also have student debt, but their share is smaller.

Two million seniors in the U.S. who are age 60 and over have student loan debt. These seniors owe 4.2% of all student loan debt, or $36.5 billion in student loans. 11.2% of all student loan debt held by seniors is in default, according to the New York Fed.

Borrowers age 30-39 carry $307 billion in student loans, followed by those under 30 at $292 billion, $154 billion in the 40-49 age group, 50-59 at $106 billion and the over 60 category carrying $43 billion, for a total outstanding debt of $902 billion.

The under 30 age group has the most borrowers at 14 million, followed by 10.6 million for the 30-39 group, 5.7 million in the 40-49 category, 4.6 million in the 50-59 age group and the over 60 category with the least number of borrowers at 2.2 million for an overall total of 37.1 million

A steadily increasing share of younger people are taking out student loans. In 2004, only about 27% of 25 year olds had student debt; in comparison, eight years later in 2012, the proportion of 25 year-olds with student debt increased to about 43%.

Read More: Wells Fargo Soft Sells Student Loans Through Social Media Forum

“You can’t get out of your student loans by declaring bankruptcy,” writes Forbes Contributor Marc Prosser. “It is next to impossible to get out of paying your student loans.”

“Thanks to a law passed in 1998 by the same government that is giving out all the student loans,” he continues, “borrowers can’t discharge federal student loans in bankruptcy.”

Because student loans take many borrowers a lifetime to repay, some people think they should be rebranded as an “educational mortgage,” because it more accurately describes the nature of the debt.

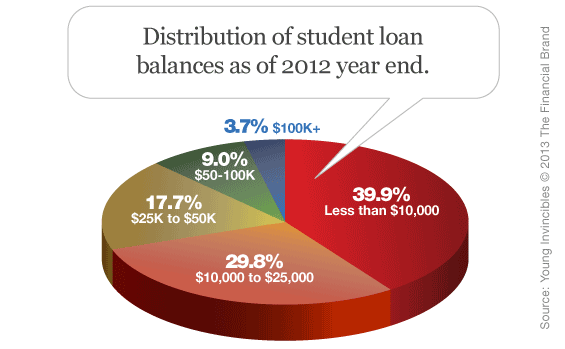

4. One in Three Borrowers Owe Over $25,000

About 40% of all student loan borrowers have less than $10,000 of debt, and about 30% of borrowers have between $10,000 and $25,000, and a small fraction of borrowers (3.7%) have over $100,000.

As of Quarter 1 in 2012, the average student loan balance for all age groups was $24,301. As of October 2012, the average amount of student loan debt for the Class of 2011 was $26,600. This represents a 5% increase since 2010, up from approximately $25,350.

Among all bachelor’s degree recipients, median debt was about $7,960 at public four-year institutions, $17,040 at private not-for-profit four-year institutions, and $31,190 at for-profit institutions.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

5. Student Loan Debt is Hampering the Housing Market

By late last year, slightly above 4% of 25- to 30-year olds with student debt were granted a mortgage. In 2005, that percentage stood at nearly 9%, according to the NY Fed. The most precipitous drop was among those who owe $100,000 or more. New mortgages among these more deeply indebted borrowers have declined 10 percentage points, from above 16% in 2005 to a little more than 6% today.

A recent Pew Research survey found that the share of millennials who own their homes had fallen from 40 percent to 34 percent during the recession, with a similar decline in residential debt. Young home buyers now make up their smallest share in the housing market in more than a decade.

“Delinquent student loan borrowers have a very difficult time accessing credit and the share of those borrowers is greater today than in the past,” says Donghoon Lee, a senior economist for the NY Fed.

Read More: Gen-Y After The Recession: Fewer Homes, Fewer Cars, Less Debt

Credit score behemoth FICO says student loans receive no special treatment in its scores, and are treated like any other installment loan; the score doesn’t employ any variables that specifically evaluate student loan data. FICO says it makes no difference to the score if the student loan is backed by the government or a private loan from a lender.

FICO adds that while student loan debt can factor into its score, credit card debt has a larger influence. “That’s because we’ve found that credit card indebtedness has a stronger statistical correlation with future borrower performance than installment loan indebtedness.”

FICO also found that recent vintages of student loans have noticeably lower credit scores than those of earlier vintages. Since 2005, the median score has dropped 17 points from 659 to 641. FICO says these findings indicate that in recent years student loan lenders have made student loans available to more consumers with lower credit quality.

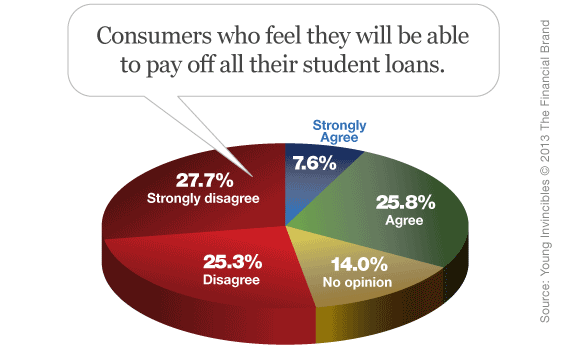

6. Student Borrowers Don’t Know What They Are Getting Into

According to a study by the Young Invincibles, more than 40% of high-debt student-loan borrowers didn’t receive in-person or online counseling for U.S. government loans, even though it’s a federally mandatory requirement.

About 65% misunderstood or were surprised by aspects of their student loans or the student loan process. Approximately two-thirds of private loan borrowers, including those who took out both private and federal loans, said that they did not understand the major differences between their private and federal options. When talking about specific aspects that they misunderstood or found surprising, about 20% of respondents mentioned their repayment terms, 20% mentioned the amount of their monthly payments, and 15% mentioned their loans’ interest rates.

56% of respondents with private loans only said that their school offered them private loans to pay for tuition or other education related expenses. However, nearly 70% of these borrowers said that they were not informed by their loan company, bank or school about their federal student loan options

7. Marketing Works… But Schools Are The Gatekeepers

Young Invincibles asked student borrowers who took out loans from private lenders, “Did marketers approach you or did you see advertisements to take out private student loans?” More than half said their school sent them materials about private student loans. Respondents also reported receiving solicitation to take out private student loans from other sources (e.g., mail, email, web or print advertisements), but their school was the most frequently mentioned source of marketing related to private loans.

| Medium for Marketing of Private Student Loan |

Dual Federal and Private Borrowers |

Private Borrowers |

|---|---|---|

| My school sent me materials | 54.5% | 35.2% |

| I received mail solicitations | 40.8% | 37.7% |

| I received emails | 30.8% | 22.8% |

| I saw an while surfing the web | 29.2% | 35.2% |

| I saw a magazine/newspaper ad | 11.0% | 12.3% |

| Marketers contacted me by phone | 9.2% | 6.2% |

| I received text messages | 1.3% | 0.6% |

| Other | 16.3% | 23.5% |

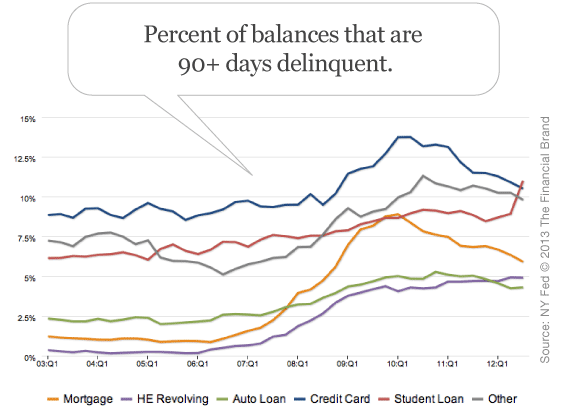

8. Delinquencies on Student Loans Are Way Up

Of the $1 trillion or so in outstanding student loan debt, approximately $85 billion is past due. Out of that, loans from private institutions represent $8 billion, or 850,000 distinct loans in default.

Of the 37 million borrowers who have outstanding student loan balances, 14%, or about 5.4 million borrowers, have at least one past due student loan account.

According to the Department of Education, more than one in 10 borrowers defaulted on their federal loans within the first three years they are required to make payments. 8.8% of federally guaranteed student loans that entered repayment in 2009 were in default by the end of 2010 (that means nine months of missed payments) — a sharp increase over the historical average of around 5%. The default rate rose to 9.1% the following year.

For every student loan borrower who defaults, at least two more borrowers become delinquent without default. Two out of five student loan borrowers (41%) are delinquent at some point in the first five years after entering the repayment phase.

9. Big Banks Are Pulling Out of the Student Lending Market

Banks and other private student lenders have already seen their role in the market diminish, after the federal government in 2010 stopped guaranteeing loans they originated.

JPMorgan Chase stopped extending student loans to non-customers back in July 2012. “The private student loan market has continued to decline and government programs have expanded to help more students and their families,” Chase spokesman Steve O’Hallaran said in an interview with The Huffington Post.

US Bank also pulled out of the student lending market last spring. In March 2012, they sent a letter to participating colleges and universities saying that it would no longer be accepting student loan applications.

“The reasoning is we’re a very small player, less than 1.5% of market share,” US Bank spokesman Thomas Joyce said. “It’s a very small business for the bank, and we’ve decided to make a strategic shift and move resources.”

There’s probably a lot more behind the story than such soundbites — carefully crafted for public consumption — suggest.

According to American Banker, some lenders including Discover Financial Services are ramping up their participation in the market. Discover has snatched up several large student loan portfolios over the past year and is growing originations.

10. The CFPB is Butting In

Just last month, the Consumer Financial Protection Bureau (CFPB) announced that it is gathering information to develop options for policymakers to make repayment of private student loans more manageable for struggling borrowers. The CFPB believes private student loan borrowers wish to pay their loans, but face high payments and lack alternative repayment and refinance options.

The Bureau is looking for ways that private student loan borrowers can have more flexible repayment options and is seeking input on a variety of issues related to repayment affordability, including:

- How student loan burdens might impact the broader economy and hinder access to mortgage credit and automobile loans

- How distressed borrowers manage their student loan obligations

- What options currently exist for borrowers to lower their monthly payments on private student loans

- Examples of successful alternate payment programs in other markets and which features could apply to this market

- The most effective mechanisms for communicating with distressed borrowers.

“What we are likely to see over the next few months is a lot of private education lenders rethinking the product, particularly if it appears that the CFPB is going to become more activist,” says Kevin Petrasic, a partner with law firm Paul Hastings.

“In the name of helping students, the Federal government is driving lenders out of the student loan business,” notes one observer of the situation. “Could this be what the future looks like for other financial products after a few years of protection by the Consumer Bureau?