One of the main online challenges for financial marketers is how to pinpoint exactly who the customers are visiting your site, and what they are really looking for.

Data from your public-facing site can shed some insight into users’ interests. But when a customer logs in to your secure internet banking platform, the opportunities multiply. You have access to all of the information in the customer’s profile, which you can exploit by extrapolating the content or promotions they are most likely to respond to.

Backbase Bank 2.0 allows financial institutions to take advantage of readily-available customer information such as age, products held, account type, account balance and other CRM data. All of this can be used help banks and credit unions figure out what each customer may be interested in.

It’s always a good idea to think of common differentiators that can ensure your message reaches only the people who are likely to find it relevant. For instance, newly-enrolled students are, regardless of age, unlikely to find mortgage offers very compelling. Suppose you have a customer who is repaying a car loan. Why not promote your new auto insurance product directly in their profile page? Similarly, you can target customers with large amounts sitting unused in their accounts with tailored promotions about high-interest savings accounts

“Contextual targeting gives banks the ability to target specific customer segments, ensuring a personal and relevant experience.”

— Jouk Pleiter, CEO Backbase

Beyond segmenting your customers along existing data, such as age or income, you can enhance your targeting capabilities by responding to their online behaviors — just like Amazon does with their digital marketing cross/up sell campaigns. Amazon combines offline CRM data with online behavioral data: user clicks, page visits, contextual information and social data. For example, if one of your customers has visited your investment pages three times this week, then she might want more information about it. This is how you make the customer’s experience even more personal and relevant.

Here are a couple simple examples of how segmented and behaviorally-targeted marketing campaigns can be implemented in a few simple steps using the Backbase Bank 2.0 Portal.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Fractional Marketing for Financial Brands

Services that scale with you.

Campaign 1: Segmented Targeting for Long-term Saving Accounts

Here we want to promote one product, a long-term savings account. We could just show everyone the same ad, but we want to promote it in a way that makes it seem uniquely relevant to as many of our customers as possible. Using the Backbase Bank 2.0 targeting tool we can appeal to different audience segments with a tailored message.

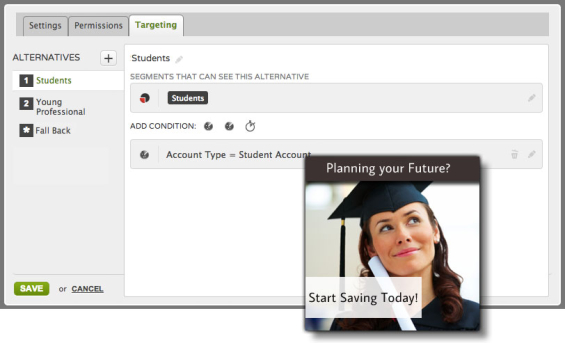

We decided to split the group using data from their accounts and the CRM, so our main target audience will be made up of students and young professionals. For the student sub-group we will only include customers who have a student account and create a visual concept we think will appeal to this younger market. This is how we do it.

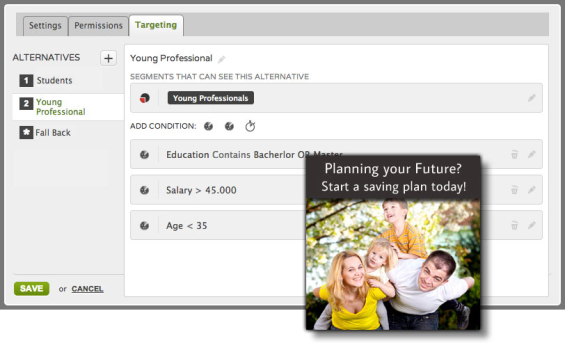

After refining our young professionals sub-group, we eventually decide the best way to target them is by age and account balance. We set the age range to be under 35 years-old, with an annual salary of $45,000, and with a bachelor’s or master’s degree. Then we come up with an ad we feel will attract the attention of these busy people.

If we want to be sure we aren’t missing out on any potential customers, we can also create a default ad to promote the product to everyone else (“fall back”).

Campaign 2: Behavioral Retargeting Auto Loans

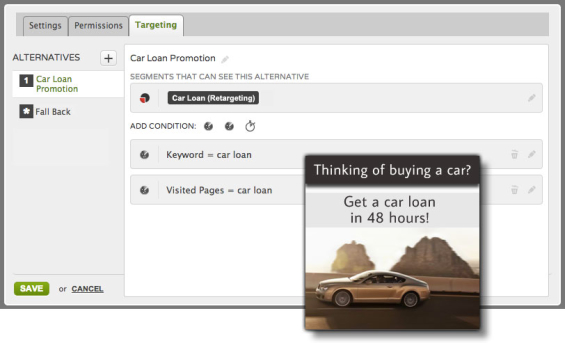

Unlike segmented targeting, which relies on the assumption that we have correctly identified our target audience, behavioral targeting allows us to zero in on our customers according to the previous actions they’ve taken on the site. In this campaign, we wait until a customer expresses interest. After they visit the car loan page on our banking website, we will then target them with an on-going auto-loan promotion.

To create this kind of campaign within Backbase Bank 2.0 Portal, we use the program’s tagging capability. To expand our target audience, we can also tag those who landed on the site by performing relevant searches (such as “car loan”).

Backbase – Online Targeted Marketing Overview

As you can see, online targeting systems like Backbase allow you to use a combination of offline CRM data and online behavior data to create Amazon-style marketing. When used effectively to deliver uniquely relevant messages to customers, it can increase conversions and acquisition rates. Most importantly, contextual delivers a more personalized experience to customers, that, in turn, builds and maintains their relationship with your financial institution.

Jouk Pleiter is CEO and co-founder of Backbase, a software company that delivers Backbase Customer Experience Portal to enterprises around the globe. Backbase has offices in New York City, Amsterdam, Moscow and Singapore. Its software is used by leading institutions such as: ABN AMRO, AIG, Barclays, Bank of America, Costco, Deutsche Bank, GE, ING and UBS. You can follow @Backbase on Twitter.