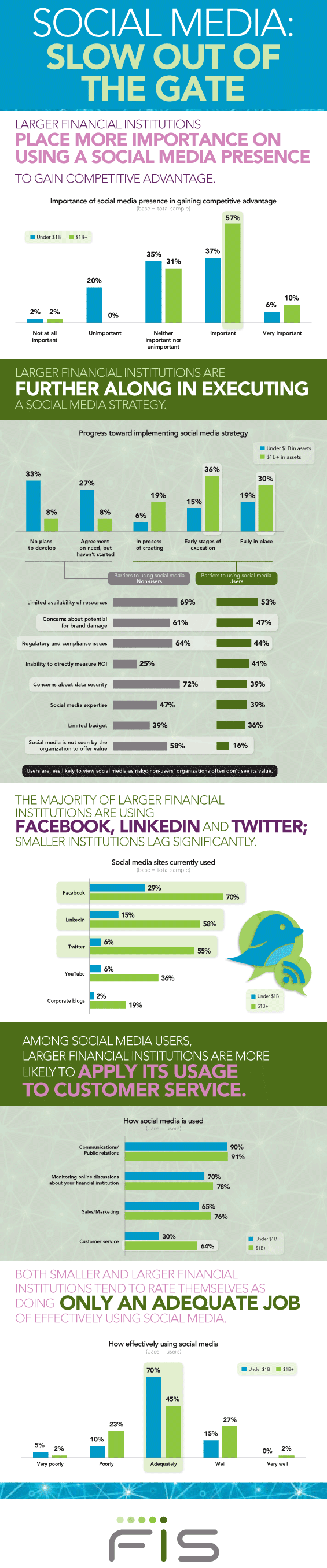

FIS conducted research in September with some of their clients, roughly half of them financial institutions with less than $1 billion in assets and half with more than $1 billion in assets. The infographic below underscores that financial institutions, especially smaller ones, are slow to embrace social media as a communication vehicle with their customers.

57% of financial institutions with $1 billion in assets or more say social media is important to gaining a competitive advantage, while only 37% of smaller institutions agree. One fifth of smaller institutions believe social media is unimportant, while none of their larger brethren feel the same way.

One in three small financial institutions say they have no plans to develop a social media strategy, even though proposed FFIEC regulations will make them mandatory for everyone.

72% of institutions not using social media today cite concerns over data security as a major barrier. 69% say limited availability of resources is what prevents them from engaging in social channels. Two thirds are concerned about all the compliance headaches that come along with a social strategy.

One quarter of financial institutions with $1 billion in assets or more say they are doing well with social media, but an equal number say they are doing a poor job. Practically no one thinks they are doing a great job.

Katie Robinson, VP of Strategic Innovation at FIS says banks and credit unions need to figure social channels out, because they are here to stay. “Despite the risks associated with social media,” she says, “financial institutions need to learn how to leverage appropriate social media platforms to listen to and converse with their customers to remain relevant – especially with today’s younger, vocal consumers.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats