Bank customers say they value their bank branches, but nearly half visit their branch fewer than five times per year. Although 58% say they would prefer their local branch close rather than pay increased fees.

A new study of over 1,400 consumers from market research firm Chadwick Martin Bailey, suggests that when forced to choose, bank customers would prefer a further drive to another branch rather than endure fee hikes or service reductions. Once viewed as essential to banking convenience, proximity to a full service bank is the first thing consumers say they are willing to give up.

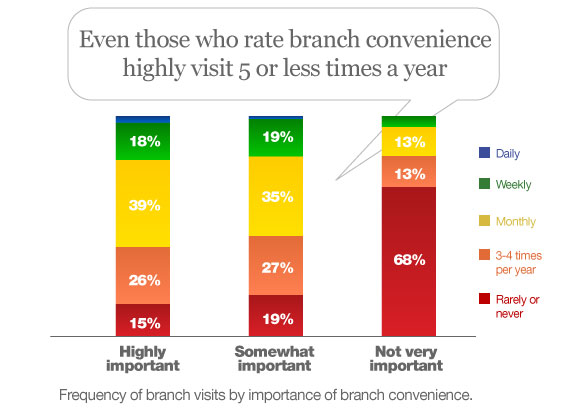

Of course, they also say having branches nearby are important to them… even if they hardly ever visit one. 45% of bank customers visit their branch fewer than five times a year. But hey, what do they know?

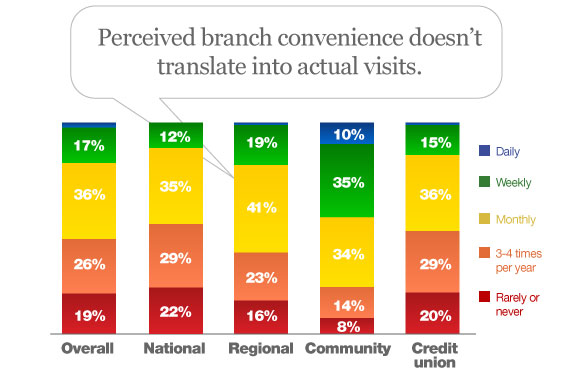

Consumer feelings about branch proximity don’t match their actual banking behavior

Customers say they value a full service branch near where they work or live but consumer banking behavior tells a different story– online and mobile banking options mean customers need to make fewer branch visits. Based on the low frequency of visits and how quickly consumers are willing to give up their branch when forced to choose, branch proximity has become less critical than in the past.

When push comes to shove, consumers say they are more willing to forgo branches

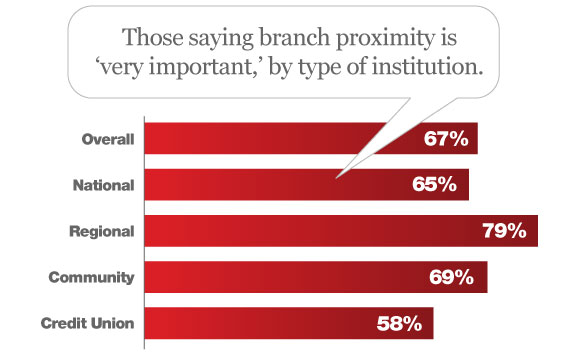

Teller-less options, particularly mobile and online banking services, have reduced the need for branch visits. Sixty-seven percent of bank customers say that having a physical branch close by is very important, but even 41% of these customers visit fewer than 5 times per year.

Branches no longer have to be mere steps away

The “sweet spot” for branch convenience is relatively wide. Bank customers within ten miles of their bank branches say they are the most satisfied with branch convenience.

Teller-less branches confuse some consumers

Teller-less branches (where sales professionals are available to answer product and service questions in addition to automated services) were seen by customers as less desirable than closing their local branch altogether, this counter-intuitive finding suggests that the concept will require banks to fully explain the benefits of the teller-less branch.

“These findings reveal that some aspects of the banking relationship, we once perceived as critical, are shifting,” says Jim Garrity, Managing Director of Chadwick Martin Bailey’s Financial Services practice. “Banks must offer alternatives to full-service branches, lower transaction costs without diminishing product sales, and at the same time educate customers by effectively messaging and communicating how these changes will affect service and behavior.”

Banks that will be successful in shifting away from the local branch model are those providing alternatives that don’t sacrifice convenience and service… and hopefully result in reduced overhead that translates to a lower cost-to-consumer.