Take a quick tour around the web and you’ll find no shortage of social media junkies and innovation addicts listing the myriad of things financial institutions could do in social channels. While they pound the drum of “potential and possibilities,” financial marketers are seldom (if ever) offered any hardcore stats on actual rates of engagement.

We are constantly reminded that there are 850 million users on Facebook, and many believe that fact alone should persuade marketing managers of social media’s power. But that number only represents 12.4% of the world’s population, and (of course) you probably aren’t targeting the entire world.

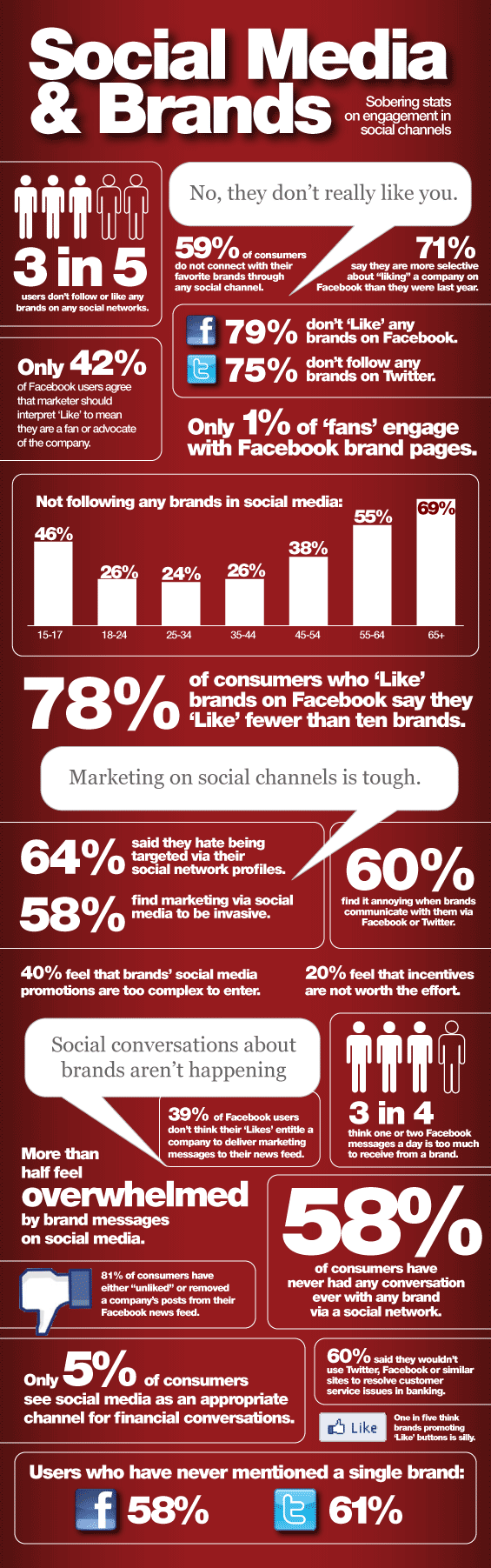

In the US, for instance, around 150 million people, or about half the total population, have a Facebook account. So if you have 100,000 customers, you could feasibly reach only 50%. But how many don’t know or don’t care that you have a Facebook page? Conservatively you could say 75%. How many don’t ‘Like’ any brands on Facebook? Somewhere between a quarter and three-quarters. So a financial institution with 100,000 customers could reasonably plan on reaching a Facebook audience numbering around 6,500.

But among those consumers who say they ‘Like’ brands on Facebook, 78% ‘Like’ fewer than ten brands. And what kinds of brands do they like? Fashion, food and entertainment brands such as Apple, Starbucks, Disney, Xbox, Red Bull, Helly Hansen. In other words, things people want, things they actually like. Banking is something people need (and they only need it to get the things they want), and it’s never been particularly well-liked.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

It’s important to remember that there are hundreds of millions of rabid Apple fans, and yet how many are connected to the company through social media (answer: a small percentage).

While hundreds of millions of loyal and devoted Starbucks customers religiously buy their lattes every day, how many are fans and followers?

Key Question: Why should you be among the ten (or fewer) brands people connect with in social channels? What do you have to offer that competes with the social media experiences offered by big brands, who themselves struggle connecting with even their most passionate supporters?

One social media expert decided to conduct a little experiment. For one week he ‘Liked’ every company that asked him to. At the end of seven days, he had ‘Liked’ 46 different brands. But only 10 had given him any reason to do so. For the first time in history, we have marketers asking consumers to do something without telling anyone what they stand to gain from it. Where’s the benefit? If brand managers are unsure, consumers are even more unsure.

Then what happens when consumers are disappointed with a brand’s social media presence? A study by Relevation Research found that a third of those who connect with a brand in social channels later turn around and dump the company. After distancing themselves from the brand on social media, many report they then view the brand more negatively, shop/visit it less often and wind up spending less.

Bottom Line: Social media isn’t all rainbows and butterflies. Contrary to what social media’s proponents would have you believe, there isn’t this vast army consumers impatiently waiting for every brand they use to hop on the Facebook and Twitter bandwagon.

You can find all the sources — a dozen in all — for the data used in the infographic shown below here on page 2.