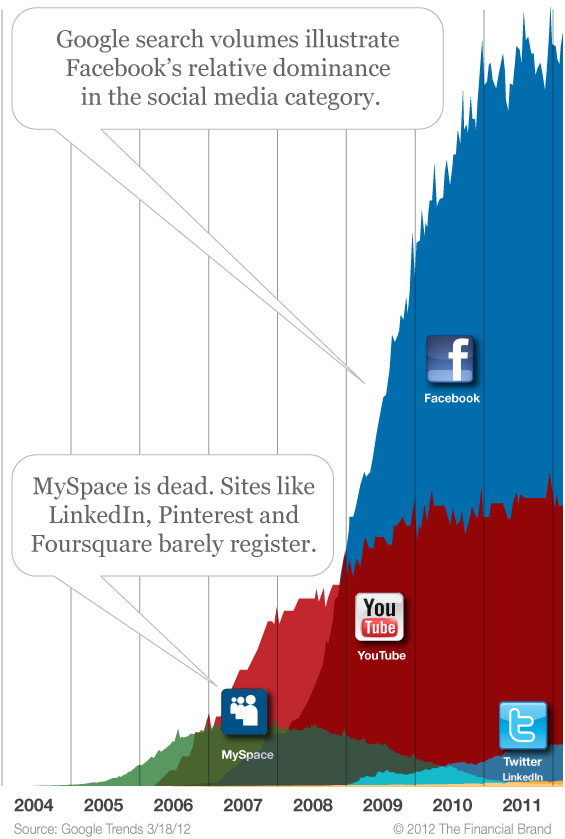

Facebook’s complete and utter dominance of the social media landscape is hard to put into words. To help quantify Facebook’s relative supremacy and put it in perspective, The Financial Brand has created the following infographics.

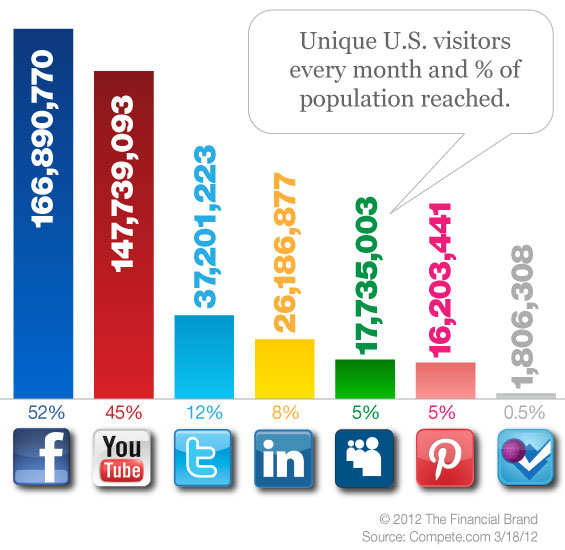

Based on number of monthly visits, Facebook is four times bigger than Twitter, five times bigger than YouTube, and 74 times bigger than LinkedIn.

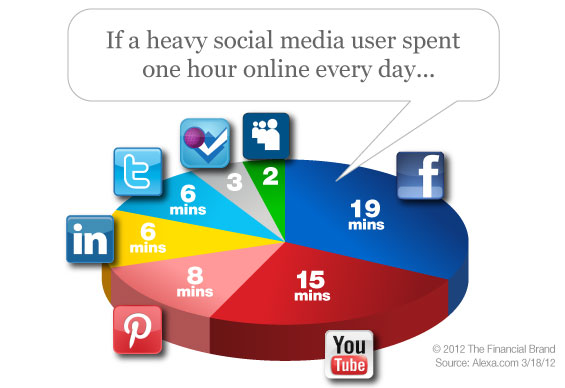

Facebook users hit the site an average of 68.7 times every month. Twitter users average 31.2 visits, while YouTube averages only 12.5. Pinterest, the latest social media sensation, gets about 9.5 visits per person per month.

Facebook and YouTube each reach about 50% of the U.S. population. About one in every eight people are on Twitter, whereas at LinkedIn it’s only around one in 11.

Considering that the vast majority of organizations allocate less than 10% of their annual budget to social media (many allocate $0), the argument could be made that all of it should go to Facebook. If your marketing budget was $1 million, your social media budget would be no more than $100,000. Simply based on each social channel’s relative site traffic, $67,000 would go to Facebook, $18,500 to Twitter, $13,000 to YouTube and only $1,000 to LinkedIn. Pinterest wouldn’t even justify a $200 annual budget.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Key Takeaways: If your organization is going to be involved in any single social media channel, it had better be Facebook.

Forget about a blog — it takes too much work. Exotic platforms like Foursquare, Pinterest and Google+ have such small user bases they are difficult to rationalize — you could skip them without anyone noticing.

YouTube is great… if you can make videos that are funny or interesting (same thing applies to photos on Pinterest). Unfortunately, financial institutions aren’t often funny and are seldom interesting. That’s why most of the banks and credit unions The Financial Brand sees on YouTube don’t average more than 250 video views. Twitter can also work, but mostly only as a customer service channel… provided your financial institution is large enough to find more than one or two relevant tweets every month.

Face It: Facebook is where it’s at.

Sources

Alexa, a traffic-ranking site, puts Facebook as the world’s #2 largest website, behind only Google. YouTube ranks #3, with Twitter trailing at #9. Compete, a similar service to Alexa, ranks Facebook 2nd, YouTube 4th, Twitter 20th and LinkedIn 36th.