Assets: $1.03 Billion

Area served: Puget Sound Area, Washington State

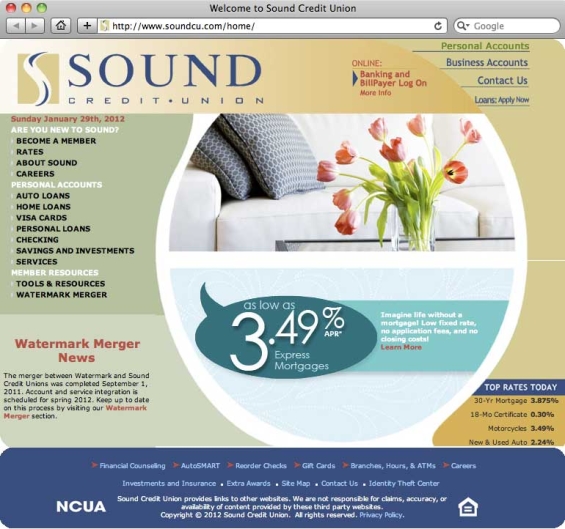

Website: www.soundcu.com

Number of members: 110,000

Number of branches: 21

Members per branch: 5,238

Number of total employees: 210

Ratio of members to employees: 524:1

Top marketing executive: Robyn LaChance, VP/CMO

Number of employees in marketing department: Seven (3.3% of total workforce)

- One VP/CMO

- One Manager

- Four Coordinators

- One Assistant

Number of campaigns run every year: 7-10 major product campaigns

URL for Facebook page: n/a

URL for Twitter account: n/a

URL for YouTube channel: n/a

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Systems & Tools

| Have Now | Don’t Have | Not Yet, But Plan To |

|

|---|---|---|---|

| Formal written marketing plan | X | ||

| Brand standards manual (for design) | X | ||

| Brand guidelines book (for staff) | X | ||

| CRM system | X | ||

| MCIF system | X | ||

| Onboarding program | X | ||

| Matrix mail program | X | ||

| Social media strategy | X | ||

| In-branch video merchandising system | X | ||

| Formal SEO strategy | X |

In-House vs. Vendor

| In-House | Vendor | Both | |

|---|---|---|---|

| Advertising | X | ||

| Design | X | ||

| Media buying | X | ||

| Direct mail | X | ||

| Email marketing | X | ||

| Web design/development | X | ||

| Online advertising/marketing | X | ||

| Social media | X | ||

| Promotional items, giveaways | X | ||

| Sales collateral, brochures | X | ||

| Public relations | X | ||

| Community relations/events | X |

Website

Marketing Channels Deployed

| Using Now | Don’t Use | Not Yet, But Plan To |

|

|---|---|---|---|

| Direct mail | X | ||

| Print ads | X | ||

| TV ads | X | ||

| Radio ads | X | ||

| Billboards/outdoor | X | ||

| Ads within online banking | X | ||

| Paid banner ad placements | X | ||

| Search engine marketing (e.g., Adwords) | X | ||

| Microsites | X | ||

| Email marketing | X | ||

| eStatement ads | X | ||

| QR codes | X | ||

| SEO strategy | X | ||

| X | |||

| X | |||

| YouTube | X | ||

| X | |||

| Foursquare | X | ||

| Blog | X | ||

| Online forum | X |

Favorite Campaign

That’s a tough one, but two campaigns come to mind. First, from a sheer results standpoint, we recently introduced a re-purposed home equity product as a no-fee, mortgage refinance option. The target audience was people who had about 15 years or less left on their mortgage, who wanted to take advantage of this current low rate environment but didn’t want to pay closing costs. We received excellent responses from members and non-members alike.

The second was a lighthearted branch relocation campaign. The new location was placed on the corner of two of the busiest streets in our capital city, Martin Way and Lily Road. To draw attention to the new address, the campaign graphically positioned “Martin + Lily” as sweethearts, depicting the names carved into a tree trunk surrounded by a heart. We had terrific feedback from the community, our own employees, and enjoyed many new members/accounts as a result.

The Biggest Challenges Over the Next 12-24 Months

We just merged a similar sized credit union into our ours. We are integrating systems in the Spring, and entering a completely new market as a result. Our challenge will be to gain market awareness and retain members from the merging credit union. A few short months before the merger integration we are converting online banking, online bill pay and mobile banking platforms for our legacy members.

Critical Products to Market This Year

Loans, loans, and more loans. And Checking.

Social Media Strategy

N/A – Currently under development.

How Do You Track ROI?

New members, new accounts, increased portfolio balances, all the usual. We generate reports from our MCIF as well as our core processing system.