Wanted: The World’s Coolest Intern

Standard Chartered Bank in Singapore is hosting a social media contest to find “The World’s Coolest Intern.” The winner will get a salary of S$30,000 (around US$23,000) in exchange for — among other things — tweeting about the bank’s new Breeze online- and iPhone banking application (more on that in a minute).

“The World’s Coolest Intern” will work with the bank’s Breeze team for six months to help run Standard Chartered’s various social media channels, including the Breeze blog and Twitter feed, as well as play a key role in the development of the overall Breeze social media strategy.

How It Works

Standard Chartered describes the ideal candidate as a Marketing/IT student or recent grad looking for practical training and experience with social media. In addition he/she should be an outgoing person who is passionate about technology and savvy with social media tools.

The winner for the “World’s Coolest Intern” will be expected to:

-

Provide creative ideas to promote Breeze using various social media channels, and to conduct brainstorming sessions to generate campaign ideas

Provide creative ideas to promote Breeze using various social media channels, and to conduct brainstorming sessions to generate campaign ideas - Support the Breeze marketing manager in managing projects and executing campaigns/initiatives

- Work with internal stakeholders and external partners to manage all social media assets and to organize outreach events, including:

- Update and maintain the dedicated Breeze blog, including posting relevant articles and responding to posts/comments

- Update and maintain the Twitter account

- Update and maintain the Youtube account

- Update and maintain the Flickr account

- Organize/launch social media marketing/outreach activities such as blogger meets, tweet-ups, etc.

RECRUITMENT VIDEO

The bank’s head of HR gives an overview of the contest in this short, very modest video.

The application process is pretty simple. All potential contestants have to do is follow @StanChartBreeze on Twitter and post something on their own blog announcing their entry.

You can find details for the entire contest including terms and conditions at the bank’s website. Submissions close on October 15, 2010.

“It’s the first time we’ve created a job like this,” Standard Chartered said.

Interestingly, Standard Chartered is not promoting “The World’s Coolest Intern” job at the corporate Careers page on its website — definitely a missed opportunity.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Another Flavor of ‘Young & Free’

The basic formula for Standard Chartered’s contest can be traced back to Young & Free, a turn-key Gen-Y social media marketing program for North American credit unions. The general outline includes a contest to recruit a blogger who wins a paid gig to blog on behalf of the financial institution for a year. Standard Chartered is pretty much sticking to the basic playbook outlined by Young & Free creators at Currency Marketing.

Currency’s Young & Free has proven itself as one of the most successful, effective, durable and portable social media programs in the financial world. A host of other banks and credit unions have mimicked the style and structure of Young & Free, including Bucks First Credit Union with Project Flipside, Connex Credit Union with their VP of Unbanking, and the Regret Nothing campaign from Compass Credit Union in Australia.

“We’ve got our little recipe here and we’re just waiting for someone to come along and make it better,” Tim McAlpine, CEO/Currency, told The Financial Brand. “We want to steal the next thing back,” he added with a chuckle.

Not everyone finds success with their Young & Free knockoffs. They struggle for one (or all) of the following reasons:

- Riddle #1: Content – They can’t figure out how to generate compelling content consistently about a subject that interests people.

- Riddle #2: Traffic – They can’t build traffic numbers that justify their massive allocation of marketing time, energy and resources.

- Riddle #3: Promotion – They don’t have a product tie-in (preferably something cool, unique, innovative and useful).

Having a Product Tie-In is Critical

Of the hundreds of financial institutions hosting various social media contests in any given year, very few integrate any kind of product or service tie-in. Not Standard Chartered; they’ve thought this through. They aren’t just jumping on the social media bandwagon simply to say they are “stimulating transparency by amplifying and maximizing organic conversations in social ecospheres” (or something to that effect).

Key Questions: If you aren’t promoting at least one of your financial institution’s products or services in your social media efforts, then you have to ask: why bother?

Standard Chartered indeed has something tweet and blog worthy, its new Breeze PFM tool. Breeze lets you see your bank accounts and transaction activities at a glance, pay your bills, transfer funds and manage your savings with just a few clicks.

“It’s banking with flexibility and simplicity,” the bank says. “Without all the jargon.”

As far as iPhone and online banking apps go, it’s pretty slick. It may not be as pretty as Mint, but it’s still a solid product.

STANDARD CHARTERED – BREEZE

A brief video illustrating how the bank’s online and iPhone banking application.

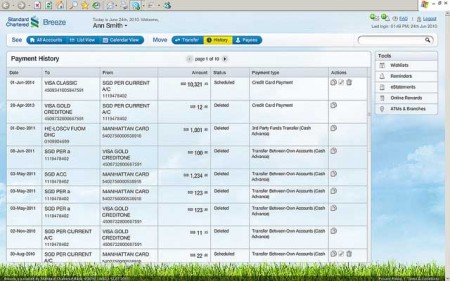

STANDARD CHARTERED – SCREEN GRABS

These screenshots of the Breeze platform come via Lester Chan, one of the world’s most well-known bloggers and author of some of the greatest plugins for WordPress.

Breeze for the iPhone has been available for a few weeks in the Apple’s App Store. Standard Chartered says an iPad version is coming soon, but that may be a bit problematic. Breeze was built using Adobe Flex, a Flash platform, and Apple has expressed extreme resistance to all things Flash on its mobile devices.

Solving the Traffic Riddle

Having a contest helps create buzz and traffic, but holding some sort of public vote is essential if you want to maximize your traffic-building opportunities.

One of the keys to Young & Free’s success is “the excitement of competing for something,” McAlpine explains. “You get people out there actively campaigning, promoting themselves and mustering votes.”

Not only do you get contestants’ campaign traffic, your social media project will transition from “search phase” to “full launch mode” with a ton of velocity — a built-in audience that’s already engaged.

Standard Chartered is fudging a bit with this step. Rather than let the public decide who is the most qualified blogger to host their social media activities, the bank is using its own hybrid selection committee including Qais Consulting on social media activation, Edelman on PR, JamiQ for social media analytics, Christophe Langlois from Visible Banking and Pat Law from Goodstuph.

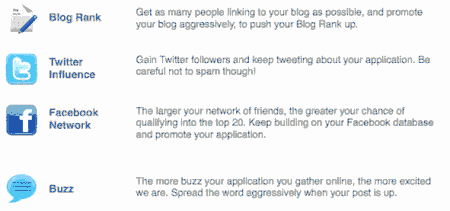

EVALUATION CRITERIA

Standard Chartered will use JamiQ, an online sentiment analysis firm, to help the bank shortlist the 20 most viable applicants. After interviewing the top 10, a selection committee will choose a winner and two runners-up.

Solving the Content Riddle

Read anything written by your typical financial institution and you’ll have to admit it isn’t very interesting — no passion, no voice, no personality. No one wants to read what banks have to say.

Reality Checks:

- This is why bank blogs suck. They are boring.

- Failing to sustain a commitment to publish consistent, compelling content is the number one cause of death for most social media initiatives.

Holding some sort of who-will-be-the-blogger contest is somewhere between the best- and only way for financial institutions to yield the content they need. After all, if you have to hire someone to write your blog for you, why not milk the hiring process for all it’s worth? Make a game out of it.

At the end of Young & Free’s recruitment process, you have a totally qualified and completely vetted candidate. This person has endured the campaigning process and proven their ability to write stuff lots of people want to read, hear or see — a highly coveted and uncommon skill these days. This person has the social media chops it takes to fuel social media success.

Social media programs take care and feeding. It’s just like adopting a puppy. If you don’t give it your time, food and love, you can’t complain when he turns into a disappointment who does nothing but misbehave.