Financial institutions have heard social media shaman banging their drums about blogging for over five years. A study by The Financial Brand revealed that 18% of banks and credit unions have succumbed to the allure and promise blogs hold, yet many of them struggle for one or more reasons.

To help define some of the most common problems and find best practices, The Financial Brand audited the blogs of 10 banks and 12 credit unions, then talked to some of the financial industry’s thought leaders about the results. Here are the findings:

Bank Blogs

| Name of Bank | Posts | Launch | Months Active |

Posts/ Month |

Total Comments |

Comments Per Post |

|---|---|---|---|---|---|---|

| ShoreBank | 140 | Sep-08 | 23.5 | 6.0 | 239 | 1.71 |

| Arvest Bank | 417 | May-08 | 27.5 | 15.2 | 538 | 1.29 |

| Standard Bank | 170 | Jul-09 | 13.5 | 12.6 | 186 | 1.09 |

| United Bank & Trust | 40 | Jun-09 | 14.5 | 2.8 | 31 | 0.78 |

| Bank Atlantic | 40 | Oct-09 | 11.0 | 3.6 | 9 | 0.23 |

| Citizens & Northern | 24 | Oct-09 | 11.0 | 2.2 | 0 | 0.00 |

| Elgin State Bank | 11 | Apr-08 | 28.5 | 0.4 | – | – |

| Brookline Bank | 14 | Nov-09 | 10.5 | 1.3 | – | – |

Credit Union Blogs

| Credit Union | Posts | Launch | Months Active |

Posts/ Month |

Total Comments |

Comments Per Post |

|---|---|---|---|---|---|---|

| South Carolina FCU | 367 | Apr-09 | 16.5 | 22.2 | 921 | 2.51 |

| Verity | 314 | Dec-04 | 56.5 | 5.6 | 569 | 1.81 |

| Hopewell | 159 | Aug-07 | 36.5 | 5.2 | 91 | 0.57 |

| Midwest Financial | 53 | May-07 | 39.5 | 1.3 | 26 | 0.49 |

| SIU | 101 | Jun-09 | 12.5 | 8.1 | 15 | 0.15 |

| Truliant | 149 | Jan-10 | 8.5 | 17.5 | 50 | 0.34 |

| Coors FCU | 493 | Feb-08 | 30.5 | 16.2 | 56 | 0.11 |

| Emery FCU | 82 | Sep-10 | 12.0 | 2.7 | 0 | 0.00 |

Top-Performing Bank & Credit Union Blogs

| Name | Posts | Launch | Months Active |

Posts/ Month |

Total Comments |

Comments Per Post |

|---|---|---|---|---|---|---|

| mBank (Poland) | 705 | Nov-07 | 34.5 | 20.4 | 8,370 | 11.87 |

| ING DIRECT | 244 | May-09 | 15.5 | 15.7 | 2,875 | 11.78 |

| SC Young & Free | 515 | Jan-09 | 19.5 | 26.4 | 4,359 | 8.46 |

| Servus Young & Free | 797 | Sep-07 | 36.0 | 22.1 | 3,865 | 4.85 |

| Vantage Young & Free | 94 | May-10 | 3.5 | 26.9 | 930 | 9.89 |

| Verity Credit Union | 181 | Jul-09 | 13.5 | 13.4 | 1,473 | 8.14 |

A Case Study In Blog Badness

This site is emblematic of everything that’s wrong with bank and credit union blogs. The design is horrible, with no pictures, no photos, no video, no polls. There is no connection back to the organization’s brand — not even a logo, or link back to the main website.

Much of the content is illegally scraped from other copyrighted sources (note: it’s against the law to copy-paste-publish someone else’s blog post). The credit union is still at it after one full year. 82 blog posts later, the only comments they’ve received (around 5) are all from spammers. Even though it takes very little energy to keep this blog up, it is clearly a waste of time. The blog is a detriment to the organization — a brand backfire — and should be killed immediately.

Postscript April 2013 – This blog was abandoned permanently in February 2011. Emery FCU promised it would start up a new blog to replace it, but they never did. They did leave the old blog up though. In Google, both the abandoned blog and another false-start blog still show up in the results. Blogs can be good — or bad — for SEO, depending on what you do with them.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

1. Banks Have No Blogging Strategy

Ask most financial institutions why they have a blog and — if they were honest — they’d probably tell you “because that’s what some expert told us we needed to do.” Just because a bunch of social media zealots tell bankers to “go be authentic and transparent” does not mean everyone should rush out and launch a blog.

Will the blog make any connection to the bank’s brand? Will the blog help sell, promote or raise awareness of the bank’s products and services? Does the bank know how its blog will be any different than any other blog already out there? The answer to all these questions is usually “no.”

Most financial institutions wouldn’t consider introducing a new product or branded service without creating a plan — some sort of strategy tied to corporate goals and objectives. There might be budgets assigned, research conducted, a SWOT analysis performed and projections created. And yet one willy nilly blog after another dribbles out from financial institutions every year with no plan, no strategy, no goals, no budgets, no projections, no metrics. Nothing. They don’t put any banner ads for their products on their blogs, but then complain about how blogs don’t help create new business?

Is it any wonder why senior leadership teams and others in the C-suite are so reluctant to take social media seriously? Until the organizations launching blogs and the people responsible for them start approaching social media with the same level of strategic acumen expected in all other areas of banking, blogs will largely remain a joke in the financial industry.

2. Banks Don’t Understand Publishing

Publishing is not an inherent part of the basic banking business model. It isn’t something that comes easy or naturally to financial institutions. It’s a huge stretch. Bankers simply aren’t prepared for today’s hyper-competitive media landscape. After all, if it was easy to be a publisher these days, don’t you think newspapers would be faring better?

Tim McAlpine, President/CEO of Currency and creator of Young & Free, thinks consumers’ attention is stretched thin by the hundreds of fun, engaging and entertaining media options available today. “There are hundreds of millions of blogs in existence. And now with Facebook and Twitter drawing most of people’s social media time, if you want your blog to draw visitors and comments, it sure better be good.”

And if you think it takes just a few minutes to bang out a blog post people will find and read, think again. It takes a lot of work. It can take anywhere from 2-5 hours of staff time per post running a blog — writing, researching, managing, admin, comments, replies, etc.

“Financial services marketers sorely underestimate how hard it is to create and maintain a compelling blog,” McAlpine says.

“Australian banks are slowly warming to social media, but have probably left the idea of blogging behind,” observes Rob Findlay, Aussie banking expert and author of TheBankChannel.com. “As large corporate, faceless organizations, the human and individual nature of blogging and broader social media is hard for banks to manage.”

“There is more than one reason for this,” Findlay continues. “Investment in setup is hard to justify. It’s difficult to operationalize. Internal understanding and support just isn’t there. And customer interest is pretty non-existent.”

According to Brett King, author of Bank 2.0, Bank of America wanted to blog but needed help, so they hired an ad agency to write it for them. “But when that agency fell out of favor,” King recalls, “they simple abandoned the whole idea.”

BofA – FUTURE BANKING BLOG

This blog didn’t last long. It is now discontinued.

McAlpine says it takes discipline to find any success with a blog. “Establish a very regular publishing schedule with hard deadlines. Publishing regularly and often is critical to making a return on your investment.”

3. The Content on Bank Blogs Sucks

Take a look at most bank blogs and what will you find? Articles about credit scores, identity theft and the bank’s latest phishing attack. There may be a blurb about Sally the new manager at the Downtown branch, or a photo of the CEO handing a check to the local Boys & Girls Club.

Reality Check: Booorrriinnnggg…

Why would people spend 2-5 minutes reading what your financial institution has to say? Seriously, would you read what you’re thinking about publishing?

“There are far better sources for financial education than your blog, so don’t set out to be the ultimate source of financial information,” advises McAlpine. “Be relevant, local and human.”

“Repurposed newsletter articles and bland posts about retirement do not keep your audience coming back,” McAlpine adds. “Show some personality, be intriguing, be funny and have an opinion.”

“I remember corporate communication staff arguing vehemently for press releases to be included on the bank’s website homepage,” recalls King. “Our tracking data showed only 0.1% of visitors read that stuff.”

“To reach readers, you have to think like a customer and not a banker,” King advises.

Unfortunately, most banks only know how to think one way — like bankers. Hiding behind compliance fears, they lack the courage to be provocative and stir the pot — and that’s what it takes to get blog readers these days.

“Putting a bunch of inane product promotions disguised as blog ramblings is not a strategy,” says King.

4. Banks Don’t Promote Their Blogs

Banks don’t tell customers about their blogs. They don’t advertise. Have promotions. Fun contests. Send emails. Ads on estatements. Comments on other blogs. Nothing. And then they sit around scratching their heads wondering why no one reads their blog. Go figure.

“One of the problems with the whole bank blog is the assumption by bankers that customers will flock to the blog just because they write it,” King complains.

How do most financial institutions promote their blogs? They get a Twitter account and tweet about their Facebook page where you can find links to lame blog posts. It’s a mess of circular irrelevancy.

If you’re looking to increase the traffic on your blog, here’s a basic place to start: the homepage of your main website.

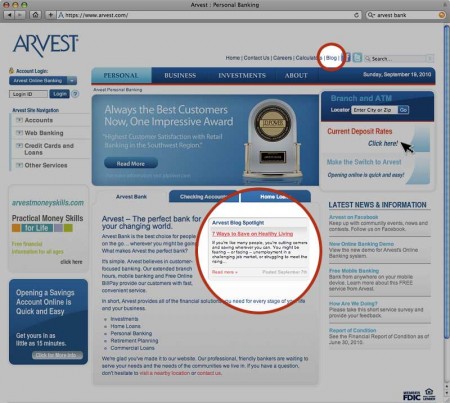

“We feed in a recent article from our blog on the front page of arvest.com in a blog spotlight area,” Jason Kincy, Arvest Bank’s VP Marketing Manager/Alternative Delivery. “We also have a blog link at the top right of the homepage.”

ARVEST BANK – CROSS-PROMOTION ON HOMEPAGE

The bank promotes its blog in two separate locations on its main website.

“For our Young & Free blogs, we are able to attract hundreds of comments during the spokesperson searches because there’s actually something to care about,” shares McAlpine about his popular Gen-Y program for credit unions. “This early activity sets the stage and builds an audience that is interested in what’s going throughout the year.”

5. Bank Blogs Are Ugly

Take a look at the typical bank or credit union blog and you aren’t likely to see the dynamic, interactive and engaging material you’d usually find at a top blog site like Mashable or TechCrunch. Where are the photos? Videos? Polls?

For that matter, why do so many financial blogs have a style of design that radically differs from the rest of their brand? Sure, sometimes a financial institution is looking to craft a different image for a blog’s specific audience, but that isn’t often the case. It frequently seems like someone took a dull, lifeless stock blog theme (one that differs from the dull, lifeless style of their main website) and did as little customization as possible to it. Why? Is it laziness? Lack of knowledge about the blogging platform deployed? Or does it reflect a general indifference and lack of commitment to the channel?

Currency’s McAlpine offers these ideas for how financial institutions can spruce up their blog: “Text posts can get pretty repetitive — especially if you are cranking out new posts everyday. Including imagery will help your posts grab attention and get read, especially with RSS readers where everyone’s content looks the same.”

“Throw some video into the mix,” McAlpine continues. “You can either embed existing video from YouTube or create your own. You don’t need a professional video crew or expensive equipment. For as little as $150, you can get a Flip digital camcorder with built-in video editing software and you are in business. And with free video hosting at sites like YouTube, Vimeo, Blip.tv and Viddler, there is no excuse not to produce your own videos from time to time.”