In 2022, financial institutions will be especially vulnerable to losing small business banking clients to newer and sleeker fintech providers. This bold declaration came from The Financial Brand in early January and kicked off the new year with a strong call to action for banks and credit unions.

“Cash flow can be a nightmare for small businesses,” Segmint co-founder Rob Heiser and Autobooks VP of Marketing Derik Sutton agreed during a recent webinar about small business banking. “It is also a nightmare from an accounting and tax perspective, trying to aggregate all of these separate payment channels…credit cards, cash, Venmo, Zelle, Paypal, etc. It’s a lot for the individual proprietor to manage.”

This year, it will be necessary for banks and credit unions to create a small business product suite, and one necessary weapon in that arsenal will be in the form of payment services. Industry surveys reveal that a big draw to fintechs are their treasury technologies. For financial institutions, that makes investing in or partnering with technology firms to provide business account holders with access to fast, secure and low-cost payment engines a top priority.

Transaction Data Tells a Story

Transaction data holds a gold mine of information about account holders, and financial institutions should capitalize on the revenue opportunities this data can reveal. We did some digging into our own institutional data, and discovered that there has been an increase across the board showing consumer accounts accepting payments from providers of alternative income (sources of money earned above and beyond a person’s regular income) as well as business related expenditures. The statistics below were observed across institutions of all sizes:

- An average of 2.35% of consumer accounts were receiving funds from a merchant processing account.

- 1.35% of consumer accounts were paying a payroll service provider.

- 5 out of 1,000 consumer accounts are working in the gig economy, as a ride-share driver or a food delivery driver.

- 3 out of every 1,000 consumer accounts are selling on Etsy.

While these numbers may not seem earth shattering, they reflect a real shift in the way Americans make income and operate small businesses.

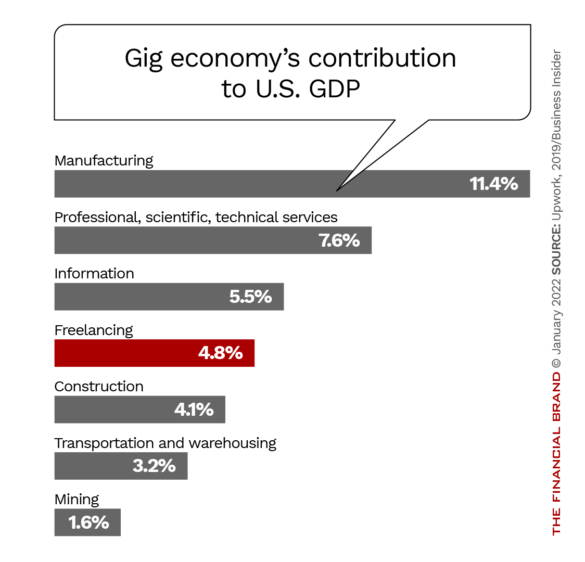

Consider that in 2020, the gig economy grew by 33%, expanding 8.25 times faster than the U.S. economy as a whole, according to Small Business Trends. Gig workers now represent about 35% of the workforce, up from between 14% and 20% in 2014, Forbes reports. That means 57 million people in our country are leveraging freelance or gig work — contributing $1 trillion dollars to the economy annually. Experts predict that this will continue, and that half of the U.S. workforce will be freelance contractors in one way or another by 2023. Banks and credit unions need to pay attention.

How the Gig Economy Affects Consumer Banking

A paycheck is still the most common source of income, but as we mentioned earlier, the number of account holders participating in the gig economy to supplement their income or to replace a traditional paycheck entirely is growing. Gig economy jobs are often short-term and task-based and workers are independent contractors versus full-time employees. However, if the trend continues as predicted, this form of employment could become just as common as a steady 9 to 5.

New Behavior Pattern:

Most people still receive a conventional paycheck, but more consumers are supplementing this income with a 'side hustle.' This trend is only expected to grow.

Account holders at one financial institution we work with saw a 93% increase in payment volume received from gig economy work in 2021 over 2020. To build an audience of these consumers, financial institutions should analyze their account holder transaction data and research payments that frequently appear from Lyft, Uber, Doordash, Grubhub and other gig economy players. There are other non-traditional income sources that should be considered, like inflows from payment processors, or marketplaces like Etsy or Shopify, that could indicate an account holder is using a consumer account to run a small business.

How to Tap the Revenue Potential of the Gig Economy

Once you have identified gig economy employees, those who make payroll payments from their personal accounts, and those making additional payments to commercial service providers, it’s time to start the outreach campaigns. Target this audience with offers to assist them in setting up business accounts. This can maximize your institution’s revenue while also building loyalty and trust with a growing group of entrepreneurs in the community.

Unfortunately, the majority of U.S. citizens do not receive formal financial education. Banks and credit unions have an opportunity to help and fill this gap. Ushered in by ‘the Great Resignation,’ the obsolescence of aging industries, pressures of the pandemic and technology and social media advancements, many people have found themselves self-employed for the first time. A good number of these newly self-employed are using a retail account to run their business. The benefits of converting a retail account being utilized for business purposes, to the right type of account are numerous:

Advantages for the financial institution:

- Increased income through business account fees

- Opportunity for new credit card openings and income

- Opportunity to sell new business loans

- Secure more share-of-wallet

- Build loyalty with account holders, leading to long term relationships and trust

- Increase household products

Advantages for the account holder:

- Eliminate limited personal liability. Should a business come into legal or taxation trouble, personal accounts could be frozen, unless they properly separate their accounts between personal and business.

- Tax benefits. As a properly established business owner there are several available tax deductions, provided they are paid to a traditional lender: loan interest, retirement plan savings, vehicle loans, business property loan interest and inventory expenses.

- Financial wellness. Overall financial well being can be achieved if an account holder is placed in the right products and services for their goals.

- Status at the institution. Enjoy benefits such as personalized service, access to loans and credit, better rates and more.

Banks and credit unions must take a proactive approach to communicating these advantages to their account holders. It is likely that many gig economy workers are new to small business operations. Educating account holders by discussing the benefits and the risks can yield positive results for both parties.

How to Gain Trust with Existing Business Customers

Tried and true ways of building trust and sales still apply today: be reliable, nurture relationships, be transparent, show your organization’s values, have great customer service, be better than the competition — the list goes on. It’s easy to say, “personalize your message” or “be relevant”, but what exactly does that mean?

A bank or credit union’s account holder transaction data holds the intelligence that can provide a holistic view of that person’s product portfolio, financial needs, trends in lifestyle activities and interests, spend patterns with merchants, usage of held-away accounts, life events and more. Accessing these specific insights undoubtedly provides a marketplace advantage and enables a customer-centric strategy of knowing the target audience. First-party data is financial institutions’ fuel for relevant engagements with account holders.

Where to Start:

To identify the gig workers among your customers and create the most relevant engagements with them, make use of the first-party data you have.

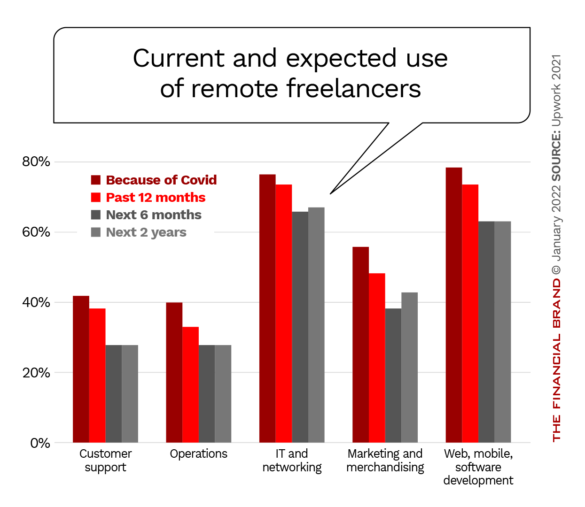

Historically, banks and credit unions have been risk averse to working with consumers whose income is gig or freelance-based. However, Business Insider states in their Gig Economy Report, “As advances in fields like AI and open banking make alternative creditworthiness assessments viable and detecting default risks more precise, cautious financial institutions now have an opportunity to harness some of the revenue offered by this booming market.”

The ways that financial institutions are interacting with account holders and prospects have required a shift over the last 24 months. With face-to-face interactions at a minimum and communications mounting from the competition, how can banks and credit unions build trust and find hidden revenue opportunities with their business clients? Simply this: Know your audience better.

About Segmint:

Segmint’s mission to make sense of unstructured transaction data in order to turn those results into actionable intel for financial institutions. By strengthening relationships with account holders, financial institutions are able to increase loyalty and trust, the key to retention, growth, and share of wallet. Learn more at Segmint.com.